An Approach to Predicting Regional Labor Market Effects of Economic Shocks: The COVID-19 Pandemic in New England

The emergence of the COVID-19 pandemic led state and local governments throughout New England and much of the nation to issue ordinances restricting activity that might otherwise contribute to the spread of the disease. Individuals also freely adjusted their behavior, hoping to reduce the chances of infecting themselves or others. As a result, many employers have experienced substantial reductions in sales revenue, which were expected to generate harmful effects on the labor market. Even though the reversal of mandated policies and voluntary behavior changes are well under way, the initial effects and ongoing public health concerns may extend the time needed for labor market outcomes to improve substantially. This study uses pre-pandemic employment data by occupation and a conceptual framework focused on labor costs to identify the subpopulation most vulnerable to the economic shock and predict layoffs and unemployment in the second quarter of 2020. The analysis allows for the possibility of wage cuts mitigating job losses. Further extensions incorporate indirect effects due to reduced product demand from directly affected workers, as well as offsetting effects of a federal policy response. Predicted second-quarter layoffs and unemployment due to the pandemic vary throughout New England, and such adverse labor market effects tend to be somewhat smaller in the region than in the country as a whole. Additionally, official estimates of unemployment from available second-quarter data fall within the range of predictions, after accounting for plausible measurement error. This approach, which builds on the work of other recent analysis, should be helpful in estimating the regional labor market impact of future economic shocks.

1. Introduction

With the rise of the COVID-19 pandemic, state and local governments in New England and much of the nation issued ordinances restricting activity that might otherwise contribute to the spread of the disease.1 Given such orders, in addition to voluntary changes in consumer behavior, some employers have experienced substantial reductions in sales revenue. Such revenue losses have raised concern due in part to their potential labor market impact. Even as mandated government policies and voluntary consumer behavior have been partially reversed, initial effects and ongoing public health concerns may extend the time needed for labor market outcomes to improve.

This study uses pre-pandemic Bureau of Labor Statistics (BLS) employment data by occupation and a conceptual framework focused on labor costs to identify the subpopulation most vulnerable to the economic shock and predict layoffs and unemployment in the second quarter of 2020. Differences in underlying parameter assumptions yield worst-case, moderate-case, and best-case scenarios regarding the extent of negative labor market effects. In the analysis, I allow for the possibility that employers reduce the wages of some workers, thereby mitigating job losses.2 In further extensions, I incorporate indirect effects due to reduced product demand from directly affected workers, as well as offsetting effects of a federal policy response.3

The analysis predicts second-quarter 2020 layoffs and unemployment due to the pandemic that vary throughout New England. These adverse labor market effects tend to be a bit smaller in the region than in the country as a whole. For instance, when the analysis allows for wage cuts, the predicted 2020:Q2 unemployment rate from moderate-case baseline direct estimates is about 23 percent in the United States and 18 percent in New England, while analogous best-case estimates are roughly 14 percent in the nation and 11 percent in the region. Official estimates of second-quarter national unemployment lie between the aforementioned predictions, after accounting for plausible measurement error. For instance, adjusting for some likely misclassification, the BLS estimates the seasonally adjusted US unemployment rate to be 19.5 percent for April 2020 and 16.4 percent for May 2020.4

This research adds to several efforts to predict the labor market effects of the pandemic, especially unemployment rates. Various approaches have been taken in this literature, including using unemployment insurance (UI) claims to help generate predictions for unemployment rates (for example, Faberman 2020). However, my study aligns most closely with the segment of the research that tries to identify workers who are at greatest risk of adverse labor market effects and then generate unemployment rate predictions accordingly (for instance, Faria-e-Castro 2020 and Gascon 2020). In particular, I build upon Gascon (2020) regarding his measurement of at-risk workers, adjusting his definition to align it with my preferred approach to calculating empirical estimates.

The rest of the study proceeds as follows. Section 2 presents the broad conceptual framework (detailed in the Appendix), while section 3 describes at-risk workers, the data, and the parameter assumptions. Section 4 discusses the projected labor market effects, and section 5 concludes.

2. Broad Conceptual Framework for Predicting Labor Market Effects

The conceptual framework I use to generate estimates of the labor market impact of the COVID-19 pandemic relies on a standard assumption of profit maximization by firms. As detailed in the Appendix, such a setup provides a basic structure for relating changes in a firm’s revenue to changes in profit, capital costs, and most importantly for this study, labor costs.

I can further decompose the change in labor costs into the component attributable to wage changes and the component arising from changes in the number of workers.5 Using economic theory, empirical evidence from the literature, and anecdotal examples from media coverage, one can make reasonable assumptions about the size and prevalence of such wage adjustments. I can similarly make informed assumptions regarding other relevant parameters, such as the rate of revenue decline experienced by employers affected by the pandemic. Conditional on such parameter values and the conceptual framework, I can derive estimates of changes in the number of workers employed. With these estimates and additional parameter assumptions, such as the stock of existing unemployed workers, I can calculate the desired predictions of the pandemic’s labor market impact.

3. Describing Workers at Risk, Data, and Parameter Assumptions

In order to apply the conceptual framework from section 2 to generate estimates of labor market effects of the pandemic, some additional empirical choices are necessary. First, one needs to determine the group(s) of workers who are most at risk of suffering a layoff or wage reduction.

The state and local ordinances restricting activity in light of the pandemic consider both public health and economic factors. I therefore use these two dimensions to identify the workers most at risk of experiencing negative labor market effects. The public health dimension of the COVID-19 ordinances is related to ensuring a safe social distance between individuals, to mitigate the spread of the disease. This dimension can be proxied by a worker’s ability or inability to work from home. The economic dimension of the pandemic-related ordinances is associated with how critical certain employment is deemed to be for the daily functioning of the economy, according to state and local government. A proxy for this dimension is the categorization of a worker’s job as “essential” or “nonessential.”6

This two-dimensional representation of labor market risk from the pandemic aligns with some existing analysis. For example, in their projections of the June 2020 unemployment rate, Aaronson, Burkhardt, and Faberman (2020) identify the workers most at risk of layoff by using an estimate of their ability to work from home combined with the likely essential status of their industry of employment. Gascon (2020) also uses these two dimensions to estimate the count and share of persons who work in occupations at risk of layoff. However, he incorporates a third dimension to determine layoff risk: whether an occupation is likely to be salaried.

My approach to determining at-risk workers builds on the valuable work of Gascon (2020). First, I likewise use the pre-pandemic BLS Occupational Employment Statistics (OES) for 2018 (Bureau of Labor Statistics 2018). Second, I use Gascon’s classification of the 808 detailed occupation codes in the 2018 OES to create national, binary measures of (1) whether workers in an occupation are able to work from home, and (2) whether workers in an occupation are “essential.” I omit Gascon’s third classification regarding whether a worker is likely salaried, as this may not prevent a layoff. However, my study incorporates the possibility of wage reductions mitigating the extent of layoffs, which is similar in spirit to Gascon’s inclusion of the “salaried” dimension.

For the work-from-home measure, I use Gascon’s occupation-based designations as he constructed. I apply the coding for this measure equivalently to all areas in my analysis. Such application thus assumes that the ability to work from home does not differ substantially across the areas examined. Gascon (2020) notes that his coding suggests 33 percent of workers are in occupations that allow them to work from home. This estimate is quite close to other assessments of the proportion of US workers who are able to work remotely.7

For the essential employment measure, I start with Gascon’s occupation-based coding for the United States, but then make some adjustments. Specifically, I use an assessment of area-specific essential employment ordinances in order to code 5 percent random samples of the 808 detailed 2018 OES occupations (that is, a random sample of 40 occupation codes).8 Aaronson, Burkhardt, and Faberman (2020) similarly assess and incorporate official essential employment designations using the Massachusetts ordinance. For that state, I obtain an unweighted distribution of nonessential and essential employment that is very similar to the one they obtain.9, 10

Separately for nonessential occupations and essential occupations, I then compare the area-specific essential employment measures with the Gascon (2020) essential employment measure, weighting by area-specific employment.11 I use this comparison to create area-specific adjustment factors. These factors allow me to rescale nonessential and essential employment in each area, as defined by Gascon’s measure, in order to adjust for the size of these worker groups implied by the area-specific ordinances.12

Figure 1 classifies US workers into four bins based on the whether they are able to work from home, as measured by Gascon (2020), and whether their employment is essential according to official US guidelines, as measured by Gascon (2020) and modified in this study. The share of workers in each bin reflects counts after adjustment factor rescaling is applied. As shown, 35.5 percent of US workers are estimated to be in the group that is most at-risk. This group reflects those not able to work from home and not designated as essential, such as carpet installers. In contrast, just 5.6 percent of the nation’s workers are able to work from home and classified as essential, such as reporters and correspondents.

To obtain estimates of pandemic-induced layoffs as a share of workers and unemployment rates in the second quarter of 2020, I start with adjusted 2018 OES employment counts in the aforementioned four worker categories, separately by area. I use March 2020 BLS estimates of the civilian labor force and the unemployment rate to obtain counts of employed and unemployed persons in each area.13 Returning to the adjusted 2018 OES employment counts, I use the conceptual framework in section 2, combined with various parameter assumptions (as indicated in Table 1, varying by worst-case, moderate-case, and best-case scenarios), to obtain estimates of layoffs and flows into unemployment.14 The layoff estimates and employed-person counts yield projections for layoffs as a share of workers, while the flows into unemployment, stock of existing unemployed persons, and civilian labor force yield projections for the unemployment rate.

4. The Predicted Labor Market Impact of COVID-19

Primary Analysis: Direct Effects

Table 2 displays moderate-case estimates of the predicted labor market direct effects of COVID-19—namely, the effects on those workers who are not able to work from home and nonessential. Regardless of whether wage reductions are allowed, the nation as a whole is predicted to experience adverse labor market effects in 2020:Q2 that are greater than those New England experiences. Without wage cuts, the estimated US layoff share is 26.1 percent and the unemployment rate is 24.4 percent. In New England, the corresponding predicted layoff share is 20.5 percent and the unemployment rate is 19.0 percent. Allowing wage cuts reduces those estimates by roughly 1 to 2 percentage points.

Table 2: Labor Market Effects, Moderate-case (Direct, No Policy Response)

| Predicted Labor Market Effects, 2020:Q2 - Direct Impact | ||||

| Assuming No Wage Cuts | Assuming Wage Cuts | |||

| Layoffs as a Share of Workers | Unemployment Rate | Layoffs as a Share of Workers | Unemployment Rate | |

| United States | 26.1% | 24.4% | 24.5% | 23.1% |

| New England | 20.5% | 19.0% | 19.2% | 18.1% |

| Connecticut | 18.1% | 17.7% | 17.0% | 16.8% |

| Maine | 18.8% | 17.7% | 17.6% | 16.8% |

| Massachusetts | 20.6% | 18.9% | 19.3% | 17.9% |

| New Hampshire | 20.6% | 18.7% | 19.3% | 17.7% |

| Rhode Island | 22.6% | 21.9% | 21.2% | 20.8% |

| Vermont | 31.5% | 27.6% | 29.5% | 26.0% |

| Source(s): Bureau of Labor Statistics, Gascon (2020), Haver Analytics, and author’s calculations Note(s): Parameter values associated with the moderate-case scenario are as described in Table 1. Direct impact captures effects on workers who are not able to work from home and nonessential. |

||||

Within the region, and without allowing for wage cuts, layoff share estimates range from 18.1 percent (Connecticut) to 31.5 percent (Vermont). The unemployment rate projections take on a low of 17.7 percent (Connecticut) and a high of 27.6 percent (Vermont).15 Allowing for wage reductions results in smaller layoff shares of 17.0 percent (Connecticut) to 29.5 percent (Vermont). Similarly allowing for such wage cuts when predicting unemployment rates leads to an estimate range of 16.8 percent (Connecticut) to 26.0 percent (Vermont).16

One may wonder how these labor market predictions vary with the underlying parameter assumptions in Table 1. Focusing on unemployment rates when wage cuts are allowed, Figure 2 displays the moderate-case estimates listed in Table 2, as well as worst-case and best-case analogs. Across all scenarios, the estimated unemployment rate in New England is lower than the estimated rate in the United States. For best-case scenarios, 2020:Q2 unemployment rate predictions are typically in the low double digits—for instance, 13.9 percent in the nation and 10.7 percent in the region. For worst-case scenarios, the unemployment rate predictions tend to be close to 25 percent.

In addition to the role that underlying parameters can have on the area-level unemployment rate estimates in this study, alternative assessments of area-level unemployment also may yield different results. For instance, one could examine differences across states in the sum of initial UI claims as a share of the labor force. Given the weekly release of claims data from the Department of Labor, such a measure yields high-frequency information about changes in local unemployment. However, because initial UI claimants are not equivalent to unemployed persons measured by the BLS (since, for example, not everyone who is unemployed is eligible for UI benefits, and since UI claimants are a “flow” measure but unemployed persons are a “stock” measure), these estimates tend to differ.17

Analysis Extensions: Indirect Effects and Policy Response

Two extensions to the existing analysis are of interest to explore. The first worthwhile extension is to incorporate predicted labor market indirect effects of COVID-19—namely, the effects on workers who are able to work from home and are nonessential. The hypothesized mechanism for these effects is a decrease in total revenue for the goods and services produced by such indirectly affected workers. Such a decrease in revenue would result from a decrease in the product demand of directly affected workers due to their diminished earnings. Other analysis also has sought to predict the size of such indirect effects (Garriga and Sanchez 2020).

Another useful extension of the analysis is to examine how the estimated labor market effects change when the impact of a policy response from the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act is incorporated. The proposed mechanism to allow a basic integration of such legislation is to include it as an increase in the total revenue for the goods and services produced by directly affected workers. This increase in revenue would result from an increase in the product demand of workers and employers due to additional income they received from the economic stimulus, assuming that such CARES funds were spent on the goods and services created by directly affected workers.18

This mechanism is suggested partly for ease of analysis. It allows me to model the CARES Act as simply mitigating the pandemic-driven decrease in sales revenue experienced by employers of directly affected workers, thus resulting in a smaller negative revenue shock. All subsequent labor market effects are then estimated as they would be in the absence of a policy intervention. Still, beyond empirical convenience, this depiction of the policy effects may be consistent with reality, to the extent that CARES funds are indeed spent on directly affected workers as assumed.19

Table 3: Labor Market Effects, Moderate-Case (Direct and Indirect, No Policy Response)

| Predicted Labor Market Effects, 2020:Q2 - Direct and Indirect Impact | ||||

| Assuming No Wage Cuts | Assuming Wage Cuts | |||

| Layoffs as a Share of Workers | Unemployment Rate | Layoffs as a Share of Workers | Unemployment Rate | |

| United States | 31.7% | 28.6% | 29.0% | 26.6% |

| New England | 24.4% | 22.1% | 22.3% | 20.5% |

| Connecticut | 21.4% | 20.2% | 19.5% | 18.8% |

| Maine | 21.4% | 19.8% | 19.7% | 18.4% |

| Massachusetts | 24.9% | 22.2% | 22.7% | 20.5% |

| New Hampshire | 24.2% | 21.5% | 22.2% | 19.9% |

| Rhode Island | 27.2% | 25.4% | 24.9% | 23.6% |

| Vermont | 38.8% | 33.3% | 35.6% | 30.8% |

| Source(s): Bureau of Labor Statistics, Gascon (2020), Haver Analytics, and author’s calculations Note(s): Parameter values associated with the moderate-case scenario are as described in Table 1. Direct impact captures effects on workers who are not able to work from home and nonessential. Indirect impact captures effects on workers who are able to work from home and nonessential. |

||||

Table 3 displays moderate-case estimates of the predicted labor market direct and indirect effects of COVID-19. Compared with those in Table 2, which examines direct effects only, the Table 3 estimates are universally larger. For instance, focusing on unemployment rate estimates that allow for wage cuts, the predicted 2020:Q2 unemployment rate for the United States increases from 23.1 percent to 26.6 percent when indirect effects are incorporated. This change reflects an increase of 15.2 percent. By comparison, the predicted 2020:Q2 unemployment rate for New England increases from 18.1 percent to 20.5 percent when indirect effects are incorporated. This change corresponds to an increase of 13.3 percent. I therefore predict that indirect effects’ impact would be greater on the nation as a whole than on the region.

Table 4: Labor Market Effects, Moderate-Case (Direct, Policy Response)

| Predicted Labor Market Effects, 2020:Q2 - Direct Impact (with Policy Response) | ||||

| Assuming No Wage Cuts | Assuming Wage Cuts | |||

| Layoffs as a Share of Workers | Unemployment Rate | Layoffs as a Share of Workers | Unemployment Rate | |

| United States | 22.7% | 21.7% | 20.6% | 20.1% |

| New England | 17.8% | 17.0% | 16.1% | 15.7% |

| Connecticut | 15.7% | 15.8% | 14.3% | 14.7% |

| Maine | 16.3% | 15.8% | 14.8% | 14.6% |

| Massachusetts | 17.9% | 16.8% | 16.2% | 15.5% |

| New Hampshire | 17.9% | 16.5% | 16.2% | 15.2% |

| Rhode Island | 19.6% | 19.6% | 17.8% | 18.2% |

| Vermont | 27.3% | 24.3% | 24.8% | 22.4% |

| Source(s): Bureau of Economic Analysis, Bureau of Labor Statistics, Gascon (2020), Haver Analytics, and author’s calculations Note(s): Parameter values associated with the moderate-case scenario are as described in Table 1. Direct impact captures effects on workers who are not able to work from home and nonessential. Policy response reflects the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. |

||||

Table 4 shows moderate-case estimates of the predicted labor market direct effects of COVID-19 when a policy response, through the CARES Act, is incorporated. Compared with the estimates in Table 2, which examines direct effects without such a policy response, the Table 4 estimates are always smaller. For example, focusing again on unemployment rate estimates that allow for wage cuts, the predicted 2020:Q2 unemployment rate for the United States falls from 23.1 percent to 20.1 percent when a policy response is incorporated. This change reflects a decrease of 13.0 percent. By comparison, the predicted 2020:Q2 unemployment rate for New England falls from 18.1 percent to 15.7 percent when a policy response is incorporated. This change corresponds to a decrease of 13.3 percent. Thus, I predict that the impact of a policy response such as the CARES Act would be slightly greater on the region than on the nation. However, given the purposefully simple representation of this policy response in the analysis, this result is intended to be largely illustrative.

Table 5: Labor Market Effects, Moderate-Case (Direct and Indirect, Policy Response)

| Predicted Labor Market Effects, 2020:Q2 - Direct and Indirect Impact (with Policy Response) | ||||

| Assuming No Wage Cuts | Assuming Wage Cuts | |||

| Layoffs as a Share of Workers | Unemployment Rate | Layoffs as a Share of Workers | Unemployment Rate | |

| United States | 27.5% | 25.4% | 24.4% | 23.1% |

| New England | 21.2% | 19.6% | 18.8% | 17.8% |

| Connecticut | 18.5% | 18.0% | 16.5% | 16.4% |

| Maine | 18.6% | 17.6% | 16.6% | 16.0% |

| Massachusetts | 21.6% | 19.7% | 19.1% | 17.8% |

| New Hampshire | 21.0% | 19.0% | 18.7% | 17.2% |

| Rhode Island | 23.6% | 22.6% | 21.0% | 20.6% |

| Vermont | 33.7% | 29.3% | 30.0% | 26.4% |

| Source(s): Bureau of Economic Analysis, Bureau of Labor Statistics, Gascon (2020), Haver Analytics, and author’s calculations Note(s): Parameter values associated with the moderate-case scenario are as described in Table 1. Direct impact captures effects on workers who are not able to work from home and nonessential. Indirect impact captures effects on workers who are able to work from home and nonessential. Policy response reflects the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. |

||||

Lastly, Table 5 presents moderate-case estimates of the predicted labor market direct and indirect effects of COVID-19 combined with a policy response through the CARES Act. The Table 5 estimates are quite similar to the estimates in Table 2, which, again, displays direct effects without indirect effects or a policy response. For example, when I allow for wage cuts, the predicted 2020:Q2 unemployment rate for the United States is 23.1 percent in both Tables 2 and 5; the analogous unemployment rate for New England is 18.1 percent in Table 2 and 17.8 percent in Table 5. The similarity between the Table 2 and Table 5 estimates suggests that the size of the policy response might fully mitigate the labor market impact resulting from indirect effects. Table 6 further emphasizes this point. The change in the predicted moderate-case unemployment rate from the combined indirect and policy effects ranges in magnitude from roughly zero to one in both the nation and New England. These combined effects are less offsetting, however, when best-case and worst-case estimates are considered. In the best-case scenario, the policy response more than accounts for the size of the indirect effects, and in the worst-case scenario, the indirect effects more than account for the size of the policy response.

Comparing Predicted and Official Unemployment Rates

Given the availability of official labor market data for part of 2020:Q2, it is of interest to assess how such estimates compare with the predictions from this study. Focusing on US unemployment rates (seasonally adjusted), the BLS official estimates for April 2020 and May 2020 are 14.7 percent and 13.3 percent, respectively. Such estimates are quite close to the best-case scenario US unemployment rate prediction of 13.9 percent for 2020:Q2 shown in Figure 2.

However, these “baseline” official estimates of national unemployment may only partially capture the full extent of job loss during the pandemic. For instance, as acknowledged by the BLS, some workers may have been misclassified as employed rather than unemployed.20 Additionally, some persons may have been counted as being out of the labor force due to a limited ability to search for a job but were actually available for work given mandated and voluntary responses to the public health situation. Departments of labor in at least two New England states have similarly indicated that “baseline” official estimates of state-level unemployment likely underestimate true unemployment.21

Unemployment rate estimates that adjust for such sources of measurement error are likely to fall between the best-case and moderate-case predictions in this study. For instance, again focusing on national data, the BLS reports that when corrected for misclassification, seasonally adjusted unemployment rate estimates are likely 19.5 percent for April 2020 and 16.4 percent for May 2020. Both of those estimates lie between the 2020:Q2 US predictions of 13.9 percent in the best-case scenario and 23.1 percent in the moderate-case scenario shown in Figure 2. Further accounting for measured labor force changes due to a restricted ability to job-search or work would likely also result in unemployment rate estimates that fall between best-case and moderate-case predictions.22

5. Conclusion

This study proposes and utilizes a conceptual framework centered on changes in labor costs in order to predict labor market effects of the COVID-19 pandemic for New England and the nation. Using pre-pandemic employment data by occupation, I identify the subpopulation most vulnerable to the economic shock and predict layoffs and unemployment in the second quarter of 2020. These estimates allow for wage cuts, indirect effects due to reduced product demand from directly affected workers, and mitigating effects of an economic stimulus.

I find that the estimated adverse labor market effects tend to be somewhat smaller in New England than in the country as a whole. When I allow for wage cuts, the predicted 2020:Q2 unemployment rate from moderate-case baseline direct estimates is about 23 percent in the United States and 18 percent in New England. After incorporating indirect effects as well as a policy response, I obtain nearly the same unemployment rate estimates. This equivalence suggests that the size of the CARES Act policy response might approximately offset the labor market impact of indirect effects. Additionally, official estimates of second-quarter national unemployment, after accounting for plausible measurement error, fall between best-case and moderate-case predictions.

Endnotes

- Such ordinances include stay-at-home orders and the closing of certain nonessential businesses.

- Media coverage of employer actions during the pandemic supports the existence of these wage cuts. See, for instance, Taylor Telford and Jena McGregor, “Latest Sign Recession Is Intensifying: White-collar Workers Are Being Laid Off,” Washington Post, March 29, 2020.

- These extensions are consistent with media coverage of responses to the pandemic. See, for example, Eric Morath, Harriet Torry, and Gwynn Guilford, “New Round of Layoffs Hits White-collar Workers—People Who Thought Their Jobs Were Secure Face Unemployment,” Wall Street Journal, April 15, 2020; and Heather Long, “As Stimulus Funds Arrive, Most Are Spending Them on Food and Other Basics,” Washington Post, April 15, 2020.

- See US Bureau of Labor Statistics, “Frequently Asked Questions: The Impact of the Coronavirus (COVID-19) Pandemic on the Employment Situation for April 2020,” May 8, 2020, and “Frequently Asked Questions: The Impact of the Coronavirus (COVID-19) Pandemic on the Employment Situation for May 2020,” June 5, 2020.

- For simplicity, I assume that workers’ hours are fixed.

- I presume that designation of one’s work as “essential” is positively correlated with labor demand. What would drive such a correlation, however, is not clear. One possibility is that such designations are endogenous—that is, areas declare employment essential that would not experience decreases in labor demand (due to decreases in consumer demand), even in the absence of such designations. Another possibility is that essential employment designations have a causal impact. Namely, when certain employment is listed as essential, it is shielded from the adverse effects of the pandemic that would otherwise be experienced. Since the latter is a stronger assumption that lacks clear supportive evidence, I assume the former.

- Other estimates of the share of US workers who are able to work from home are as follows: 36.7 percent in the baseline estimate of Aaronson, Burkhardt, and Faberman (2020); 34 percent in Dingel and Nieman (2020); and 29 percent in the 2017–2018 American Time Use Survey (Statistics on Job Flexibilities and Work Schedules), regarding workers age 15 and over who indicate that they “could work from home.”

- I first examined a 40 percent random sample of the 2018 OES occupations and assessed essential employment status of these occupations against the Massachusetts ordinance that designates essential employment. I then compared values of this “essential” Massachusetts measure against the Gascon (2020) US “essential” values, noting cases where the values differ. When examining these comparison statistics in subsamples ranging from 5 percent to 40 percent (in 5 percent increments), I observe that the statistics remain relatively stable across all the subsamples. The same stability holds true when assessing essential employment for a 100 percent sample of 2018 OES occupations in Rhode Island (examined in full, since the Rhode Island ordinance is narrow in scope, focusing primarily on essential retail employment). Thus, I assume that such statistical convergence holds true for all geographic areas included in the analysis, relying on 5 percent random samples in each case.

- If one groups together the “partially essential” and “nonessential” categories of Aaronson, Burkhardt, and Faberman (2020), the resulting binary measure has 42 out of 83 three-digit North American Industry Classification System industries classified as essential (50.6 percent) when compared to the Massachusetts ordinance. The remaining 41 out of 83 three-digit NAICS industries are classified as nonessential (49.4 percent). In the 40 percent sample of 323 out of 808 detailed OES occupations in 2018 that I compare to the Massachusetts ordinance, 158 out of 323 OES occupations are classified as essential (48.9 percent), and 165 out of 323 OES occupations are classified as nonessential (51.1 percent).

- The area-specific ordinances that are used are as follows: US, “Guidance on the Essential Critical Infrastructure Workforce: Ensuring Community and National Resilience in COVID-19 Response” from March 28, 2020; CT, “Frequently Asked Questions on the State of Connecticut’s Actions Related to COVID-19” from April 9, 2020; ME, “Executive Order No. 19” from March 24, 2020; MA, “Emergency Order” from March 23, 2020; NH, “Emergency Order No. 17” from March 27, 2020; RI, “Executive Order No. 20-14” from March 28, 2020; and VT, “Executive Order no. 01-20 – Addendum 6” from March 24, 2020. Because CT and ME default to the US guidelines in the absence of state-specific criteria, essential employment coding for these states also reflects such US designations when applicable. I additionally impose such a US default on the RI and VT essential variables. The RI state ordinance narrowly focuses primarily on essential retail employment, while the VT state ordinance is relatively limited in detail regarding its essential employment designations, as compared with other areas. I therefore assume that such US designations help reasonably capture the pandemic-induced changes in the RI and VT labor markets.

- When 2018 OES data do not report employment for a given area and occupation, I leave these values as missing. An alternative approach would be to impute values for these missing observations (as in, for instance, Gascon and Werner 2020). While retaining missing employment values in this study avoids potential caveats of imputation, it also results in 16 occupations in Vermont’s 5 percent random sample (that is, 40 percent of the occupations) having no measured employment. Such a lack of measured employment affects adjustment factor values for this state, thereby affecting final estimates of labor market impact. Thus, results for Vermont should be interpreted with some caution.

- The adjustment factors for nonessential employment are as follows: US, 0.685; NE, 0.571; CT, 0.523; ME, 0.492; MA, 0.574; NH, 0.566; RI, 0.648; and VT, 0.822. The New England adjustment factor is an employment-weighted average of the adjustment factors for the six states in the region. The relatively high adjustment factor value for Vermont is due to a combination of broad essential employment designations in the state ordinance, as well as several cases of missing 2018 OES employment. In order to ensure that adjusted employment aggregates to initial employment in each area g, the area-specific adjustment factor for essential employment, aeg, is derived using a formula: aeg = (1 – angLng)/(1 – Lng). Lng is the share of area-specific total employment that is accounted for by area-specific nonessential employment (as defined by Gascon 2020), and ang is the area-specific nonessential adjustment factor. I also verify that, when restricting to the 5 percent random samples, the adjustment factors derived with the aforementioned formula are identical to the adjustment factors obtained from direct calculation, as described in the text. The adjustment factors for essential employment are as follows: US, 2.523; NE, 3.045; CT, 3.398; ME, 3.350; MA, 2.979; NH, 3.197; RI, 2.570; and VT, 1.909. Once again, the New England adjustment factor is an employment-weighted average of the adjustment factors for the six states in the region. The relatively low adjustment factor value for Vermont follows from earlier discussion of its relatively high nonessential employment adjustment factor.

- Although March 2020 estimates may partly reflect effects of the pandemic, I opt for this date to estimate the labor market projections relative to the first quarter of 2020.

- The assumed parameter values for the Table 1 “share of flows out of employment to unemployment (EU) rather than not-in-labor-force (EN): EU/(EU + EN)” are partly informed by examining this measure using BLS data (Labor Force Flows: Employed to Unemployed [LNS17400000] and Employed to Not in Labor Force [LNS17800000]; retrieved from FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org). These data show that the EU/(EU + EN) measure has a mean value of 0.37 during the Great Recession, and a maximum value of 0.44 during the same period. However, there are several reasons that EU/(EU + EN) could reasonably be higher during the pandemic compared with during the Great Recession. For instance, an expansion of UI benefits during the pandemic, in response to a historic surge in claims, may reflect an especially large share of flows out of employment that remain in the labor force as unemployed persons, as compared with the Great Recession. Additionally, depending on hiring activity, maybe some labor market transitions that were employment-to-employment flows with decreased labor utilization during the Great Recession (for instance, changing from full-time to part-time status) are occurring instead as employment-to-unemployment flows during the pandemic. Lastly, perhaps individuals are less likely to be discouraged about future job prospects during the pandemic than during the Great Recession. Thus, even the “best-case scenario” value of this parameter in Table 1, 0.6, is higher than the values observed at the time of the Great Recession.

- Without allowing for wage cuts, the unemployment rate in Connecticut is 17.65 percent, while the rate in Maine is 17.73 percent.

- When allowing for wage cuts, the unemployment rate in Connecticut is 16.78 percent, while the rate in Maine is 16.82 percent.

- According to calculations from the New England Public Policy Center using seasonally adjusted data from the Department of Labor and BLS, for the seven-week period ending May 2, 2020, initial UI claims as a share of the labor force were as follows for the areas examined in this study: US average, 20.9; NE average, 22.2; CT, 15.2; ME, 18.2; MA, 25.0; NH, 23.7; RI, 33.8; and VT, 17.0. As shown, when comparing these UI claims estimates with this study’s unemployment rate projections, estimate magnitudes and relative rankings between areas both differ.

- For example, given parameter assumptions in the moderate-case scenario (see Table 1), I estimate that CARES funds would reflect 10.6 percent of inflation-adjusted US personal consumption expenditures ([$2,200,000 (CARES funds in millions, 2020 USD) × 0.7 (MPC)]/[$13,988,761.90 (Personal Consumption Expenditure, 2018 US total in millions, 2018 USD) × 1.04 (purchasing power in Feb 2020 of $1 in Feb 2018)]). Thus, for all areas, the assumed proportional change in total revenue for directly affected workers when incorporating this policy response is –0.7 + 0.106 = –0.594.

- Such spending may occur through purchases based on limited or adjusted firm operations (for example, restaurant takeout orders in the absence of a dine-in option), implicit donations in the absence of any firm operations (for instance, maintaining a membership to a gym that has no physical or virtual offerings), or by other means. Additionally, the current assumption concentrates CARES funds toward directly affected workers, thus analyzing the potential labor market benefits of the policy for this group. In reality, it may be the case that such policy funds and associated market benefits are distributed more broadly (for instance, accruing to essential workers as well).

- For example, as noted in the US Bureau of Labor Statistics, “Frequently Asked Questions: The Impact of the Coronavirus (COVID-19) Pandemic on the Employment Situation for May 2020,” June 5, 2020: Some individuals with a job who were not at work for “other reasons” were recorded as employed, but likely should have been recorded as unemployed due to a “temporary layoff.” According to the BLS, such misclassification “can occur when respondents misunderstand questions or interviewers record answers incorrectly.”

- The Connecticut Department of Labor website notes that the BLS seasonally adjusted unemployment rate estimate of 9.4 percent for the state in May 2020 “appears severely underestimated due to challenges encountered in the collection of data for the May Current Population Survey (CPS).” State officials estimate that the true unemployment rate for the same period is likely closer to 19 percent. Similarly, the Maine Department of Labor website indicates that the 9.3 percent BLS seasonally adjusted unemployment rate for the state in May 2020 does not “fully reflect the magnitude of job loss that has occurred.” The department estimates that the true unemployment rate for the state at that time is probably 18 percent.

- See Nancy Levin, “Boston Fed Leader Predicts Double-Digit Unemployment through 2020,” Providence Business News, June 19, 2020.

- Employer revenue losses due to COVID-19 prevalence and response measures (for example, social distancing) may slow down hiring and limit worker job search. Alternatively, firms may exhibit labor market power even absent such pandemic-driven reductions in worker mobility.

- For simplicity, I assume that employed workers are full-time employees, thus ruling out any hours adjustments.

- One could also assume that firms have some degree of power in the product market, allowing them to set prices rather than take them as given. If firms face downward-sloping market demand and output prices aren’t sticky in the short run, such an adjustment would allow firms the option to lower prices in response to a negative demand shock, such as the one induced by the pandemic. However, this feature is omitted since it is not important for the framework’s purpose in this study—to predict changes in the labor cost, wL, and its components, w and L.

- In this assumption, the relative magnitudes of payments to factors and profit do not change after the pandemic-induced market shock. Alternatively, the payment structure may change because employers opt to prioritize certain payments after experiencing the negative shock. Additionally, the payment structure may transform because the production process adjusts, such as a shift from a capital-intensive to a labor-intensive technique.

- Although not necessary, it is also then possible to determine (Ldw/pQ) and (wdL/pQ), the components of the firm’s change in labor share.

References

Aaronson, Daniel, Helen Burkhardt, and Jason Faberman. 2020. “Potential Jobs Impacted by Covid-19.” Chicago Fed Insights. Chicago, IL: Federal Reserve Bank of Chicago.

Bureau of Labor Statistics. 2018. “Occupational Employment Statistics.” Washington, DC: Department of Labor [www.bls.gov/oes/].

Daly, Mary C., and Bart Hobijn. 2014. “Downward Nominal Wage Rigidities Bend the Phillips Curve.” Journal of Money, Credit, and Banking 46(S2): 51–93.

Dingel, Jonathan I., and Brent Neiman. 2020. “How Many Jobs Can Be Done at Home?” Working Paper No. 26948. Cambridge, MA: National Bureau of Economic Research.

Elsby, Michael W. L., Bart Hobijn, and Aysegul Sahin. 2013. “The Decline of the U.S. Labor Share.” Brookings Papers on Economic Activity Fall: 1–52.

Elsby, Michael W. L., and Gary Solon. 2019. “How Prevalent Is Downward Rigidity in Nominal Wages? International Evidence from Payroll Records and Pay Slips.” Journal of Economic Perspectives 33(3): 185–201.

Faberman, Jason. 2020. “Predicting the Unemployment Rate in a Time of Coronavirus.” Chicago Fed Insights. Chicago, IL: Federal Reserve Bank of Chicago.

Fallick, Bruce, Daniel Villar, and William Wascher. 2020. “Downward Nominal Wage Rigidity in the United States during and after the Great Recession.” Working Paper 16-02R. Cleveland, OH: Federal Reserve Bank of Cleveland.

Faria-e-Castro, Miguel. 2020. “Back-of-the-Envelope Estimates of Next Quarter’s Unemployment Rate.” On the Economy Blog. St. Louis, MO: Federal Reserve Bank of St. Louis.

Garriga, Carlos, and Juan Sanchez. 2020. “How Closing Restaurants and Hotels Spills Over to Total Employment.” On the Economy Blog. St. Louis, MO: Federal Reserve Bank of St. Louis.

Gascon, Charles. 2020. “COVID-19: Which Workers Face the Highest Unemployment Risk?” On the Economy Blog. St. Louis, MO: Federal Reserve Bank of St. Louis.

Gascon, Charles, and Devin Werner. 2020. “COVID-19 and Unemployment Risk: State and MSA Differences.” On the Economy Blog. St. Louis, MO: Federal Reserve Bank of St. Louis.

Gross, Tal, Matthew J. Notowidigdo, and Jialan Wang. 2020. “The Marginal Propensity to Consume over the Business Cycle.” American Economic Journal: Macroeconomics 12(2): 351–384.

Parker, Jonathan A., Nicholas S. Souleles, David S. Johnson, and Robert McClelland. 2013. “Consumer Spending and the Economic Stimulus Payments of 2008.” American Economic Review 103(6): 2530–2553.

Appendix. Detailed Conceptual Framework for Predicting Labor Market Effects

To establish a guiding framework for analysis to predict the labor market effects of the COVID-19 pandemic, I start by assuming that firms seek to maximize profit, π. I further assume that during the pandemic, firms have some degree of power in the labor market, thereby allowing them to set wages.23 However, product markets and capital markets are competitive. Output, Q, is produced by the firm as a function of inputs for labor (workers), L, and capital, K.24 The prices at which output is sold, labor is hired, and capital is rented, are p, w, and r, respectively. Given p and r,a firm selects optimal w, L, and K, which then determine optimal Q and maximized π = pQ – wL – rK.25

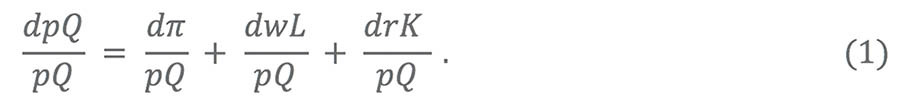

Rearranging terms, taking total derivatives, and dividing by total revenue, pQ, yields:

Equation (1) illustrates that at the firm level, the proportional change in firm revenue, dpQ/pQ, is equal to the sum of the change in the profit share, dπ/pQ, the change in the labor share, dwL/pQ, and the change in the capital share, drK/pQ. Thus, if values for the proportional change in revenue, the change in the profit share, and the change in the capital share are known or can be reasonably assumed, one can determine the change in the labor share.

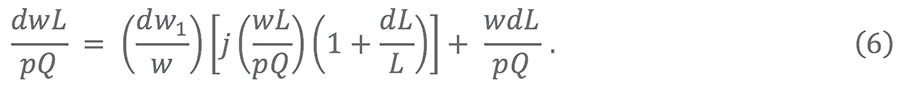

Since the firm can set worker wages as well as the number of workers employed, the change in the firm’s labor share can be decomposed as follows:

where Ldw/pQ reflects the change in the labor share due to a wage change, and wdL/pQ reflects the change in the labor share due to a change in the number of workers. Since the focus of this study is the labor market impact of firm responses to a negative revenue shock, as driven by the pandemic, any changes in wages or employment also will be negative (that is, cuts or layoffs, respectively).

To operationalize the role of potential wage cuts in the firm’s response, I allow for worker heterogeneity. Let L = L1 + L2 + L3 be the initial group of employed workers, before any firm adjustments to the pandemic. L1 reflects “job stayers” who receive wage cuts, L2 reflects “job stayers” who do not receive wage cuts, and L3 reflects “job leavers.” Thus, L + dL is the final group of employed workers, suggesting that L3 = –dL. Also, since only some job stayers receive wage cuts, Ldw = L1dw1, which implies that Ldw/pQ = L1dw1/pQ.

Note that the proportional wage cut imposed by the firm on the relevant job stayers, dw1/w1, also can be written as dw1/w, assuming that all three groups of workers are paid the same initial wage. Multiplying and dividing by pQ/L1 yields:

The inverse of the first right-hand-side term in equation (3) can be multiplied and divided by L, obtaining:

where the first right-hand-side term is the labor share, and the second right-hand side term is the share of initial workers composed of job stayers who receive wage cuts. Suppose share j of job stayers, L + dL, receives wage cuts. Then L1 = j(L + dL), which can be substituted into equation (4) to yield:

Substituting equation (5) into equation (3), and utilizing equation (2), I can derive:

With a few simplifying assumptions, it is possible to use equation (6) to derive an expression for the proportional change in workers, dL/L. Specifically, I assume that dw/w (again, equal to dw1/w1), drK/rK, and dπ/π are all equal to dpQ/pQ.26 This further implies that dπ/pQ = (dpQ/pQ)(π/pQ) and drK/pQ = (dpQ/pQ)(rK/pQ). Observing that the shares of profit, capital, and labor sum to one, one can also derive that dwL/pQ = (dpQ/pQ)(wL/pQ).

If I use these simplifying assumptions to substitute some terms into equation (6), I obtain the following expression for the proportional change in workers, dL/L:

Thus, given values for parameters j and dpQ/pQ (which, recall, is equal to dw/w), I can derive dL/L, which is central to empirically predicting the labor market impact of the pandemic.27

It is illustrative to examine extreme values of these parameters and the resultant proportional change in workers. For example, assume that dpQ/pQ is strictly bounded between –1 and 0, and j is weakly bounded between 0 and 1. If j is 1, then all job stayers receive wage cuts and there are no layoffs, as dL/L is 0. The necessary reduction in labor costs operates entirely through wage reductions (which, again, I assume equal the rate of revenue loss: dw/w = dpQ/pQ). If j is 0, then no job stayers receive wage cuts, and the rate of layoffs equals the rate of revenue loss, as dL/L = dpQ/pQ. In this case, the necessary reduction in labor costs operates completely through reductions in the number of workers. Meanwhile, as dpQ/pQ approaches –1, dL/L likewise approaches –1, where all workers are laid off. In the limit, the prospective share of job stayers receiving wage cuts does not matter for the result. And since job leavers do not receive wage cuts, this outcome is consistent with the absence of any such wage reductions. Alternatively, as dpQ/pQ approaches 0, dL/L likewise approaches 0, where no workers are laid off. Once again, in the limit, the prospective share of job stayers receiving wage cuts is not relevant for the result. However, by assumption, dw/w = dpQ/pQ. Thus, this outcome is consistent with no wage cuts occurring.

About the Authors

About the Authors

Osborne Jackson,

Federal Reserve Bank of Boston

Osborne Jackson is a principal economist with the New England Public Policy Center in the Federal Reserve Bank of Boston Research Department.

Email: Osborne.Jackson@bos.frb.org

Acknowledgments

Acknowledgments

The author thanks Jeff Thompson for his valuable suggestions and feedback. He is also grateful to Charles Gascon for sharing his coding of essential and work-from-home occupations, and to Melissa Gentry for initial work replicating unemployment rate estimates from select studies. Thu Tran provided excellent research assistance, and Larry Bean provided helpful edits.

Resources

Resources

Site Topics

Keywords

- COVID-19 ,

- wages ,

- New England ,

- labor costs ,

- unemployment rates ,

- NEPPC

JEL Codes

- J30 ,

- L80 ,

- E24