2014 Series • No. 2014–1

Current Policy Perspectives

SNAP: Should We Be Worried about a Sudden, Sharp Rise from Low, Long-Term Rates?

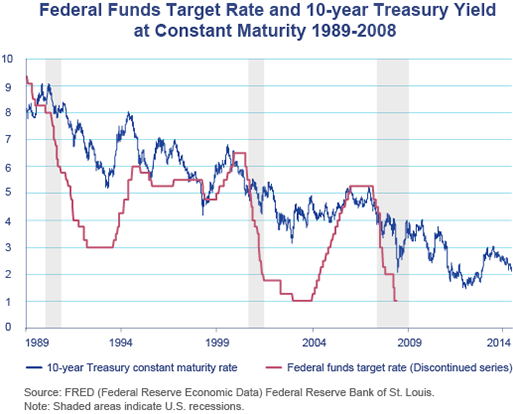

Despite the expectations of FOMC and market participants at the beginning of 2014 to the contrary, the yield on 10-year U.S. Treasury debt declined by about 50 basis points from 2.72 percent at the beginning of 2014 to 2.17 percent as of December 22, 2014. This raises the worrisome possibility that we might observe a sudden change in longer-term yields once the Federal Reserve announces an increase in short-term rates. In other words, longer-term rates could snap, very much as they did in the summer of 2013 after the tapering announcement, once the Fed announces its first short-term rate hike indicating the end of the era of loose monetary policy. In order to study this possibility, this paper examines reactions to Fed announcements during the period when conventional monetary policy tools were used, to investigate whether FOMC announcements that imply reversals in the monetary policy stance have a greater effect on longer-term Treasury yields than similar monetary policy actions that do not imply a policy reversal.

Key Findings

Key Findings

- The analysis suggests that the effects of a monetary policy surprise on long-term interest rates and corporate bond yields are greater for reversals that involve a rise in interest rates (known as "liftoff") than for other monetary policy announcements.

Exhibits

Exhibits

Implications

Implications

Overall, the analysis implies that policymakers should exercise caution regarding the timing of the liftoff announcement because the policy surprise might have a sudden and disproportionately large effect.

Abstract

Abstract

Despite the expectations of FOMC and market participants at the beginning of 2014 to the contrary, the yield on 10-year U.S. Treasury debt declined by more than 50 basis points, from 2.72 percent at the beginning of 2014 to 2.17 percent as of December 22, 2014. This raises the worrisome possibility that we might observe a sudden change in longer-term yields once the Federal Reserve announces an increase in short-term rates. In other words, longer-term rates could snap, very much as they did in the summer of 2013 after the tapering announcement, once the Fed announces its first hike in short-term rates indicating the end of the zero lower bound era of monetary policy. In order to study this possibility, this paper examines reactions to Fed announcements during the period when conventional monetary policy tools were used in order to investigate whether FOMC announcements that imply reversals in the monetary policy stance have a greater effect on longer-term Treasury yields than similar monetary policy actions that do not imply a policy reversal. The analysis suggests that the effects of a monetary policy surprise on long-term interest rates and corporate bond yields are greater for reversals that involve a rise in interest rates (known as "liftoff"). Overall, the analysis implies that policymakers should exercise caution regarding the timing of the liftoff announcement because the policy surprise might have a sudden and disproportionately large effect on interest rates.