Childhood Savings and College Success

As the cost of postsecondary education continues to rise, many families, especially low-income families, are concerned about their ability to pay. A variety of initiatives are making it easier to start saving early.

With college out of reach for many lower-income families, studies showing a link between savings and educational attainment are garnering increased attention. Thus the time may be ripe to promote Children's Savings Accounts (CSAs), a long-term asset-building tool.

Consider that, regardless of family income level, children of parents who own assets are more likely to have higher academic achievement and complete more years of education, even with savings as limited as $3,000.[1] Whether black or white, children who have savings are roughly twice as likely to be in college or to graduate has those without savings.[2] Furthermore, targeting children for savings accounts appears to have a multiplier effect: Whole families start to accumulate assets and to regard college as achievable.[3] Assetbuilding policies for children are also thought to diminish the intergenerational transmission of poverty.[4]

First proposed in the early 1990s, CSAs targeted toward lowand moderate-income families now include matches from foundations, financial institutions, and even municipalities.[5]

Children who have savings are roughly twice as likely to be in college or to graduate than those without savings.

Savings Programs

Singapore's Edusave is one of the oldest and most comprehensive CSA programs. Since 1993, Edusave accounts have been created automatically for children at age 6. Over the child's next 10 years, the government adds $4,000 in interest-bearing grants for enrichment programs and approved school fees. Singapore also has universal accounts for children from birth to age 6 and postsecondary accounts for children 7 to 18.

In the United Kingdom, the Child Trust Funds (CTF) Act of 2004 created long-term savings and investment accounts. Children born after September 1, 2002, received a £250 account at birth and another £250 voucher at seven. Low-income families were eligible for an additional £250 at birth and age seven. Parents, family, and friends could contribute up to £1,200 per year, tax exempt. Funds could be withdrawn only by the child after age 18, with no restrictions on use.[6] The CTF was phased out in 2011, however, and replaced by Junior Individual Savings Accounts, which do not involve government grants.

Children's Savings Account Programs in the United States

In the United States, the proposed America Saving for Personal Investment, Retirement, and Education (ASPIRE) Act of 2007 sought to create universal CSAs with a one-time $500 government contribution, but it failed to pass Congress.[7]

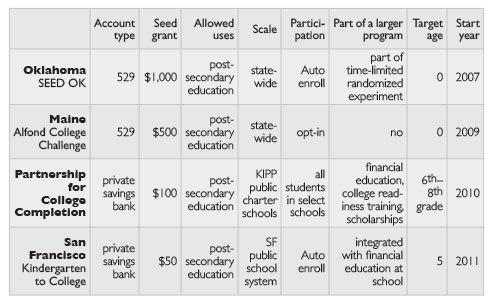

Nevertheless, smaller-scale investments have confirmed the potential. The Saving for Education, Entrepreneurship, and Down-payment (SEED) initiative, sponsored by the nonprofit Center for Enterprise Development (CFED), tested variations of CSAs with more than 1,100 children in 12 states over six years. Many SEED participants did save and build assets, although saving was hard for low-income families. The pilot has led to largerscale experiments. (See "Children's Savings Account Programs in the United States.")

SEED OK

SEED for Oklahoma Kids (SEED OK) is a largescale, randomized experiment meant to track the effectiveness of CSAs in terms of family attitudes and behaviors, actual savings, and child development. The program studies 2,708 children, half of whom automatically received an Oklahoma College Savings Plan (OCSP) account with $1,000 deposit soon after birth.

The program also offers a savings match up to $250 a year for low-income families, who need to open a separate OCSP account to make contributions. Although the children are now only five, too young to measure long-term effects, qualitative interviews with mothers have provided a wealth of data about the financial knowledge and behavior of the family, savings motives and challenges, educational aspirations for their children, and perspectives on paying for college and on the SEED OK.[8] Many say they feel more optimistic about college but also see competing needs for their money.

Alfond College Challenge

The Harold Alfond Foundation worked with the state of Maine to create a comprehensive CSA program in 2009. Each child born in Maine is eligible for a $500 grant in a NextGen account, Maine's 529 College Savings Plan. The child must be enrolled prior to age one, and the parent must complete an inquiry form and enrollment kit.[9] Only 40 percent of eligible families actually signed up in 2009, underscoring how important it would be to move to universal enrollment. [10]

Partnership for College Completion

The Partnership for College Completion (PCC) is a collaboration of the United Negro College Fund, the KIPP network of public charter schools, and CFED to improve the college completion rate for low-income and minority youth from less than 10 percent to 40 percent by 2035.

In fall 2010, PCC began a pilot program in 29 KIPP middle schools in Chicago/Gary (Indiana), the San Francisco Bay Area, Houston, Washington DC, and New York City. Students received accounts seeded with $100 initial deposits in partnership with Citi Foundation. Family contributions are matched up to the current annual limit of $250, but there is no contribution limit. In addition, PCC awards merit- and need-based scholarships to students with savings accounts and offers financial education classes and workshops for parents.[11]

Kindergarten to College

In spring 2011, San Francisco implemented the Kindergarten to College program and automatically opened college savings accounts with an initial deposit of $50 for the first group of kindergartners. Children in the national school lunch program receive an additional $50. The program also helps the schools integrate financial education into K-12 math and eventually will link attendance to incentives.

Parents may deposit up to $2,500 per year in accounts. To avoid taxes, the accounts do not earn interest but will be awarded a growth match, set at money market rates, upon use of the funds for postsecondary education. Current savings incentives include a match up to $100 by the Earned Assets Resource Network, a nonprofit focused on asset building. Additionally, parents who sign up to make automatic monthly deposits or make contributions for six months in a row receive $100.[12]

Looking Ahead

CSAs have great potential, but the long time frame, from birth to adulthood, makes proving their success challenging. Preliminary analysis indicates that only a small percentage of families have contributed additional savings. Furthermore, socially and economically advantaged families were much more likely to open the accounts. CSA program redesigns are taking such findings into account.

Universal children's savings accounts could potentially give every family a foundation on which to build assets and a better future for their children. And although existing programs have emphasized postsecondary education, CSAs could also be applied to home or car purchases or a business start-up.

More and more cities and regions are getting on board. In Cuyahoga County, Ohio, a CSA program was launched in late 2012, and 19 other cities are actively exploring the concept. Combined with improved financial education and college-readiness programs, CSAs can make higher education a reality for all.

Cathy Lin was a Boston Fed intern at the time of this writing and studying at the Harvard Graduate School of Design. Contact her at clin.989@gmail.com.

Acknowledgment

The author wishes to thank Anna Steiger, Federal Reserve Bank of Boston, for her help.

Endnotes

[1] M. Zhan and M. Sherraden, "Assets, Expectations, and Children's Educational Achievement in Female-Headed Households," Social Service Review (2003): 191-211. [Back to story]

[2] William Elliott III and Ilsung Nam, "Direct Effects of Assets and Savings on the College Progress of Black Young Adults" (working paper 11-14, Center for Social Development, George Warren Brown School of Social Work, Washington University, St. Louis, Missouri, 2011). [Back to story]

[3] M. Zhan, "Assets, Parental Expectations and Involvement, and Children's Educational Performance," Children and Youth Services Review (2006): 961-975. [Back to story]

[4] M. Sherraden, "From a Social Welfare State to a Social Investment State," in C. Kober and W. Paxton, eds., Asset-Based Welfare and Poverty: Exploring the Case for and against Asset-Based Welfare Policies (London: National Children's Bureau, 2002). [Back to story]

[5] M. Sherraden, Assets and the Poor: A New American Welfare Policy (New York: M.E. Sharpe Inc., 1991). [Back to story]

[6] V. Loke and M. Sherraden, "Building Assets from Birth: A Global Comparison of Child Development Account Policies," International Journal of Social Work (2009). [Back to story]

[7] Barbara A. Butrica, "The Case for National Children's Savings Accounts," Communities & Banking 21, no. 1 (winter 2010), http://www.bos.frb.org/-/media/Documents/cb/PDF/Butrica_Child_Savings_Accounts.pdf. [Back to story]

[8] K. Gray, M. Clancy, et al., Interviews with Mothers of Young Children in the SEED for Oklahoma Kids College Savings Experiment (St. Louis: Washington University, 2012). [Back to story]

[9] See http://www.famemaine.com/files/Content/NextGenFiles/0-DIRECT_Enrollment_Kit.pdf.s [Back to story]

[10] J. Huang, S. Beverly, et al., "Early Program Enrollment in a Statewide Child Development Account Program," Journal of Policy Practice (2011). [Back to story]

[11] Leigh Tivol, "CFED Announces Partnership for College Completion," June 22, 2011, http://cfed.org/blog/inclusiveeconomy/cfed_announces_partnership_for_college_completion/. [Back to story]

[12] Leigh Phillips and Anne Stuhldreher, Kindergarten to College (case study, New America Foundation, Washington, DC: 2011), http://assets.newamerica.net/publications/policy/kindergarten_to_college_k2c. [Back to story]

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Cathy Lin, Federal Reserve Bank of Boston