Business Loans to Low-Income Entrepreneurs

Nonprofit lenders are removing the barriers to loan capital for lower-income entrepreneurs who are starting or growing businesses.

Low-income entrepreneurs face challenges in obtaining capital to start or grow a business. Fortunately, the community development lending industry has stepped up to the plate. Focused research from the FIELD program at the Aspen Institute has documented how community development lending to U.S. microenterprises has assumed an increasingly significant role in both economic development and poverty alleviation nationwide.[1] In a rural New England state, Community Capital of Vermont (CCVT) has been part of that movement.

Community development small business lenders serve people with viable ideas whose low-income status may prevent them from qualifying for a bank loan. They are people such as these:

Kelly

Kelly, who had a vision to grow her small, side-street hair salon into a Main Street business with a large picture window, lots of light, and space for a boutique selling one-of-a-kind fashions.

Sean

Sean, who suffered a serious injury logging timber in Vermont's Northeast Kingdom and decided it was time to return to trucking, the work he loved-staying safely on paved roads-by starting a long-distance trucking operation.

Janice

Janice, whose success creating a product with a following-Vermont Kale Chips-was leading her from a small food-venture incubator, where she shared space, to a larger production facility. Poised for growth, she was ready to catch the wave of Vermont's Farm to Plate initiative.

Chris

Chris, a talented carpenter and designer, who was eager to enter the highly competitive custom-furniture arena using social-marketing and pop-up sales.

Yvonne

Yvonne, born and raised in a small Vermont town, who wanted to launch a Main Street party-supply store after several years as a stay-at-home mom.

Although their businesses take many forms, these lower-income entrepreneurs have all benefitted from a CCVT loan to start or grow their ventures.

Loan Needs in Vermont

CCVT is a nonprofit micro and small business lender. The bulk of the organization's loan capital is Community Development Block Grant funds. The capital "revolves" as borrowers make loan payments and funds are deployed to other borrowers. CCVT is certified as a community development financial institution and is a designated Small Business Administration microloan intermediary. Its mission is to help small businesses and lower-income entrepreneurs prosper through the provision of flexible business financing. A stepping-stone for entrepreneurs, it helps them build the sales, experience, and credit to become sustainable and bankable businesses in the future.

CCVT's loans range in size from $1,000 to $100,000 and can be used for a start-up or for a company's growth and expansion. Borrowers are in sectors such as retail, service, and manufacturing. Most often, the borrowers are low income, but sometimes it is the employees who are. Or CCVT may see a compelling community need, such as investment in a distressed downtown. Technical assistance also is available to support borrowers. Overall, CCVT has provided $5 million in small business loans to 200 businesses since 1995, 80 percent of which were to lower-income borrowers. Seventy-three percent went to pre-venture or start-up businesses, and 55 percent to women-owned businesses.

Small business revolving loan funds like CCVT's help applicants who face challenges qualifying for a traditional business loan. These are typical issues:

- limited personal savings and no "friends and family" network with savings to invest in the business;

- a low or nonexistent credit score;

- a major personal, credit, or employment crisis signaling risk, such as bankruptcy or medical debt;

- insufficient collateral, such as no guarantors, no real estate, or no personal property equity;

- no second income in the household to cushion periods of poor cash flow in the business; and, importantly,

- limited business management experience.

Given that the risks are so varied, it is critical to ask what an applicant's overall strengths and weaknesses are. No single criterion should be the sole cause for denying a loan. CCVT has no threshold criterion such as a credit score exceeding 600 or a loan-to-value ratio less than 1:1.

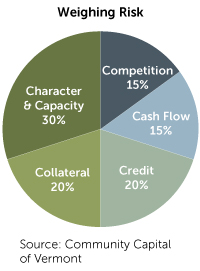

Like most commercial lenders, however, community development lenders must evaluate an application using the "five C's" of underwriting: credit, collateral, character, competition, and cash flow. CCVT aims for a full picture of creditworthiness by applying weights to the five C's. (See "The Five C's of Lending." )

The most heavily weighted component of CCVT's underwriting-character-can be the most difficult to score. CCVT assesses how responsive the applicants are in working with a loan officer, how well they communicate in writing and in conversation, how deep their experience in their industry is, what business management experience they have, and how strong their connections are to the community where their business is located.

Balancing risk factors allows a strong factor to outweigh a poor score on another factor. For example, Kelly, the salon owner, was approved for a $9,000 loan even though CCVT valued her collateral at $5,000. The risk seemed reasonable because of the cash flow Kelly was generating in her original location and because of the compelling case she made in her business plan (scored in "competition/market" ).

Yvonne, who opened a party-supply store in a small downtown, received a $39,000 loan despite the risks associated with small-scale retail establishments (scored in "competition/market" ). Her family's deep connections in the community and her above-average credit score were decisive.

A Unique Kind of Lending

CCVT and nonprofit lenders nationwide have learned that not only does a holistic approach to underwriting improve the chances of success investing in lower-income businesses, but that providing a fixed interest rate can be important, too. Fixed rates support more predictable cash flow, allowing borrowers to roll closing costs into their loan if they have limited cash reserves. Affordable origination costs also help borrowers. A $25,000 loan from Community Capital, for example, may have closing costs of $85, including lien filings. (In Vermont, the closing costs are offset by a grant from the state.)

Community development lenders also consider not just the financial value of having borrowers itemize their collateral but the psychological value. Borrowers will work hard to protect against the loss of something they value, such as their woodworking tools or recreational vehicles. In cases where an owner's collateral is limited, community development lenders may ask for a limited guarantor or a cosigner. CCVT is often undercollateralized, and therefore maintains high loan-loss reserves to compensate for the deficiency.

Community loan applicants are expected to make some investment of cash or "sweat equity" in their business, often being evaluated on the degree to which their investment is in accordance with their ability. CCVT allows for interest-only payments up to six months in the beginning of a loan if entrepreneurs need to finish leasehold improvements, ramp up sales, roll out new products, or give marketing campaigns time to work.

Borrowers with limited or no experience managing business finances and who have credit issues must have their loans disbursed directly to a third party, such as a supplier. That strategy minimizes the risk that the borrower will mismanage the loan dollars and allows CCVT to fully understand its collateral position.

In addition, many microenterprise lenders offer postloan technical assistance to support a business through the stages of growth. CCVT conducts a site visit at least annually (monthly for some) to ensure that the borrower-lender relationship remains open and cordial. Direct support, either through staff or consultants, includes assistance in preparing financial reports, expertise offered for inventory management and point-of-sale systems, and branding and marketing.

A balanced review of risk during the loan underwriting process does not, however, guarantee success, and Community Capital's loan losses exceed what a commercial lender would find acceptable. In 2013, CCVT expects to post 7 percent of their notes receivable as bad debt. For CCVT's board, staff, and funders, such losses are offset by the jobs and wealth generated by the successful borrowers, who otherwise would not have had access to capital for their business.

Providing loan capital to lower-income entrepreneurs also is important from a public policy perspective because it supports economic development, spurs new investment in communities, and creates jobs. At the same time, it represents investment in the aspirations of people who have been denied conventional credit. Entrepreneurs borrowing from community development lenders-including CCVT clients Kelly, Sean, Janice, Chris, and Yvonne-are an inspiration to continue developing the tools that remove barriers to credit.

Martin Hahn is the executive director of Community Capital of Vermont, a statewide nonprofit microenterprise lender based in Barre. Contact him at mhahn@communitycapitalvt.org.

Endnotes

[1] In a FIELD study, "those pursuing business ownership experienced income growth over time. Low-income individuals show particularly strong growth in income." Moreover, "the businesses owned by low-income individuals can and do contribute to the local economy." See Elaine Edgcomb and Joyce Klein, "Opening Opportunities, Building Ownership: Fulfilling the Promise of Microenterprise in the US" (white paper, FIELD, Aspen Institute, 2005), http://fieldus.org/publications/fulfillingthepromise.pdf.

[Back to story]

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Martin Hahn, Community Capital of Vermont