Why Don't Lower-Income Individuals Have Retirement Saving Plans?

Lower-income individuals— lower employment rate—and the smaller probability of their working for an employer that offers pensions—underlie the pension gap between higher- and lower-income groups.

About half of U.S. private-sector workers do not participate in a retirement plan at their current job.[1] Not surprisingly, nonparticipants are more likely to have lower incomes. Low participation is becoming a more serious concern as individuals will need more retirement savings due to declining Social Security replacement rates and longer lifespans.

In response, policy experts have proposed ways to expand participation in 401(k) plans and similar employer-based savings plans. Assessing the potential of these options requires a precise understanding of why individuals, particularly those with lower incomes, do not have pensions. A recent study concludes that the key reasons for the lack of pension participation among lower-income individuals are a lower likelihood of being employed and, if employed, of working for an organization that offers a plan.[2] The most effective way to increase coverage would be to provide all workers with access to a plan and automatically enroll them.

Mechanics of Pension Participation

Obtaining an employer pension involves four steps. First, to be associated with a plan, an individual must work regularly. Lower-income individuals, perhaps because they have less education and fewer job skills, have weak labor-force attachment and higher unemployment rates.

Second, a worker must work for an employer that offers a pension to at least some of its employees. Previous research finds that lower-income workers are less likely to be at organizations offering fringe benefits like health insurance, paid time off, and disability insurance.[3] Less is known about their likelihood of working for a company offering a pension.

Third, if a pension is offered by the employer, the worker must be eligible for coverage. Many enterprises make pension plans available only to workers with sufficient tenure and hours worked.

Finally, to participate in a pension plan, the eligible worker must actually take up the employer's offer. That issue is not relevant for defined benefit plans, which usually feature mandatory automatic enrollment and guarantee a certain benefit level. In contrast, participation in a 401(k) is voluntary, and many of the factors that limit voluntary 401(k) participation among workers at all income levels-liquidity constraints, high discount rates, insufficient tax incentives, and insufficient financial literacy-are particularly relevant for those with lower incomes.[4] The net effect is that lower-income people are much less likely than their higher-income counterparts to participate in a retirement plan. The question is, Where are the weak links in the participation chain?

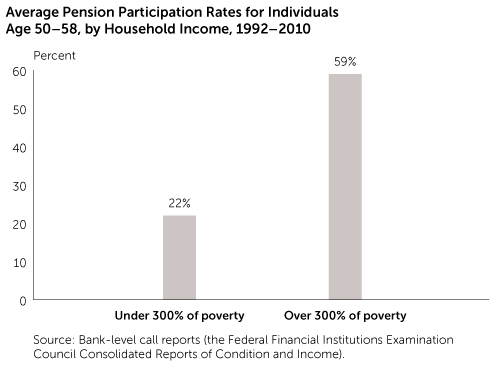

To answer that question, we used data from the 1992-2010 waves of the University of Michigan's Health and Retirement Study (HRS), a longitudinal survey covering households with members over age 50.[5] The main sample consists of respondents age 50 to 58 who answered the pension questions and whose household income is less than 300 percent of the poverty line (about $39,000, based on a weighted average between the one- and two-person households in our sample). The analysis compares older lower-income individuals to older individuals with household incomes of more than 300 percent of the poverty line. For the core sample of lower-income individuals, the average pension-participation rate at a current job was just 22 percent during the 1992-2010 period, well below the 59 percent rate for higher-income individuals. (See "Average Pension Participation Rate for Individuals Age 50 to 58." )

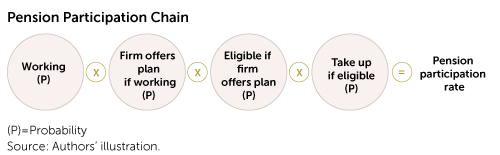

What is the relative importance of the four links in the pension participation chain: employment, employer offer, eligibility, and take-up? The percentage of the sample employed is an unconditional probability. The remaining three elements are all conditional probabilities that rely on meeting the previous condition. (For example, conditional on being employed, does the employer offer a pension plan to any of its workers?) The four probabilities (P) multiplied together equal the percent who participate in pensions. (See "Pension Participation Chain." )

The results show that the low participation rates of lower-income respondents are driven primarily by weak labor-force attachment and by working for a firm without a pension. (See "Pension Participation Rate and Its Components" and "401(k) Participation Rate and Its Components." ) Only about half of the lower-income individuals are working, and among those who are working, only about 60 percent work for companies that offer a pension. That is where the most serious trouble spots for participation lie. Eligibility and take-up rates among lower-income workers also help to explain their low participation but are considerably less important as they are between 85 percent and 90 percent.

Pension Participation Rate and Its Components,

Individuals Age 50-58, 1992-2010

| Condition | Under 300% of poverty line |

Over 300% of poverty line |

| Individual is working | 49% | 79% |

| Firm offers pension if working | ? 59% | ? 82% |

| Worker is eligible if firm offers | ? 89% | ? 95% |

| Worker takes up if eligible | ? 86% | ? 95% |

| Pension participation | =0.22% | =0.59% |

Source: Wu and Rutledge, "Lower-Income Individuals without Pensions."

401(k) Participation Rate and Its Components,

Lower-Income Individuals Age 50?58, 1992?2010

| Condition | Under 300% of poverty line |

| Individual is working | 49% |

| Firm offers pension if working | ? 59% |

| Worker is eligible if firm offers | ? 89% |

| Worker takes up if eligible | ? 86% |

| Pension participation | =0.22% |

Source: Authors' calculations

Can Policy Changes Help?

In considering how policy changes could expand pension participation, it is important to exclude the individuals in the sample who work for organizations that offer defined-benefit coverage, because defined-benefit plans are in the process of disappearing from the private sector.[6] Policy options to expand coverage generally involve some type of defined-contribution plan.

When the defined-benefit workers are excluded from the sample, the take-up rate for lower-income workers drops from 86 percent to 78 percent. From this vantage point, take-up rates are a weaker link than is apparent from looking at the full sample. The overall participation rate also drops because each link in the chain is weaker.

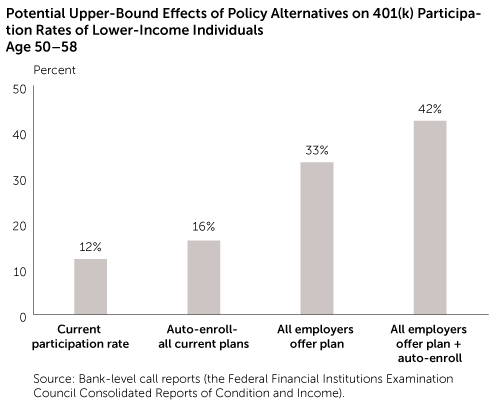

To assess the implications of policy reforms, the conditional probabilities for each link in the participation chain can be used for a back-of-the-envelope calculation. For example, if all existing 401(k) plans offered full-scale auto-enrollment, it could increase the potential take-up among eligible lower-income individuals from 78 percent to as much as 100 percent. One hundred percent is an upper bound as individuals would still be able to opt out.

To calculate the participation rate under such a policy change, the four probabilities are multiplied together. The participation rate would be, at maximum, .42 (working) x .44 (company offer) x .84 (eligible) x 1.0 (take-up rate) = 16 percent. (See "Potential Upper-Bound Effects of Policy Alternatives." ) Compared with the baseline rate of 12 percent, this type of auto-enrollment policy is an improvement, but it helps only those who already have access to a plan.

A more ambitious proposal would be to require all employers to offer pensions to their workers, similar to a universal IRA. In that case, both the offer rates and eligibility rates are assumed to rise to 100 percent. If the take-up rate remains unchanged from the baseline of 78 percent, the potential participation rate would increase to 33 percent (.42 x 1 x 1 x .78).

Taking it one step further, if all workers were eligible and they were auto-enrolled, the participation rate would be, at most, 42 percent (.42 x 1 x 1 x 1). These policies could also be paired with features such as automatic escalation in the saving rates to help ensure that participants are putting enough aside. Of course, providing universal pension coverage in the workplace would still leave a large fraction of lower-income individuals without coverage because of their low employment rates.

Among today's older lower-income individuals, the most important reasons for low pension-participation rates are a lack of employment and employment with organizations that do not offer pensions. These findings suggest that the most potent approach for boosting pension participation would be requiring employers to offer all workers access to a retirement saving plan that includes auto-enrollment. But because such a policy would not help lower-income individuals of working age who are unemployed, it will also be critical to support measures to boost employment.

April Yanyuan Wu and Matthew S. Rutledge are research economists at the Boston College Center for Retirement Research. Jacob Penglase is a doctoral student in economics at Boston College. Contact them at matthew.rutledge@bc.edu.

Endnotes

- Alicia H. Munnell and Dina Bleckman, "Is Pension Coverage a Problem in the Private Sector?" (Issue in Brief 14-7, Center for Retirement Research at Boston College, Chestnut Hill, Massachusetts, 2014).

- April Yanyuan Wu and Matthew S. Rutledge, "Lower-Income Individuals without Pensions: Who Misses Out and Why?" (working paper, Center for Retirement Research at Boston College, Chestnut Hill, Massachusetts, 2014).

- Henry S. Farber and Helen Levy, "Recent Trends in Employer-Sponsored Health Insurance Coverage: Are Bad Jobs Getting Worse?" Journal of Health Economics 19 (2000): 93-119.

- Defined benefit implies that a certain amount of money is guaranteed periodically in retirement based on years of service and past earnings. That is in contrast to defined-contribution plans, where the pension does not include a guaranteed payout. Instead, the onus is on the employee to contribute and choose investments, though most employers provide matching contributions.

- See http://hrsonline.isr.umich.edu/. Throughout our study, "household" refers to the individual and his or her spouse, if present, ignoring the characteristics of any other household member.

- Some workers are covered under both defined benefit and 401(k) plans. These workers are excluded in the analysis discussed here.

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

April Yanyuan Wu, Boston College

Matthew S. Rutledge, Boston College

Jacob Penglase, Boston College