Social Security and Unsecured Debt

Motivation for the Research

Most young households simultaneously hold both unsecured debt on which they pay an average of 10 percent interest and social security wealth on which they earn less than 2 percent. Nationally, consumer revolving debt currently totals about $700 billion, while social security wealth is about $11 trillion. As a nation, we are apparently borrowing on credit cards and saving in a passbook savings account.

This paper documents this inefficiency and explores ways to reduce it.

Research Approach

The authors focus on the old-age portion of social security and explore this topic in three steps. First, using data from the Panel Study of Income Dynamics (PSID), they examine the distribution across individuals of non-collateralized debt and social security wealth to see whether the households who owe the debt are the same as those who have the wealth. Second, they develop a dynamic, life-cycle, portfolio choice model that reflects the assumption that the world is populated by two types of households: tempted households who care about the future but face an overwhelming desired to consume all available resources in the current period, and disciplined households, who face no such desire. Third, they conduct two policy experiments aimed at alleviating the inefficiency of simultaneous debt and social security holdings.

In the first experiment, households currently in the social security system are allowed to access their social security wealth to pay off debt. In the second experiment, young households are exempted from making social security payments.

The paper is agnostic on the issue of how social security is funded. Nor do the authors take any stand on changing the financing of the social security system. In other words, they estimate how their proposals would affect the solvency of a pay-as-you-go system. The policy experiments require households to contribute at least as much to social security in present-value terms as they do in the current system and to leave the benefit portion of social security unchanged.

Key Findings

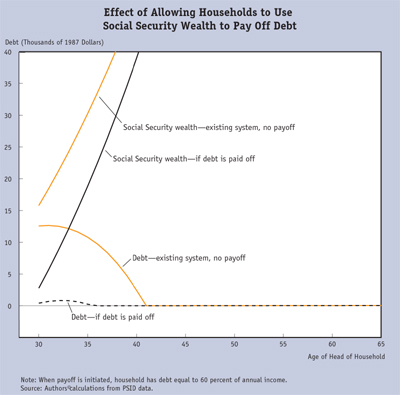

- Simply allowing households to use the money they have paid in to the social security system to pay off debt would allow many households to get out of debt completely and others to dramatically reduce their exposure to high-interest unsecured debt.

- If households could access their social security wealth to pay off debt, only 17 percent would still have debt. And for that 17 percent, debt would be dramatically reduced; for the 90th-percentile household in the debt distribution, unsecured debt would fall from 84 percent to 33 percent of that household's average income.

- Both experiments, but particularly the one that allows exemptions for younger households, solve the problem in question and lead to significant increases in household welfare, consumption, and saving, and to reductions in high-interest, unsecured debt.

- Moving from the existing system to one in which households whose head is under 30 are exempt from contributing to social security (but are forced to make up the taxes later in life) raises certain-equivalent consumption by 3.4 percent for disciplined households and by 3.3 percent for tempted households.

- With the exemptions, disciplined households come closer to approximating the optimal allocation across risky and riskless assets without actually investing any of their social security wealth in risky assets.

- The welfare gains from the "loans" the government makes to households by allowing them to borrow against their social security wealth are so great that the government could charge a higher internal borrowing rate and still make households better off. In other words, the government could borrow at 2 percent, lend at 5 percent, and still make households better off!

Implications

The options explored in this paper generate comparable and often higher welfare increases than popular proposals to increase the return on investment in social security. And they do so without any major administrative change to the social security system. There are no individual accounts. There is no uncertainty about returns. And the proposals preserve the basic functions of social security: They do not subject tempted households to politically unacceptable risks.

The main point of the paper-that the ideal life-cycle profile of contributions is not flat- applies equally well to any tax. Given the choice, households with a hump-shaped income profile would rather pay less income tax when young and more income tax when middle-aged.

The authors focus on social security for two reasons. First, the explicit purpose of social security, unlike that of other U.S. taxes, is to smooth life-cycle consumption. So it is particularly ironic that the contribution structure does precisely the opposite at certain points in the life cycle. Second, a progressive income tax approximates the ideal life-cycle structure by lowering tax rates when income is low. Since social security taxation is, in fact, regressive, not progressive, it is a natural target for the authors' analysis.

A model that incorporates both endogenous labor supply and general equilibrium would strengthen the results significantly. However, for one policy proposal-the age-30 exemption- neither extension should have a sizable effect on the conclusions.

About the Authors

About the Authors

Erik Hurst

Paul S. Willen,

Federal Reserve Bank of Boston

Email: Paul.Willen@bos.frb.org