Should the Fed Regularly Evaluate Its Monetary Policy Framework?

Broadly speaking, a monetary policy framework is the set of tools and processes that a central bank uses to define and attain its high-level economic goals. Components of this framework include the bank’s policy instruments, such as short-term interest rates; operational targets, such as the inflation rate; and the rules and discretion that the bank follows when making its policy decisions. From the inception of central banking, monetary policy makers have adjusted their approach based on advances in economic theory, changes in the structure of the economy, and lessons learned from past policy failures and successes. For instance, the high inflation that the United States experienced beginning in the late 1960s prompted Congress to pass the Humphrey-Hawkins Act in 1978, which directed the Federal Reserve to pursue the “dual mandate” of achieving price stability and maximum employment. More recent changes in the Federal Reserve’s monetary policy framework involve the use of quantitative easing and forward guidance, alternative policy instruments employed when the short-term interest rate was at the effective zero-lower-bound during the Great Recession and the prolonged recovery. The Federal Open Market Committee (FOMC) specified an explicit 2 percent inflation target in a framework document that the Committee began issuing in 2012. This annual "Statement on Longer-Run Goals and Monetary Policy Strategy" is revised every January, but the authors believe that shortcomings in the internal procedure mean that the current process is suboptimal: the time allotted for reviewing the framework is limited, the scope of questions discussed is usually rather narrow, and since 2012, no alternative framework or new direction has been seriously considered. The authors propose that initiating a more comprehensive formal reevaluation of the Fed’s monetary policy framework, conducted at least once every five years to overlap with each chair’s four-year term, is a natural next step to achieve a more stable framework and to strengthen the Federal Reserve as an institution.

This research is part of the Federal Reserve’s recent efforts to engage a wide range of stakeholders across the country to provide feedback on the Fed’s approach to monetary policy. The Boston Fed is hosting a half-day conference on May 13, 2019 to gather perspectives from a number of New England organizations that focus on the underserved, as well as views from an array of demographic groups, and impressions from small business and labor.

Key Findings

Key Findings

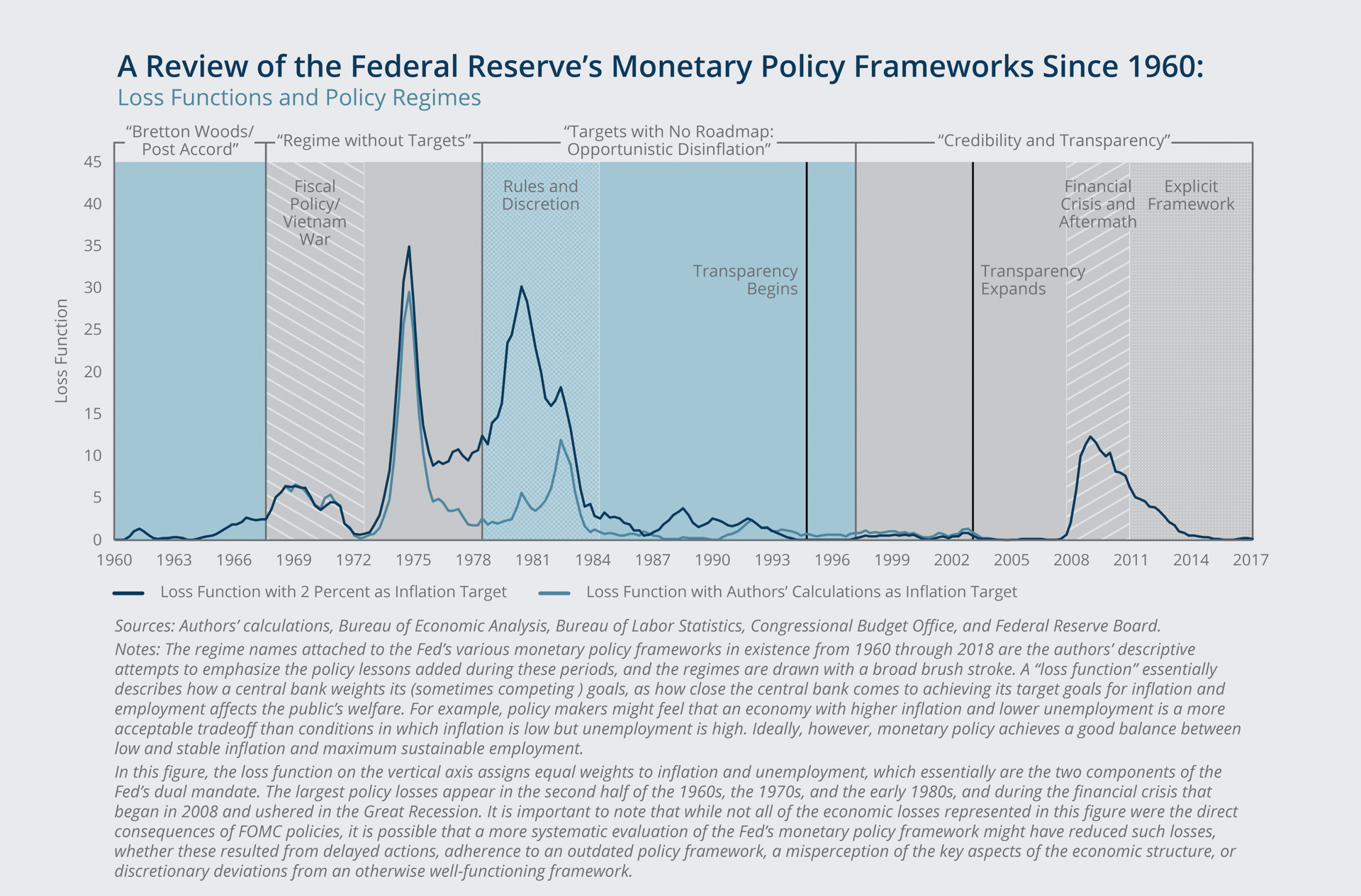

- A review of the Federal Reserve’s monetary policy framework suggest that some changes have occurred too slowly at key junctures. Given the non-systematic way that changes have been made to the framework, and the mixed history on the timeliness and effectiveness of such changes, instituting a formal regular review should ensure that the status quo is periodically challenged and that necessary changes to the framework are promptly adopted.

- Throughout the Federal Reserve System, the staff is constantly reassessing the monetary policy framework, so a large inventory of potential topics should be available for the FOMC to choose from when setting the agenda for a formal review. The Committee should also solicit evidence-based input from external participants, as doing so would increase transparency, accountability, and avoid the political risks inherent to an opaque review conducted internally.

- Given that the past decade has been marked by the largest financial crisis and the longest recession since the Great Depression, the unprecedented use of alternative monetary policy tools, and a disappointingly long recovery, especially to full employment, the formal changes to the Fed’s framework document have been relatively minor. Now may be a good time to institute a more formal review, as in the past the Fed has arguably failed to address emerging problems. One current high-level challenge to the Fed’s monetary policy framework is what appears to be a low-real-interest-rate regime, which in an economic downturn enhances the likelihood of spending protracted periods at the effective lower bound on interest rates. Another current challenge is the Fed’s limited ability to stabilize the economy, including a chronic pattern of significantly overshooting full employment. It may be the case that the FOMC should examine the whether price-level targeting might be an appropriate adjustment to the Fed’s monetary policy framework.

Exhibits

Exhibits

Implications

Implications

Over its 105-year history, the Federal Reserve has evolved significantly as the structure of the US economy and the global economy has changed. Constant advances are made in understanding how the economy works and the consequences, intended or not, of the policy choices faced by central banks. To best fulfill its Congressional mandates, the Fed should more proactively reassess its monetary policy framework at regular fixed formal intervals to benefit from the best current theoretical and empirical policy contributions from central bankers and academic economists. Over the long run, instituting a more comprehensive and regularly scheduled review should improve the economic performance of the US central bank and deliver better outcomes to the American public.

Abstract

Abstract

Would a more open and regular evaluation of the monetary policy framework improve policy in the United States? Even when considering a relatively short timeframe that spans the 1960s to the present, it is possible to point to many significant changes to the framework. Some of the changes were precipitated by acute economic conditions, while others were considered and implemented only gradually as a response to long-standing problems with the framework. But the process for evaluating and changing frameworks to date has not always been transparent, and changes have not always been timely. Could a more formal, and open, review improve how well we adhere to our current framework? Could transitions to a new framework be made more effectively? We conclude that such a review might indeed be beneficial, and outline one possible review process.