Eyes on the Prize: How Did the Fed Respond to the Stock Market?

Motivation for the Research

Both the actual and the appropriate roles for equity prices in monetary policy deliberations have been hotly debated for some time. This paper addresses the first part of that debate: How has the Federal Open Market Committee (FOMC) actually responded to movements in broad equity price indexes? The paper does not take a stand on whether it would be appropriate for the Federal Reserve to respond directly to asset prices; it only examines whether the FOMC has, in fact, responded directly to asset values.

Quantifying the Fed's response to equity prices is not as straightforward as it might seem.The correlation between stock price movements and future values of variables of universal concern to central banks — CPI inflation, the unemployment rate, GDP growth — has made the identification of the equity price effect problematic. The authors attempt to identify the extent to which the federal funds rate responds to movements in equity price indexes after taking into account the role of these indexes in forecasting “goal” variables for monetary policy.

Research Approach

Previous attempts to account for the effect of equity prices on forecasts of these central bank goal variables have used forecasts that embody a different information set from the one used by the FOMC, which could bias the estimated effect of equity prices. The authors use the actual forwardlooking variables the FOMC examines before each meeting. These forecasts are presented in the “Greenbook,” a document compiled by Federal Reserve Board staff in preparation for each FOMC meeting. Each issue of the Greenbook contains a detailed outlook of the economy, including forecasts of real GDP and its components, the unemployment rate, employment growth, and various measures of inflation.

The testing strategy begins by examining whether the Greenbook forecasts efficiently incorporate equity price information. If they do not, estimates of the independent effect of equity prices on monetary policy could, again, be biased. The next step is to “correct” the Greenbook forecasts using the results from the efficiency tests so that the outlook efficiently incorporates equity price information. The final step is to estimate the policy rule including these efficient forecasts and the recent movements in equity prices.

Key Findings

- Once the control variables the FOMC actually uses to determine its policy actions are included, there is little evidence that the FOMC overreacts to stock market information.The reaction is just what would be expected, given the effect of stock prices on the traditional variables of concern to the FOMC.

- Equity prices do not enter significantly in the Greenspan era, once one controls for the four-quarter- ahead forecasts of unemployment, GDP growth, and inflation.

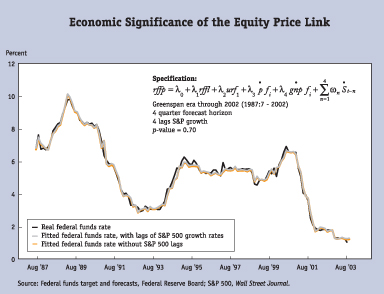

- Just as important, the difference in the fitted values for the policy rules with and without equity prices is barely detectable. (See the chart, “Economic Significance of the Equity Price Link.”)

Almost all of the variation in the federal funds rate is well explained by forecasts of the goal variables that are mentioned in the Federal Reserve charter.

Implications

The authors' findings suggest that the only way that equity prices affect the FOMC's actions is through the impact of those prices on a forecast of accepted monetary policy goal variables. The paper does not address whether the FOMC should react in a more complicated way to changes in asset values. If, for example, these changes represent alterations in the other moments of the forecast, perhaps policy should respond independently.” This is a question for additional research and discussion.

About the Authors

About the Authors

Jeff Fuhrer is an executive vice president and senior policy advisor at the Federal Reserve Bank of Boston. His email is Jeffrey-Fuhrer@hks.harvard.edu.

Resources

Resources

Related Content

Episode 1: How did labor markets rebound from epic COVID-19 collapse?

Labor Markets During and After the Pandemic

A Look Inside a Key Economic Debate: How Should Monetary Policy Respond to Price Increases Driven by Supply Shocks?

How Should Monetary Policy Respond to a Slow Recovery?