Casinos and Cities: Can They Live Together?

Gambling is big business. In 2011, nearly 60 million Americans visited a casino, and commercial casinos existed in 22 states.[1] At that time, casinos employed 339,000 people, generating nearly $35 billion in gross revenues, and paying state and local governments nearly $8 billion in direct gaming taxes, not to mention property taxes and income taxes from casino employees.[2]

Casinos have an unusual place in the economy. Although widely legal, they are allowed to operate only under stringent regulatory restrictions and usually exist in a quasimonopolistic environment.[3] Their unique status reflects the ambivalence of much of the American public. On the one hand, people see a casino as a powerful fiscal and economic development tool. On the other hand, many feel explicit or covert moral disapproval and fear of casinos' social and economic implications.

Any economic sector of this size, particularly one usually based in large facilities concentrated in a small number of discrete locations, is bound to have some impact. What the impacts are, however, can be hard to pin down.

Casinos provide fodder for both supporters and opponents. Opponents point to negative social impacts of casinos on people and communities. They mention crime and compulsive gambling. Proponents tout the number of jobs created and the fiscal benefits to state and local governments. Both views are reality based, but a closer look suggests that both proponents and opponents tend to exaggerate the impacts they cite. Crime typically rises in high tourism areas, and there is little evidence to suggest that casinos are much different from other large visitor attractions. Conversely, proponents of casinos rarely acknowledge how much the money that people spend in casinos displaces spending elsewhere in town.

Thirty Years of Experience

Nonetheless, after more than 30 years since casinos spread outside Nevada, we can identify features that could maximize the benefits of a new casino to a host community.

From a purely fiscal standpoint, state governments almost always come out ahead with casinos. That has nothing to do with casinos as such, but rather with the fact that when states create monopolies or oligopolies, they can impose significantly higher taxes on them than on other sectors. Although no state has a general sales tax rate higher than 7 percent, state taxes outside Nevada on casino revenues consistently exceed 15 percent. In Pennsylvania, they are as high as 55 percent.

How much the host city benefits depends on how the state divides the revenue. In Pennsylvania, host cities get only a small share of the total. The city of Detroit, however, gets 40 percent of the combined state/local casino tax. Although host cities get property tax revenues, it is often a close call whether the fiscal benefits to the city outweigh the costs.

The economic and fiscal benefits of casinos, both to the state and the host cities, depend on where the casino visitors come from and where the casino workforce comes from. The ideal, from an economic standpoint, is a community with a large local workforce and also a large regional and multistate visitor pool.

The more local the workforce, the greater the share of casino revenues that stay in the community, and the greater the multiplier effect of those revenues on the local economy. The more that casino visitors come from outside the area, the less that the local community will suffer the displacement of revenues that occurs when casino-goers bypass local entertainment and other local spending. Displacement still happens, but it happens somewhere else. From a national perspective it may be a wash, but from the local perspective, it is significant. For the state, too, out-of-state casino visitors represent a much greater net fiscal benefit than in-state gamblers.

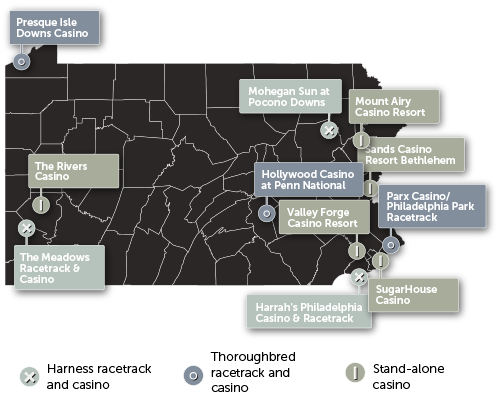

With casinos in operation in most states, how much a new casino can draw out-of-state visitors without cannibalizing the revenues of other casinos in those states is limited. In the competition between states and cities for scarce revenues, however, that rarely bothers officials. Pennsylvania's highly successful casino strategy aimed to draw gamblers from outside the state and take business from the Atlantic City market. The majority of the sites dictated by the state for casinos form a ribbon along the state's eastern boundary with New Jersey. Most of the others are close to Ohio and upstate New York. That was hardly a coincidence. (See "Location of Pennsylvania Casinos.")

Assuming a local pool of potential casino employees is available, and the casino can draw a regional?and at least a partly outof- state?visitor pool, the potential opportunity for positive local economic impacts is there. If that opportunity is to be turned into reality, however, more has to happen than simply opening a casino on a vacant site somewhere in the area.

Planning for Positive Impact

If local residents are to become the majority of the casino's workforce, a systematic effort has to be made to reach potential workers and provide them with training opportunities well before the casino opens its doors. In Bethlehem, Pennsylvania, the casino formed a partnership with the local community college to train its workforce. The college even opened a satellite facility adjacent to the casino. More than 85 percent of the Sands Casino workforce lives within a 15-mile radius. Many live in the adjacent South Side neighborhood. The SugarHouse Casino in Philadelphia signed a community benefits agreement with the New Kensington Community Development Corporation, which led to a significant number of local residents being hired in the casino, as well as other neighborhood improvements.

The location of the facility is equally important. Putting a casino on an unused site outside a city center near an interstate highway exit may minimize traffic and crime effects on the city, but at the cost of essentially eliminating the possibility of positive economic spin-off effects. Placing the casino in the heart of the city, however, does not in itself guarantee positive spin-offs. How the casino is designed and how it relates to the rest of the community are critical considerations.

The Atlantic City casinos were built to be self-contained environments that would keep their patrons inside the facility to the maximum extent possible. Even after more than 30 years, spin-offs, such as noncasino restaurants, shopping, and entertainment venues, are few and far between. I believe a major goal for any city hosting a casino should be for it to be built in a way that not only permits but encourages constant movement of visitors between the casino and the rest of the city.

Location of Pennsylvania Casinos

Constant flow between city and casino is a rarity in the industry. From what I have observed, I suggest that cities would do well to push back against resistance to such an approach. In Massachusetts, for example, the state and a given city should recognize that they are offering a casino operator a regional monopoly worth billions. That is a prize for which an operator will gladly pay, not only in design concessions, but by making a serious investment in community amenities and facilities.

The sophisticated casino operator understands that such amenities and facilities ultimately benefit the casino as well by making the destination more attractive to visitors. In Bethlehem, the casino made a significant financial contribution to redeveloping other parts of its site, the old Bethlehem Steel Works, for a major arts facility and new studios for the regional Public Broadcasting System station. These facilities have become attractions in their own right and are now an integral part of the casino's marketing package.

With the proliferation of casinos across the United States, there is a growing risk that, from a national perspective, building a casino is a zero-sum game. Casinos can still bring benefits to their host communities, however, if local governments and other local stakeholders take the opportunity to become active partners in the siting and planning of a casino, to ensure that it is integrated into the community's physical and economic fabric and that the residents of the community share in the jobs and other opportunities it brings.

Alan Mallach is a nonresident senior fellow at the Brookings Institution in Washington, DC, and a visiting scholar at the Federal Reserve Bank of Philadelphia. Contact him at amallach@comcast.net.

Endnotes

[1] The number is 38 states if Native American casinos are included. [Back to story]

[2] See State of the States: The AGA Survey of Casino Entertainment (Washington, DC: American Gaming Association, 2012): http://www.americangaming.org/industry-resources/research/state-states. [Back to story]

[3] The only exception to this rule is Nevada. [Back to story]

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Alan Mallach, Brookings Institution