2014 Series • No. 14–10

Research Department Working Papers

The Forecasting Power of Consumer Attitudes for Consumer Spending

A subsequent version of this paper has been published in the Journal of Money, Credit and Banking.

The widely studied Reuters/Michigan Index of Consumer Sentiment is constructed from the answers to five questions from the more comprehensive Reuters/Michigan Surveys of Consumers. Yet little work has been done on what predictive power the information taken from this more thorough compilation of consumer attitudes and expectations may have for forecasting consumption expenditures. The authors construct a limited set of real-time summary measures for 42 questions selected from these broader Surveys corresponding to three broad economic determinants of consumption-income and wealth, prices, and interest rates, and then use regression analysis to evaluate and test the ability of these summary measures to predict future changes in real consumer expenditures, even when controlling for current and future fundamentals. They explain a nontrivial portion of consumption and other real activity forecast errors from professional forecasts. This is consistent with these measures' ability to predict consumption even when conditioning on a broader set of fundamentals as well as professional forecasters' judgmental forecast adjustments.

Key Findings

Key Findings

- The broader Surveys contain information that is not captured in the Reuters/Michigan Index of Consumer Sentiment. The information embedded in the summary measures constructed from the broader Surveys questions has explanatory power for consumption behavior above and beyond the Reuters/Michigan Index of Consumer Sentiment, and this power is largely related to consumer attitudes toward prices and interest rates.

- When the Surveys' summary measures are added in addition to the observed standard consumption fundamentals, there is a significant improvement in fit. Instead, when these fundamentals are controlled for, the role of consumer sentiment in predicting consumption is marginal at best.

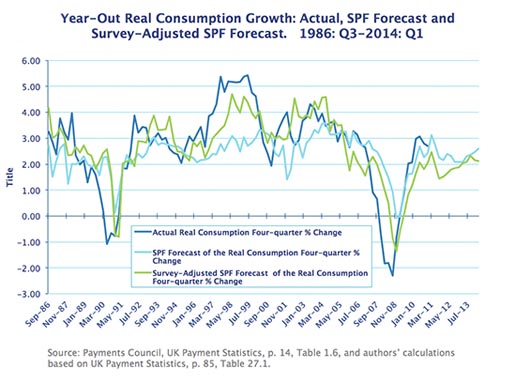

- Using a sample Greenbook forecast from 1987:Q1 through 2008:Q4 and a Survey of Professional Forecasters' sample from 1987:Q1 through 2013:Q4, roughly 20 to 40 percent of the variation in the forecasting errors can be explained by including the three summary measures from the Surveys.

Exhibits

Exhibits

Implications

Implications

In predicting real aggregate consumption growth, the forecasting power improves when consumer attitudes regarding prices, interest rates, and credit availability are included. Efficiently incorporating the information from the Surveys could have appreciably lowered forecast errors during the second half of the 1990s and during the Great Recession, and may prove useful at this current juncture, as real consumption growth, despite the low interest rate environment, could be impeded by credit conditions.

Abstract

Abstract

We assess the ability of the Reuters/Michigan Surveys of Consumers to predict future changes in consumer expenditures. The information in the Surveys is summarized by means of principal components of consumer attitudes with respect to income and wealth, interest rates, and prices. These summary measures contain information that goes beyond the information captured by the Index of Consumer Sentiment from the same Surveys. The summary measures have forecasting power for aggregate consumption behavior, even when controlling for current and future economic fundamentals. These measures also help to explain a nontrivial portion of consumption and other real activity forecast errors from the Survey of Professional Forecasters and the Federal Reserve Board's Greenbook. This finding is consistent with the ability of these summary measures to predict consumption even when conditioning on a broader set of fundamentals and on forecasters' judgmental assessments of developments that are not easily quantifiable.