Does Getting a Mortgage Affect Credit Card Use?

Buying a house and getting a mortgage for the first time change a household’s balance sheet and may leave the household exposed to other shocks. The authors examine how this large change in the household balance sheet affects credit card use. Studying the relationship between mortgage debt and credit card debt is essential for understanding how consumers treat various types of debt.

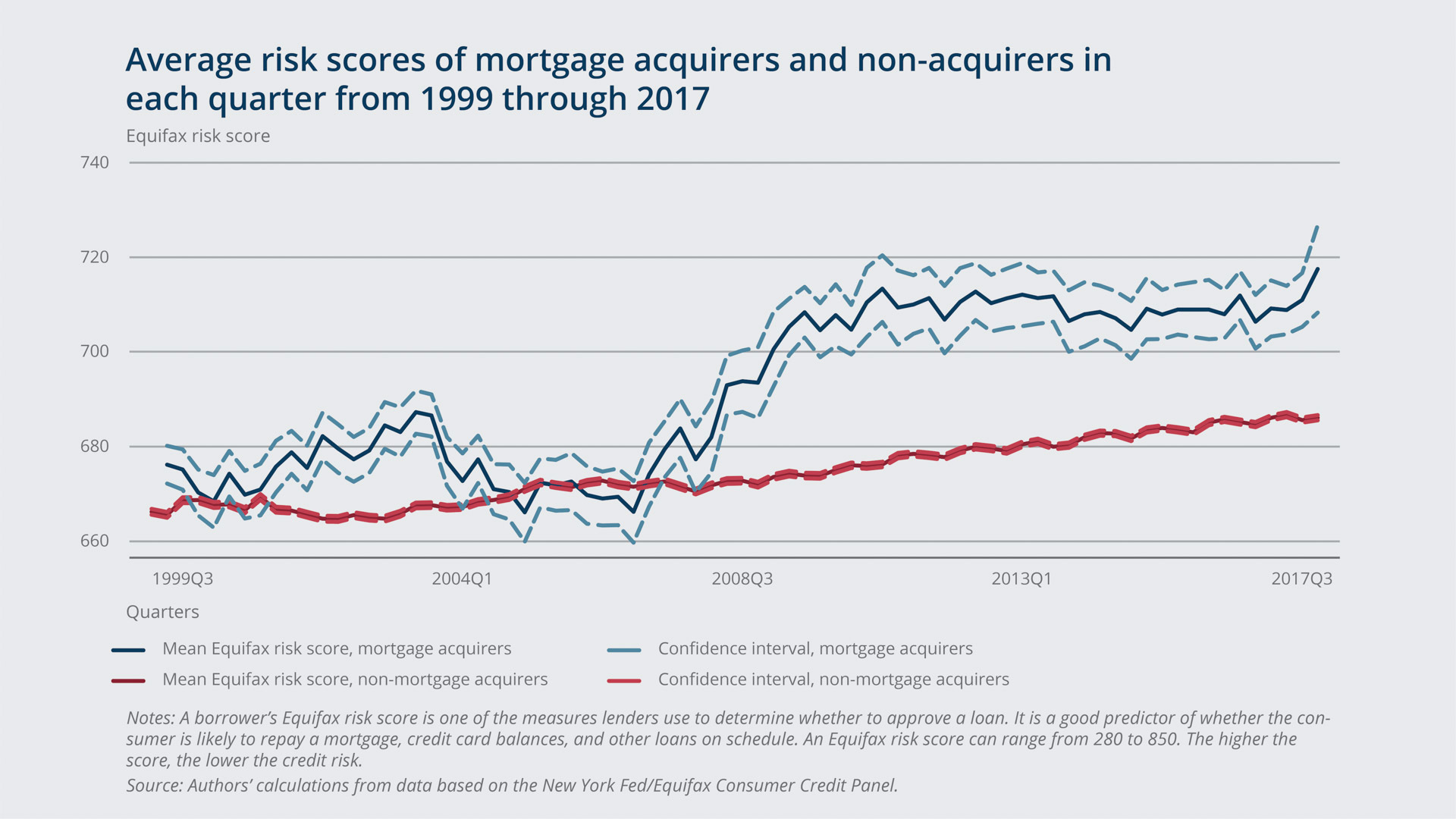

The literature on this topic includes very few studies that track the same consumers over time to analyze the relationship between changes in mortgage debt and credit card debt. The authors of this paper therefore employ a large panel of credit reports (the New York Fed/Equifax Consumer Credit Panel) that enables them to track those changes for a given individual upon the acquisition of his or her first mortgage. Because consumers may plan for years to buy a house, the authors examine credit card use during the period that precedes the acquisition of the mortgage as well as the period immediately around the acquisition and the period following it. They also look at how the 2007–2009 financial crisis may have affected the relationship between a mortgage acquisition and credit card use, and how credit risk scores may impact that relationship

Key Findings

Key Findings

- Although mortgage holders’ credit balances are, on average, three times greater than those of non-mortgage holders, the two groups have similar utilization rates (the percentage of the credit card limit that a cardholder uses). This is because credit card limits are proportionally higher for mortgage holders.

- In general, credit card debt increases steadily before a mortgage acquisition. Then it rises more rapidly when the mortgage is acquired and continues to do so for several quarters afterward, before returning to the steady rate of increase.

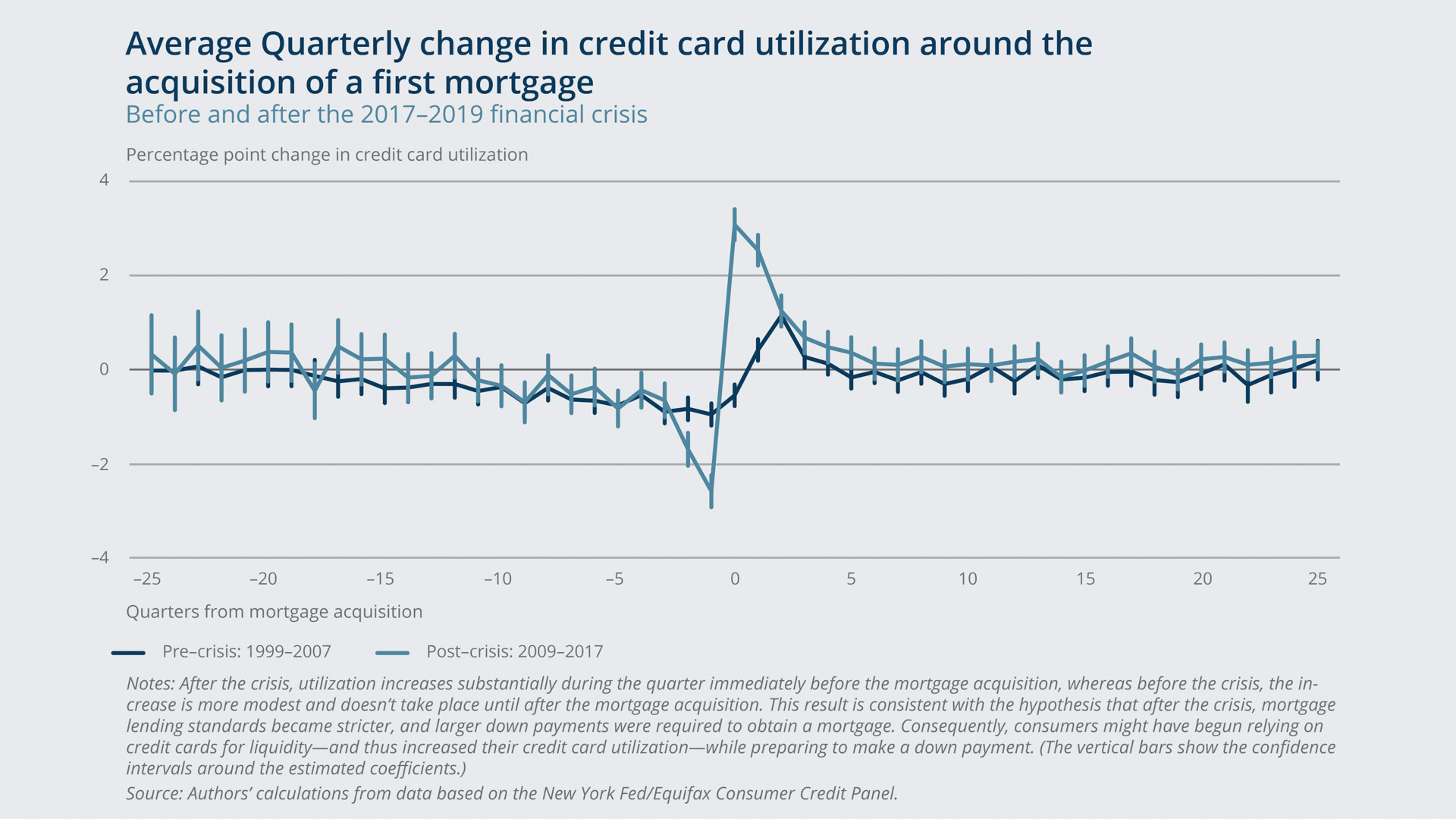

- Before the 2007–2009 financial crisis, credit card debt did not start rising steeply until after consumers acquired a mortgage. After the crisis, consumers began substantially increasing their debt a few quarters before getting a mortgage.

- The average short-term increase in credit card utilization upon acquiring a mortgage is 11.1 percentage points. The increase was significantly larger after the 2007–2009 financial crisis, at 12.9 percentage points.

- The increase in credit card utilization around a mortgage acquisition is greater among consumers with higher credit scores, but this effect was smaller after the financial crisis.

Exhibits

Exhibits

Implications

Implications

Acquiring a mortgage for the first time can affect credit card use in two ways: It can increase credit card spending (a debt effect), and it can lead to higher credit limits (credit effect). Based on their sample, the authors find that in the short run, the debt effect dominates. New-mortgage acquisition has a robust and statistically significant positive effect on credit card utilization—consumers increase their credit card spending around the time that they get a mortgage. The long-term effect changed over time. The credit effect seemed to exceed the debt effect in the study’s sample period before the 2007–2009 financial crisis, possibly because credit limits rose and dampened utilization rates. In the sample period after the crisis, when lending standards became more stringent, the debt effect dominated: Compared with the pre-crisis period, consumers’ credit card utilization rose higher when they acquired a new mortgage, which is consistent with lenders requiring larger down payments post-crisis, possibly leaving households more liquidity constrained.

Abstract

Abstract

Buying a house changes a household’s balance sheet by simultaneously reducing liquidity and introducing mortgage payments, which may leave the household more exposed to other shocks. We find that this change affects credit card use in two ways: A debt effect increases credit card spending, while a credit effect leads to higher credit limits. In the short run, a new mortgage acquisition has a robust and statistically significant positive effect on credit card utilization—the fraction of a consumer’s credit card limit that is used—of approximately 11 percentage points. Before the 2008 financial crisis, the credit effect exceeded the debt effect in the long run, pushing down long-term utilization. In our sample period after the financial crisis, the debt effect dominated in the long run, and credit card utilization rates rose upon the acquisition of a new mortgage, consistent with larger down payments leaving households more constrained.