Mobile Financial Services: Expanding Financial Access and Inclusion

Given that many unbanked and underbanked consumers have mobile phones, the technology already in their pockets may help them access safe, convenient, and affordable financial services.

For those who have bank accounts, everyday financial activities such as making purchases with a debit or credit card, having paychecks directly deposited into a checking account, or paying bills and viewing account balances online may be taken for granted. However, not all consumers have access to the same services. In fact, the Federal Deposit Insurance Corporation has found that more than one in four U.S. households are either unbanked or underbanked and conduct at least some of their financial transactions outside the mainstream banking system.[1] The rate for the Northeast, although lower than the national rate, is still 7.1 percent.[2]

Many unbanked and underbanked consumers use cash or alternative financial services (AFS) such as check cashers or nonbank money orders, which can be costly. Mobile banking could be a better option, but a 2012 Boston Fed study revealed that fewer than 10 percent of financial institutions surveyed offered mobile-banking services that targeted the needs of the underserved.[3]

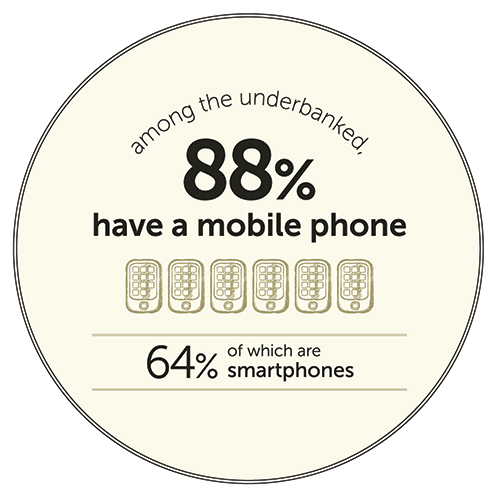

But according to a Federal Reserve System Board of Governors report, the underserved make significant use of mobile phones and smartphones. Among individuals who are unbanked, 69 percent have access to a mobile phone, and approximately half of the mobile phones are smartphones. Among the underbanked, 88 percent have a mobile phone, 64 percent of which are smartphones.[4] This means that a potential platform for expanding financial access and inclusion already exists. Consumers don't need a desktop computer or a checking account to do online/mobile banking.

The underserved are a financially diverse segment with varied reasons for using AFS. Some of the most common reasons given for not having a bank account are not needing or wanting one, not having enough money, and being unable to open an account because of identity theft or problems with credit or banking history. Other reasons included dislike of dealing with banks, excessive fees and service charges, and inconvenient bank hours and locations.

More Uses, More Convenience

Mobile technology can foster financial inclusion by helping underserved consumers access safe, convenient, and affordable financial services.[5] Increased use of smartphones is encouraging more financial-services providers to offer mobile-account capabilities for the underserved. Many mobile-banking features previously available only with traditional bank accounts, such as mobile alerts, bill payment, money transfers, and remote deposit capture (RDC), are now available with bank and nonbank prepaid products, providing opportunities to expand access to mainstream financial services. Moreover, mobile technology provides the benefits of real-time, 24/7 access to financial information.

A recent Boston Fed paper analyzed 10 currently available retail payment products with mobile-banking features that can help underserved consumers.[6] The new products represent a portfolio of features and services suitable for a diverse underserved population. Prepaid products with mobile-banking capabilities remove some of the barriers encountered with traditional bank accounts, such as credit-history problems, minimum-balance requirements, and overdraft fees. Some prepaid products from banks include BB,T MoneyAccount, Chase Liquid, and Regions Now Banking Card. Nonbank prepaid products include American Express Bluebird, Banking Up UPside Card, Boost Mobile Wallet Plus, and Moven. The Fed study also reviewed two branchless mobile-checking accounts, GoBank and Simple.[7]

The new products offer traditional checking-account features, such as a network-branded debit card, ATM cash withdrawals, and FDIC insurance with mobile capabilities. Thus consumers can conduct financial transactions on their own schedule and from virtually any location. The products have mobile-banking features such as new-account enrollment, customizable alerts, bill payment, person-to-person (P2P) payments, and mobile RDC. A few products include mobile personal financial management and savings tools.

AmEx Bluebird, a reloadable prepaid account obtainable online or at Walmart, is one example. It allows customers to receive direct deposits, set up mobile alerts, pay bills electronically, deposit checks via mobile RDC, and set aside savings, among other features. Customers can access their Bluebird account via mobile web and mobile app.

Mobile Banking Features

Consumers may benefit from an overview of key mobile-banking attributes as they exist today. Many are available not just with checking accounts but with prepaid, which can benefit those without access to a traditional bank account.

- New Account Enrollment enables opening an account at any time from any place without being limited to branch operating hours and locations. Mobile enrollment affords more convenience to consumers who do not work traditional business hours, cannot easily access branch locations, or prefer a more digital lifestyle.

- Alerts and Account Monitoring let consumers track their financial activities with greater convenience and efficiency. Mobile alerts provide real-time account-activity updates, giving consumers more control over their money and potentially influencing their financial behavior. For example, low-balance alerts can motivate consumers to reduce spending or deposit money. Similarly, payments-due alerts can improve consumers' ability to pay bills on time.

- Bill Payment offers value, utility, and convenience by reducing cost and time spent paying bills and offering consumers more control over when and how they pay. Several products offer a virtual-check feature through mobile websites and apps as a more convenient and less expensive alternative to money orders.

- Person-to-Person Transfer enables consumers to send and receive money using their mobile phones. Customers access online accounts on their mobile devices to send money to an individual in the United States. Without a checking account, sending money can be expensive and burdensome. Mobile P2P offers a cost-effective and convenient alternative to money orders and money-transfer services.

- Mobile Remote Deposit Capture (mRDC) allows consumers to deposit paper checks electronically using the camera on their mobile phone. Compared with the effort required to travel to the bank, ATM, or check-cashing agent, mRDC affords more speed and convenience. Mobile RDC is also an attractive alternative to check-cashing services because it can eliminate fees and increase availability of funds. Several prepaid products offer mRDC without a checking account.

- Personal Financial Management Tools help consumers track and manage their money. Products offer varying levels of detail and entertainment features to help customers create budgets and better understand their spending behavior.

- Savings Tools can motivate people to do a better job of managing their finances. Saving can be challenging for consumers with little disposable income and limited access to mainstream accounts. Some products offer savings features with no minimum deposit or balance requirements. Although these are not separate bank accounts, the tools allow consumers to designate funds for savings and serve as a buffer against unintentional spending.

From Opportunity to Reality

Financial-service products that leverage mobile capabilities, particularly those built on prepaid products, demonstrate opportunities to help meet the financial needs of underserved consumers and provide otherwise unavailable access to the mainstream financial system. Moving from opportunity to reality will require educating consumers on how these products work and how they can improve financial well-being. Greater awareness of product availability and benefits through channels that the underserved use most may reduce consumer fears and confusion and lead to broader adoption.

Solution providers partnering with community-based nonprofit organizations that are focused on financial inclusion and financial literacy could help build awareness and promote adoption of mobile financial solutions among underserved consumers. Opportunities exist for more banks and financial-services providers in New England to leverage mobile technology and offer products that could improve underserved consumers' banking experience and expand access to safe and affordable financial services.

Elisa Tavilla is a payment strategies industry specialist at the Federal Reserve Bank of Boston. Contact her at Elisa.Tavilla@bos.frb.org.

Endnotes

- Federal Deposit Insurance Corporation, 2011 Survey of Unbanked and Underbanked Households (September 2012), http://www.fdic.gov/householdsurvey/2012_unbanked

report.pdf. The FDIC defines unbanked households as households where no one has a checking or savings account and underbanked households as households with a checking and/or a savings account that has nevertheless used nonbank money orders, nonbank check-cashing services, nonbank remittances, payday loans, rent-to-own services, pawnshops, or refund-anticipation loans in the past 12 months. The term underserved refers collectively to both the unbanked and underbanked. - The FDIC defines the Northeast region as Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont.

- Federal Reserve Bank of Boston, 2012 Mobile Banking and Payments Survey of Financial Institutions in the First District, http://www.bostonfed.org/bankinfo/payment-strategies/publications/2013/mobile-payments-and-banking-survey-2012.htm.

- Board of Governors of the Federal Reserve System, Consumers and Mobile Financial Services 2014, http://www.federalreserve.gov/econresdata/consumers-and-mobile-financial-services-report-201403.pdf.

- Financial inclusion involves promoting access to and use of safe, affordable financial products and services, and educating consumers about ways to become fully integrated into the banking system. Availability of banking and payment services to the entire population without discrimination is a prime objective of financial-inclusion public policy.

- Federal Reserve Bank of Boston, How Mobile Solutions Help Bridge the Gap: Moving the Underserved to Mainstream Financial Services, http://www.bostonfed.org/-/media/Documents/cb/PDF/how-mobile-solutions-help-bridge-the-gap.pdf.

- Simple is not specifically designed for underserved people as it requires a checking account, but it was included in the analysis because of the potential benefits that its mobile financial features could offer the underserved.

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Elisa Tavilla,

Federal Reserve Bank of Boston

Email: Elisa.Tavilla@bos.frb.org

Resources

Resources

Related Content

Mobile Banking and Payment Practices of U.S. Financial Institutions: 2016 Mobile Financial Services Survey Results from FIs in Seven Federal Reserve Districts

Mobile Banking in New England is Mainstream: 2014 Mobile Banking and Payments Survey of Financial Institutions in the First District – Summary of Results

Advancing Leading Women in Financial Services Conference

Racism and the Economy: Focus on Financial Services