Payment Discounts and Surcharges: The Role of Consumer Preferences

Shy and Stavins (2015) showed that in 2012 U.S. merchants rarely took advantage of their recent freedom to differentiate prices based on the method of payment use. The authors of this paper use new data from the 2015 Diary of Consumer Payment Choice to analyze price discounts and surcharges based on the payment method used for transactions. They examine consumer preferences for specific payment instruments and test whether consumer demand for payment instruments is price elastic—specifically, whether consumers are likely to deviate from their preferred methods in order to obtain a discount or avoid a surcharge.

Key Findings

Key Findings

- As in 2012, the occurrence of price incentives based on the payment method used continued to be low in 2015.

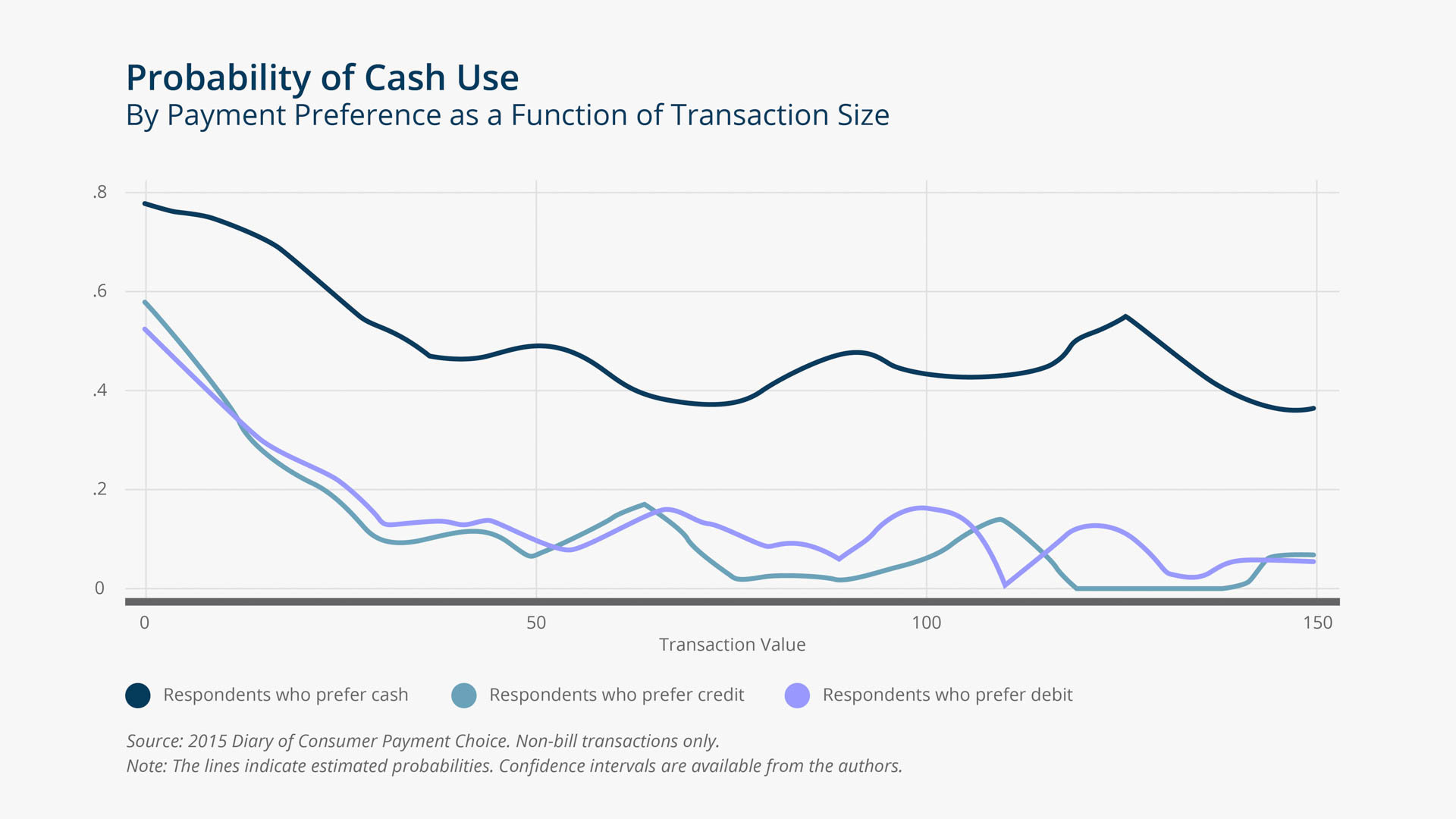

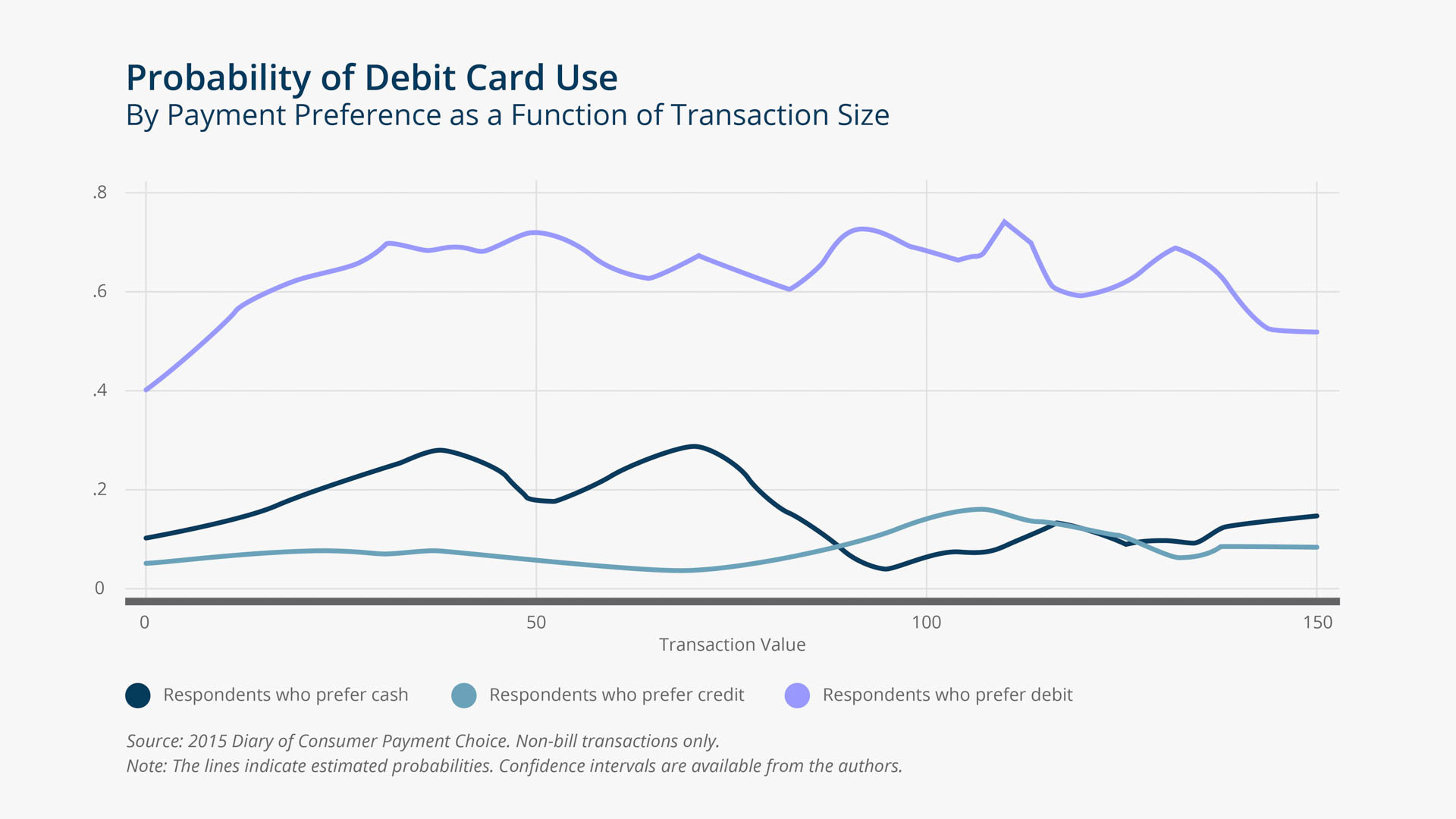

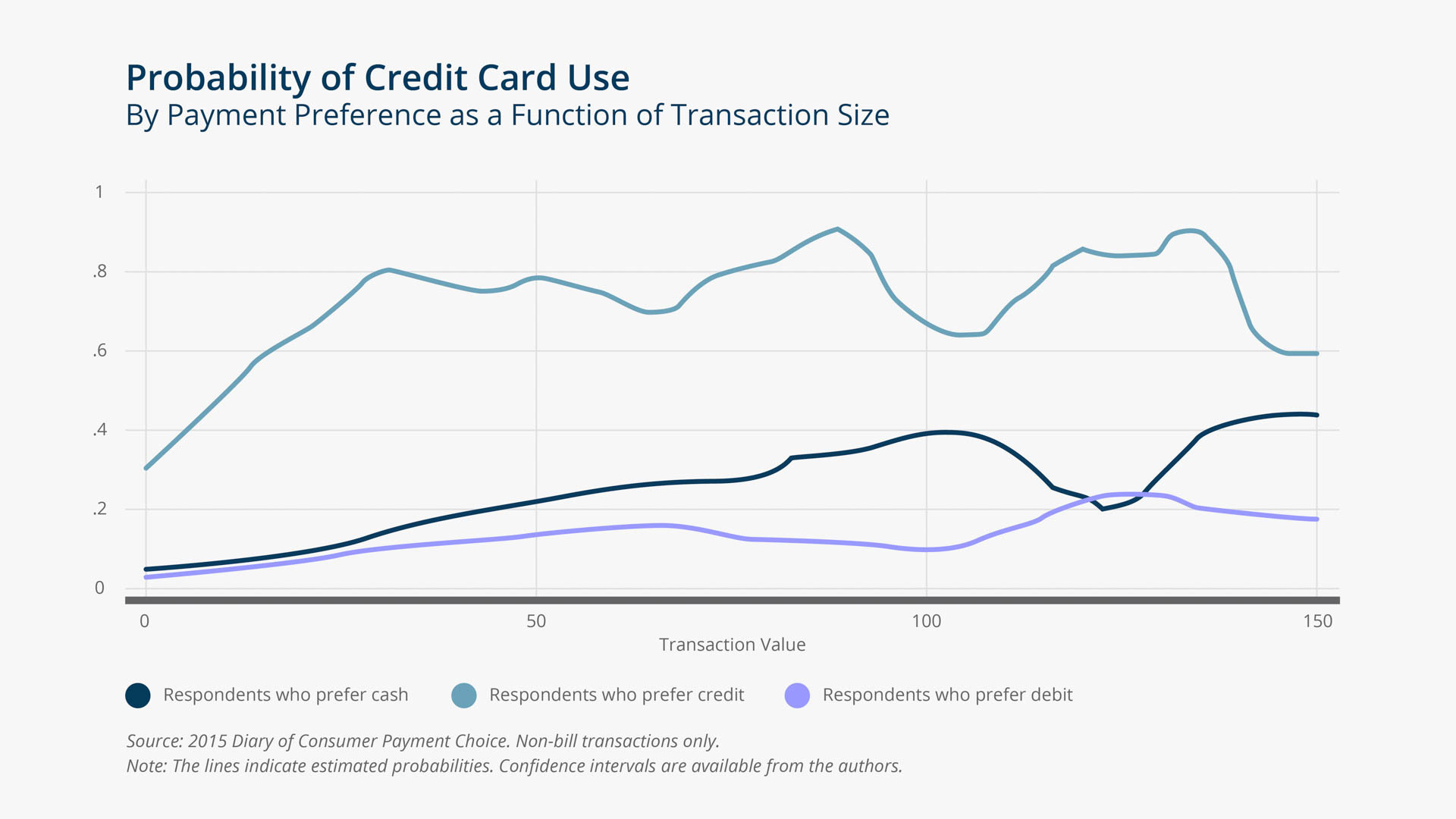

- Consumer preferences are correlated with demographic and income attributes, but they also vary by the value and type of transaction.

- For the majority of transactions, consumers tend to use their preferred payment instruments, deviating mainly because of the dollar values of transactions—for example, by switching to cash for low-value transactions—or because of the merchant type. Those consumers who prefer to use cash typically shift to another payment method because of insufficient cash on person to conduct a cash transaction.

- However, consumers who prefer other payment methods have an 11.7 percent probability of switching to cash because of cash discounts, after controlling for merchant category and dollar value of the transaction. As the amount of cash discount is typically low, this indicates that consumers' demand is highly elastic with respect to discounts.

- Choice of payment method is affected very strongly by consumer individual preferences, but steering by merchants may be effective under some circumstances. Both merchants' reluctance to offer price discounts and consumers' limited response to them lead to the low observed occurrences of such incentives.

Exhibits

Exhibits

Implications

Implications

The current paper extends previous work on the effect of discounting and surcharging and incorporates information from self-reported consumer preferences for certain payment instruments, yielding new insights that had not been fully explored previously.

Although some consumers switch from their preferred payment methods to cash if a discount is offered, most of the switching continues to take place for low-value automobile transactions, such as gasoline purchases, where cash discounts have long been offered.

More research is needed to determine whether the infrequent occurrence of price incentives is caused by merchants' reluctance to offer them or by consumers' inelastic demand for payment instruments.

Abstract

Abstract

We use new data from the 2015 Diary of Consumer Payment Choice to analyze price discounts and surcharges based on the payment method used for transactions. We examine consumer preferences for specific payment instruments and test whether consumer demand for payment instruments is price elastic. Specifically, we test whether consumers are likely to deviate from their preferred methods in order to get a discount or to avoid a surcharge. We find that the occurrence of price incentives is low, but consumers who preferred other payment methods had an 11.7 percent probability of switching to cash because of cash discounts, after controlling for merchant category and dollar value of the transaction. Payment method choice is affected very strongly by consumer individual preferences, but steering by merchants may be effective under some circumstances. Both merchants' reluctance to offer price discounts and consumers' limited response to them lead to the low observed occurrences of such incentives.