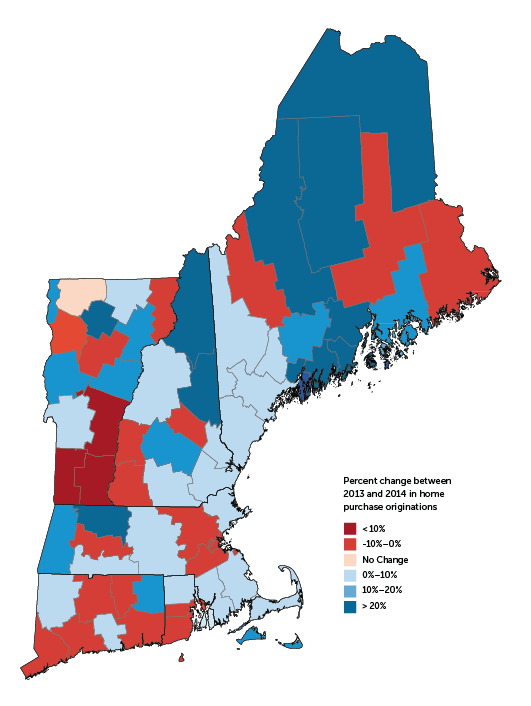

Mapping New England: Changes in Home Purchase Mortgage Originations, by County

Between 2013 and 2014, New England's percentage of home purchase loan originations slightly declined. However, at state and county levels, the picture is more mixed, with both increases and decreases. The largest declines were experienced by three Vermont counties: Bennington, Windham, and Windsor. The largest increase in New England was seen in Somerset County, Maine, where home loan originations increased almost 23 percent.

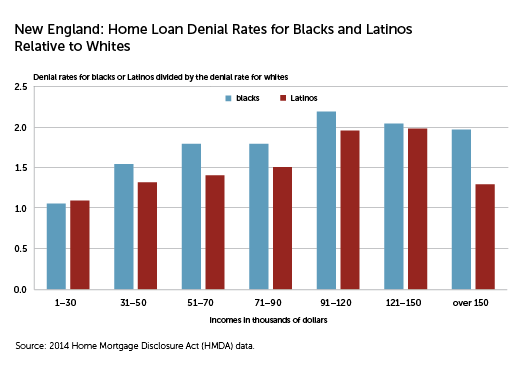

Looking at New England as a whole, in general blacks and Latinos are more likely to be denied home purchase loans than whites are. Though we do not have data on individual debt-to-income ratios or credit scores, we do know annual income for individuals in these groups. Interestingly, the largest disparities are found among applicants who earn $91,000 to $120,000. In this income bracket, blacks and Latinos are at least twice as likely to be denied loans as their white peers.

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

collapse all

collapse all

expand all

expand all