Energy Efficiency and Mortgage Risks: Implications for the Northeast

Residential energy efficiency can be promoted by linking it with mortgage finance.

Increasing energy efficiency is not only one of the easier ways to transition to a low-carbon future, it also can lower mortgage risks. Low-income households have a disproportionately high energy burden relative to their income, so promoting energy efficiency can be useful. With the residential sector accounting for one-fifth of U.S. energy consumption, a recent McKinsey report suggested that energy- efficiency investments in homes could produce $41 billion in annual savings.[1] Increasing residential efficiency of the housing stock would benefit both the environment and the pocketbook.

Significant barriers to adopting efficient technologies and practices exist, however, including lack of knowledge, uncertainty about the returns on investments, and split incentives. In the residential sector, financing large up-front costs is particularly difficult because home-valuation practices favor cosmetic improvements over efficiency upgrades. One way to overcome that barrier is to tie energy efficiency to the mainstream housing-finance system. Recent research shows that energy efficiency is associated with lower mortgage risks, and that could lead to a novel way to finance efficiency.

Energy Use in the Northeast

The Northeast census region (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, New Jersey, New York, and Pennsylvania) has 18 percent of the U.S. households but consumes more than 23 percent of the energy, according to the 2009 Residential Energy Consumption Survey by the Energy Information Administration.[2] Furthermore, household energy expenditure (excluding transportation) is 28 percent higher in the Northeast compared with the rest of the United States. This has distributional implications, too. Northeast households within 150 percent of the poverty line spend 26 percent more on energy than average lowincome households nationwide. Heating costs are a substantial portion of their energy budgets, and because the Northeast experiences relatively harsh winters, any program or policy to promote energy efficiency should pay rich dividends.

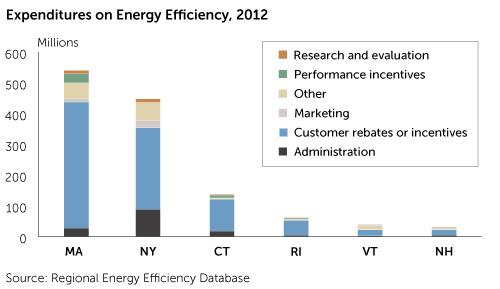

Between 2006 and 2010, U.S. utility-funded energy-efficiency programs doubled (from $2 billion to $4.8 billion).[3] Most programs are concentrated in California and Oregon in the West and Connecticut, Massachusetts, New Jersey, and New York in the Northeast. These states represent almost 70 percent of total energyefficiency spending nationwide, with Massachusetts spending the most. (See "Expenditures on Energy Efficiency, 2012.") Interestingly, efficiency expenditures do not seem to translate into higher numbers of Energy Star houses in those states.[4] Except for New York and New Jersey, the market penetration of the Energy Star label is less than 15 percent for new construction in the Northeast.

The Role of Housing Finance

Energy efficiency could be promoted by linking the upgrades with housing finance. That is the rationale behind Energy Efficient Mortgages (EEM). EEMs were touted as a solution to financing the large up-front costs associated with energy-efficiency measures.[5] They allow some flexibility in underwriting so that borrowers can qualify for larger loans to implement energy-saving improvements or can purchase homes that meet certain performance criteria.

EEMs backed by the Federal Housing Administration and the Department of Veterans Affairs have yet to catch on, however. The problem has been transactional complexity, poorly developed lender guidance, limited benefits for lenders, and lack of consumer information. Less than 1 percent of mortgages are EEMs. It therefore makes sense to think about linking energy efficiency with traditional mortgages. Traditional residential mortgages offer the potential to create the scale necessary for energyefficiency investment because they rely on the mainstream financial system. Current underwriting standards do not recognize the potential lower risks associated with energy-efficient housing. All things being equal, lower and less volatile utility costs might provide a household with some cushion to pay its mortgage in case of crisis. Energy efficiency might also be a marker of financial savvy. If mortgages held by homeowners in energy-efficient homes have lower risks than those in less efficient homes, then good credit policy would merit more-flexible underwriting standards or even consideration in loan-level price adjustments. Additionally, more-accurate information on risks may enable lenders to develop mortgage products that meet both consumer and investor needs better. Valuing energy efficiency in mortgages also will require homeowners and buyers to pay closer attention to homes' performance metrics, resulting in larger investments in the sector.

In a study conducted with the support of the Institute for Market Transformation (IMT), the authors examined 70,000 mortgages nationwide and found that the odds of default of households in Energy Star-rated houses are a third lower than those of households in conventional residences.[6] The odds of prepayment are also 28 percent lower. Prepayment decreases the profitability of loans for lenders and therefore increases the overall cost of borrowing. Within Energy Star houses, families that live in more-efficient residencies (defined by Home Energy Rating System, or HERS) have lower odds of either prepayment or default, suggesting an associative link between energy efficiency and mortgage performance.[7]

The researchers found that in the Northeast, the default odds of the Energy Star households are 42 percent lower than for other households, although the prepayment odds are higher (21 percent). That result is driven by small sample size (~1,700 mortgages) and the lower proportion of Energy Star households. However, the associative link between default and energy efficiency is fairly consistent.

According to a study by the Joint Center for Housing Studies at Harvard University, two-fifths of home-remodeling spending is for building-envelope replacements and system upgrades (including electrical and HVAC systems). Boston, Providence, and New York metros are among the largest average home-improvement spenders.[8] One way to harness that market toward energy efficiency is to find mechanisms to encourage time-of-sale improvements on energy-efficiency measures. Such measures are especially likely to help lower-income borrowers, who often purchase older, less-energy-efficient homes.

The U.S. Environmental Protection Agency should encourage more lenders to join the Energy Star program to broaden the consideration of energy efficiency in mortgage underwriting. Currently, there are at most two lending partners in each of the Northeastern states that offer mortgages based on energy efficiency.

The research described here is but a first step toward internalizing energy metrics in housing finance. One should keep in mind the difference between design efficiency and energy conservation. Although the latter is primarily related to the consumer's behavioral response, the former is about the relative efficiency of equipment and the built environment. If the main goal of public policy is to reduce energy consumption rather than to promote energy efficiency, then better measures of energy savings that accrue from behavioral changes, forgone demand, and consumption patterns should be considered in future studies to capture more fully the impact of energy efficiency on mortgage risks. Other concerns could be addressed using other datasets and different research designs. However, even with observational studies such as this one, we can point to associative links that are worth exploring.

Maine and Vermont produce more than one-fifth of their consumed energy from renewable resources, while some other Northeast states are not far behind. Although the emphasis on decarbonizing the energy systems is laudable, saving a kilowatt-hour on site has been shown to translate to a 3-kilowatt-hour savings of primary energy.[9] Linking energy efficiency to the traditional housing-finance system has the potential to remove some of the barriers that have been holding back rapid gains. In addition to increasing energy efficiency in general, such linkages have the potential to particularly benefit low-income residents, who are highly sensitive to the volatility of the energy burden. By offsetting the costs of up-front investments and therefore increasing the adoption rates of energy efficiency measures, this initiative can help residents in low-income communities to meet their housing needs.

Nikhil Kaza is an assistant professor in city and regional planning and a fellow at the Center for Community Capital at the University of North Carolina at Chapel Hill. Roberto G. Quercia is a professor and chair of city and regional planning and director of the Center for Community Capital. Chao Yue Tian is a research associate at the Center for Community Capital. Contact them at nkaza@unc.edu.

Endnotes

- Hannah Choi Granade, et al., "Unlocking the Energy Efficiency in the US Economy" (white paper, McKinsey , Co., 2009), http://www.mckinsey.com/client_service/electric_power_and_natural_gas/

latest_thinking/unlocking_energy_efficiency_in_the_us_economy. - "2009 Residential Energy Consumption Survey" (report, Energy Information Administration, Washington, D. C., 2012), http://www.eia.gov/consumption/residential/data/2009/

index.cfm?view=consumption#summary. - Galen L. Barbose, et al., "The Future of Utility Customer-Funded Energy Efficiency Programs in the United States" (white paper, Ernest Orlando Lawrence Berkeley National Laboratory, Berkeley, California, January 2013), http://emp.lbl.gov/sites/all/files/lbnl-5803e.pdf.

- Energy Star is a certification for residences that are 15 percent more efficient than a typical house.

- See http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/eem/eemhog96.

- Nikhil Kaza, Roberto G. Quercia, and Chao Yue Tian. "Home Energy Efficiency and Mortgage Risks," Cityscape 16, no. 1 (2014): 263-282.

- See http://www.resnet.us/energy-rating.

- "The U.S. Housing Stock Ready for Renewal: Improving America's Housing 2013" (report, Joint Center for Housing Studies, Cambridge, Massachusetts, 2013), http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/

harvard_jchs_remodeling_report_2013.pdf. - John Randolph and Gilbert M Masters, Energy for Sustainability: Technology, Planning and Policy (Washington, DC: Island Press, 2008).

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Nikhil Kaza, University of North Carolina

Roberto G. Quercia, University of North Carolina

Chao Yue Tian, University of North Carolina

Resources

Resources

Related Content

The Implications of High Leverage for Financial Instability Risk, Real Economic Activity, and Appropriate Policy Responses

“Cross-Sectional Patterns of Mortgage Debt During the Housing Boom: Evidence and Implications”

Cross-Sectional Patterns of Mortgage Debt during the Housing Boom: Evidence and Implications

Subprime Outcomes: Risky Mortgages, Homeownership Experiences, and Foreclosures