Output Spillovers from U.S. Monetary Policy: The Role of International Trade and Financial Linkages

To understand how macroeconomic shocks in one country can have spillover effects that affect output in other countries, the authors of this paper estimate the effects of U.S. monetary policy changes on real GDP per capita in 44 advanced and developing countries during the period ranging from 1995 through 2017. Furthermore, they examine the cross-country heterogeneity of these spillover effects, with a focus on an individual country’s openness to foreign trade and its exposure to the global financial system. With additional data on bilateral trade and financial flows, the authors proceed to estimate a range of spatial models, shedding new light on international trade and financial networks and on the role that these individual linkages play in the propagation of monetary shocks across countries. This framework enables the authors to estimate the network amplification effect, decomposing a country’s spillover effect into a direct effect stemming from a U.S. monetary policy shock and a chain of indirect effects due to the output responses in other countries propagating through the network of global trade and financial linkages.

Key Findings

Key Findings

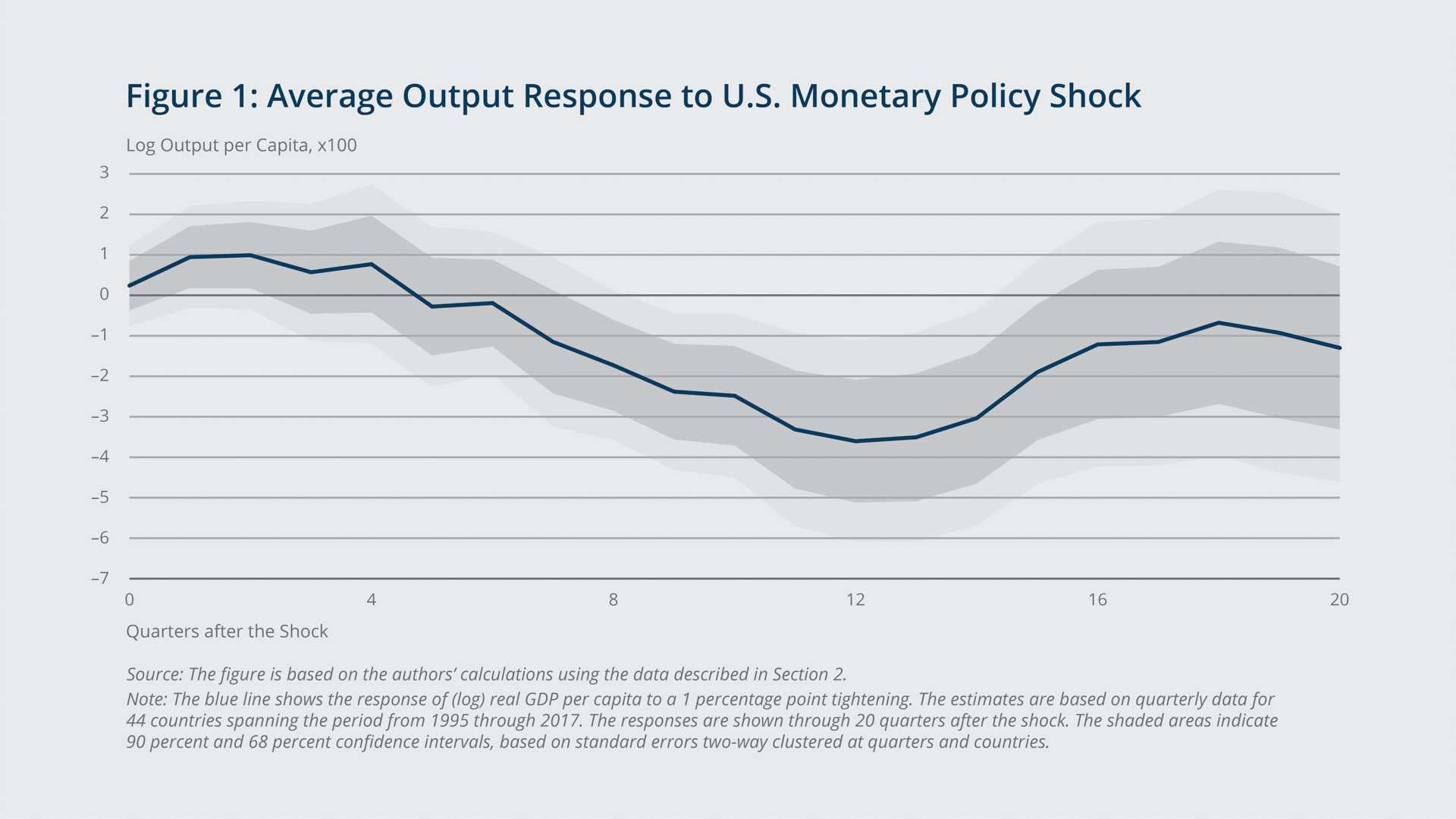

- In response to a surprise increase in the federal funds rate of 25 basis points, real output in the sample of 44 countries declines on average by 0.9% after three years.

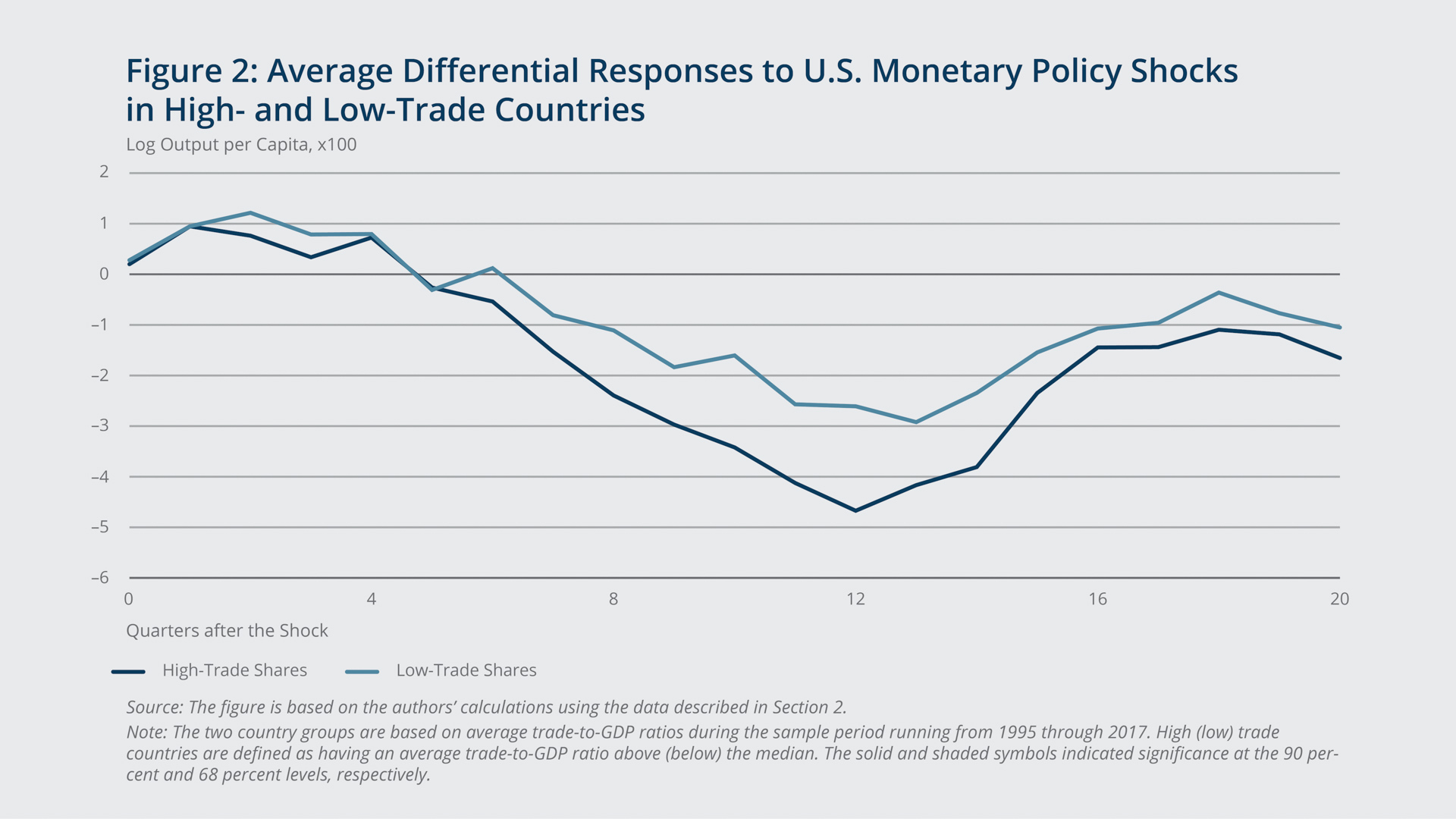

- International trade networks appear to be a more important factor than international finance linkages in explaining these spillovers. Countries with a high share of exports and imports in output are estimated to have 79% larger responses than countries with a low share, whereas no significant heterogeneity is found depending on a country's financial openness.

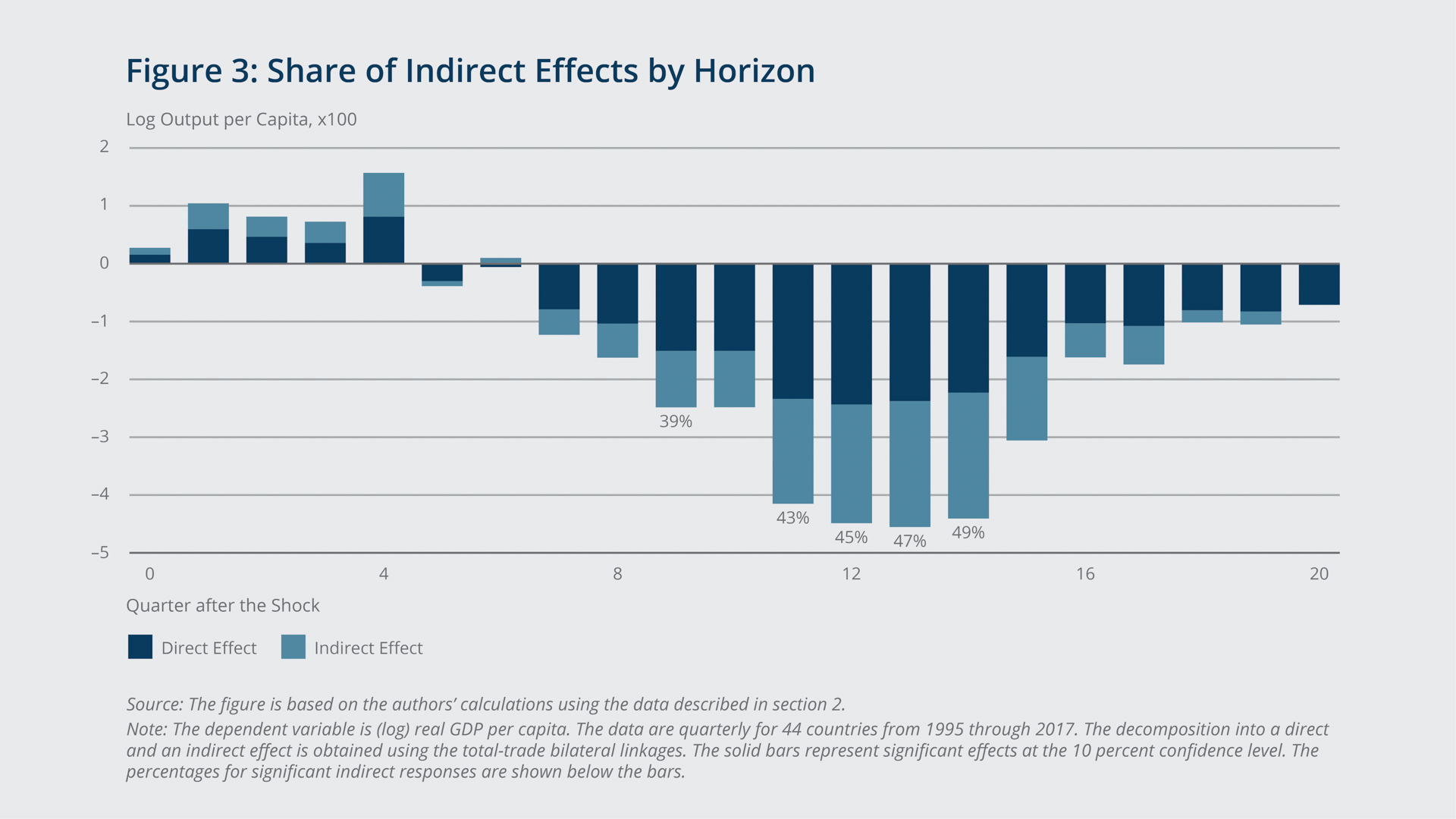

- The spatial correlation of output associated with the trade network is sizable, and the network amplification effect accounts for 45% of the total spillover effect at the peak horizon.

- The observed heterogeneity in the spillover effects, however, is explained mostly by the heterogeneity in the direct effects, as the indirect effects do not vary much across countries.

- In contrast to the trade network, the financial network is characterized by a low and statistically insignificant spatial correlation and a lack of network amplification.

Exhibits

Exhibits

Implications

Implications

Research on the international effects of macroeconomic shocks should potentially incorporate measures of endogenous amplification through network effects, because abstracting from these indirect spillovers may result in mismeasurement of the effects and potentially yield both quantitatively and qualitatively different theoretical predictions. In particular, trade networks could be an important ingredient of theoretical models focusing on the international effects of monetary policy shocks. Policymakers, especially in large open economies, should consider these spillover effects and the potential feedback loops when designing optimal policy. Small open economies, in order to understand and to predict the effects of foreign shocks, would benefit from analyzing their trade linkages.

Abstract

Abstract

We estimate that U.S. monetary policy has sizable spillover effects on global economic activity. In response to a surprise increase in the federal funds rate of 25 basis points, real output in our sample of 44 countries declines on average by 0.9% after three years. We find that international trade is a more important factor than international finance in explaining these spillovers. In particular, countries with a high share of exports and imports in output have 79% larger responses than countries with a low share, whereas we do not find significant heterogeneity depending on a country’s financial openness. Bilateral trade linkages appear to be quantitatively important, as the network amplification effect accounts for 45% of the total spillover effect at the peak horizon. We conclude that trade networks could be an important ingredient of theoretical models focusing on the international effects of U.S. monetary policy shocks.