The Great Leverage 2.0? A Tale of Different Indicators of Corporate Leverage

Many policymakers have expressed concerns about the rise in nonfinancial corporate leverage and the risks this poses to financial stability, since (1) high leverage raises the odds of firms becoming a source of adverse shocks, and (2) high leverage amplifies the role of firms in propagating other adverse shocks. This policy brief examines alternative indicators of leverage, focusing especially on the somewhat disparate signals they send regarding the current state of indebtedness of nonfinancial corporate businesses. Even though the aggregate nonfinancial corporate debt-to-income ratio is at a historical high, these firms’ ability to service the debt, as measured by the interest coverage ratio, looks healthy. A simple model shows that this pattern can be consistent with firms’ optimal choice of leverage in response to an exogenous decline in interest rates. On the other hand, the model also reveals that the fall in the interest coverage ratio due to a given yield increase is magnified when interest rates are at low levels. The implication is that the elevated nonfinancial corporate debt-to-income ratio that has been present in recent years raises the downside risk of firms becoming unable to service their debt following any adverse shock, such as a decline in income or an increase in risk premia.

1. Introduction

In recent years, US policymakers have repeatedly expressed concerns about the rising leverage of nonfinancial corporate businesses and the risks this poses to financial stability and the real economy. A natural question is just how high this leverage is by historical standards: Is it so far beyond the historical norm as to be alarming? Several alternative metrics are used to measure leverage, and it turns out they tell somewhat different stories. Using aggregate data from the Financial Accounts of the United States (formerly known as the Flow of Funds), this policy brief reviews some of the most commonly used measures, focusing on the distinctions across these leverage measures and how they have evolved differently over time. The goal is to distill an overall coherent story regarding what the current state of the debt levels carried by US nonfinancial corporations may imply about risks to financial and economic stability. Specifically, in this brief we examine three alternative measures of leverage. The first is the metric most often used to gauge corporate leverage: debt over gross domestic product (GDP).1 For example, in his speech on September 20, 2019, Federal Reserve Bank of Boston President Eric S. Rosengren highlighted the increase in the debt-to-GDP ratios seen in the leveraged-loan market segment. More broadly, in May 2019, Federal Reserve Board Chairman Jerome H. Powell underscored the general increase in the debt-to-GDP ratio in the business sector.2 Debt over GDP compares the stock of debt with the flow of income. To more directly gauge a firm’s ability to service its debt, we use a second leverage measure based entirely on flow variables, specifically the ratio of income to interest payments, which is generally referred to as the interest coverage ratio (ICR). The higher this ratio is, the more able a firm is to cover interest expenses out of its current income, and hence the lower the firm’s effective leverage is. In corporate finance, leverage is often measured using the value of debt over assets, which is a ratio between two stock measures. This third measure can be regarded as the capitalized version of the (inverted) flow-based measure.

Our basic finding is that even though the nonfinancial corporate debt-to-GDP ratio has been at a historical high in recent years, the levels of the other two leverage ratios seem to be far less alarming. During the same period that the debt-to-GDP ratio has risen, the debt-to-asset ratio has hovered around its longer-term (since the 1960s) average. Furthermore, the current ICR is above the historical mean over the past few decades. We show that this overall pattern is consistent with the interpretation that US firms have optimally increased their amount of debt relative to income in response to an exogenous secular decline in interest rates. We illustrate this mechanism using a simple stylized model. On the other hand, this model also demonstrates that, all else being equal, a higher debt-to-income ratio renders a firm more vulnerable to a given (percentage point) increase of the corporate debt yield, since its interest payments will rise by a larger proportion relative to its income.

One potential trigger for an increase in a firm’s interest rate is a spike in the credit-risk premium (risk spread) during a so-called risk-off scenario, where debt investors suddenly pull back on their investment in risky assets, possibly due to a capital or funding shock. Credit spreads also tend to rise when the economy is hit by negative shocks, which can take the form of a regular recession or unforeseen rare events such as the coronavirus outbreak that has swept across the globe since January 2020. A widening in credit spreads in such cases reflects a perceived increase in default (credit) risk as cash inflow falters, possibly exacerbated by a deterioration in market liquidity. Obviously, during such a downturn, firm income falls as a result of the contraction in economic activity. In fact, any disruption to income is seriously detrimental whenever a firm’s creditworthiness depends primarily on its ability to service its debt payment, as evidenced by the fallout from the coronavirus outbreak. A reduction in income combined with a spike in credit spreads can lead to precipitous falls in the ICR. It is conceivable that this dynamic could lead to a vicious feedback loop that sees the credit spread spiraling up, as an acute decline in the ICR makes ratings downgrades or technical defaults more likely, which may then induce a flight to safe assets, raising risk spreads and further depressing the ICR. In sum, the implication is that, even with a healthy current ICR, the historically high debt-to-income ratio raises the downside risk to the ICR, which could decline precipitously in a downturn.3

In fact, even controlling for the level, today’s high debt-to-income ratio likely poses greater risk to the economy than it did during past business cycles. One aggravating factor is the historically high share of BBB (the lowest investment grade) bonds, a situation that inevitably increases the expected number of downgrades of BBB bonds to high-yield bonds should a downturn occur. This in turn raises the likelihood of a flight to safety and possibly the tail risk of fire sales, in particular, because some investors face restrictions on or increased costs of holdings of high-yield debt, resulting in a reduction of supply of funding and a credit crunch. Another reason for the higher risk is that monetary policy is more constrained in this era of low real and nominal interest rates. As a result, the reduction in risk-free rates brought about by traditional monetary policy easing is more limited and can be easily overwhelmed by spikes in the credit risk spread.4 In short, there are reasons to suspect that the downside risk due to the currently high nonfinancial corporate debt-to-income ratio is much heightened in today’s world despite the still solid ICR.

The rest of the analysis is organized as follows. We study aggregate US data for nonfinancial corporate leverage, then offer a stylized model that can rationalize the overall pattern observed in data. Finally, we discuss the potential policy implications and conclude.

2. Three Different Aggregate Measures of Nonfinancial Business Leverage

The Financial Accounts of the United States divides nonfinancial US businesses into two sectors—corporate and noncorporate—and reports statistics for them separately. The corporate sector is materially larger than the noncorporate sector. The total assets of the noncorporate sector fell from about 60 percent of the corporate sector in 1960 to a nadir of 38 percent in the fourth quarter of 2000, and has since recovered to nearly 50 percent. Naturally, more emphasis is placed on the corporate sector because of its larger size. Moreover, data availability limits micro analysis at the firm level to the corporate sector. We will analyze such firm-level data for the corporate sector in a subsequent study.

2.1 Debt-to-GDP Ratio

We first consider the most popular metric of leverage: the ratio of debt over GDP, which is depicted in panel (a) of Figure 1. Debt is defined as borrowing via market securities (such as bonds and commercial paper issued by corporations) and loans. GDP is measured at the relevant sector level.5 There is a clear secular upward trend in this measure. For the corporate sector, this ratio rose from a little over 50 percent in the early 1980s to nearly 100 percent in 2019:Q4. Some studies have shown that an unusually rapid growth of debt relative to output during expansions has often led to deeper and longer downturns.6

Panel (b) of Figure 1 shows the four-quarter change in the corporate sector’s debt-to-GDP ratio, which clearly confirms the upward trajectory of the ICR after the last recession. On the other hand, the average four-quarter growth rate of 0.24 percentage points (ppt) since 2010 is only slightly higher than the four-quarter average rate over the two decades with the slowest growth rates (about 0.15 ppt, over the 1970s and the 1990s), and it is notably lower than the historical average of 0.77 ppt since 1960.

For the noncorporate sector, as shown in panel (a) of Figure 1, the debt-to-sector-GDP ratio trended up between 1960 and the early 1980s, rising from just below 50 percent to 150 percent, then falling subsequently. This ratio has climbed back to a tad over 150 percent in the past couple of years. Mortgages account for much of the run-up in the noncorporate sector’s leverage; in fact, when mortgage debt is excluded, the relative magnitudes of the debt-to-GDP ratios of the two sectors reverse, as shown in Figure 2.

A cyclical pattern since the early 1980s is also evident in Figure 2, with the ratio spiking during recessions due to the greater decline in sector GDP (the denominator) than in the debt balance (the numerator). Over this cycle, the corporate debt-to-GDP ratio fell as the economy (and hence income) recovered. But since bottoming out about 2012, corporate sector borrowing increased and boosted the debt balance at a pace faster than that of income growth, leading the debt-to-GDP ratio to climb continually, with the latest value (2019:Q4) just surpassing the peak level reached during the Great Recession. By comparison, the debt-to-GDP ratio for the noncorporate sector also fell substantially following the recession, but its current level is still somewhat below its all-time high reached in mid-2009.

GDP measures the overall income received by both labor and capital. Since the cost of debt financing is paid out of capital income, it is arguably more relevant to compare a firm’s debt balance with its capital income. And the ratio of debt to capital income should have risen less, because the share of capital income in GDP has risen (that is, the share of labor income has fallen).7 It is interesting to note that this is indeed the case, especially for the corporate sector. As Figure 3 shows, the ratio of debt to capital income (net of depreciation) for the corporate sector has basically been stationary (although volatile) since the mid-1980s.8 This ratio exhibits clear cyclical fluctuations, but no meaningful secular upward trend. By comparison, this ratio still shows a (shallower) trend increase over this cycle for the noncorporate sector.

2.2 Debt-to-Assets Ratio

Debt over GDP compares the stock of debt with the flow of income. In corporate finance, leverage is often measured using debt over assets, which is a ratio between two stock measures. As shown in Figure 4, for the nonfinancial corporate sector this ratio appears largely stationary, except for a major swing in the early 1980s and a peak in the mid-1990s. In recent years, the nonfinancial corporate debt-to-assets ratio has hovered near its historical average. For the nonfinancial noncorporate sector, the debt-to-assets ratio spiked during the Great Recession but has since fallen, though the current level is still high by historical standards. As noted above, much of this rise in leverage is accounted for by the increase in mortgage borrowing. In sum, the degree of leverage, as measured by the debt-to-assets ratio, by and large has not exhibited a clear upward trend since the 1990s, especially not in the corporate sector, in contrast to the debt-to-GDP ratio.

It is worth noting that the measure of debt used in almost all extant analyses does not include a category labeled as “Unidentified Miscellaneous Liabilities,” which essentially is a residual accounting term used to balance the books. 9 For the corporate sector, this category has hovered at just over 25 percent of all liabilities since the early 1990s. By comparison, in the past decade, market debt and loans have amounted to a tad under 40 percent of corporate liabilities. For the noncorporate sector, the unidentified miscellaneous category grew to 20 percent of total liabilities in the early 2000s and has remained at that level, while loans amount to just under 70 percent of liabilities. If a portion of miscellaneous liabilities is included in the numerator for either of the two leverage ratios above, these measures will be higher, especially for the corporate sector (for instance, this inclusion could boost the current corporate debt-to-GDP ratio to as high as 160 percent). We exclude this category in our calculations because little is known about the exact nature of these miscellaneous liabilities (in particular, whether they entail an obligatory repayment, as regular debt does), and to facilitate comparison with other studies.

2.3 Interest Coverage Ratio

Yet another way to measure leverage is to use only flow variables by comparing income to interest payments to gauge firms’ ability to cover their interest expenses. The interest coverage ratio (ICR), defined here as the ratio of capital income (that is, operating surplus) after depreciation over interest expenses, is typically used for this purpose: the higher the ratio, the lower the effective leverage in terms of the affordability of the debt payment. The corporate sector’s ICR has in fact been quite healthy in recent years by historical standards, as illustrated in Figure 5; the ICR rose steadily after the Great Recession to reach a historical high in 2014 when compared with the rest of the period starting in the early 1980s. The ICR has retreated somewhat since then, but it remains at a level that is clearly higher than the average over the previous four decades.

A qualitatively similar pattern is also apparent for the noncorporate sector; that is, its current ICR exceeds the average over the previous four decades, although this sector has always maintained an average ICR higher than that of the corporate sector. Figure 6 shows that the 1960s is the only other period in the data when the interest rates paid by the corporate sector were relatively low, similar to those in recent years, although the levels of ICR were noticeably higher (albeit falling) in the 1960s.10

It is worth noting that since 2014 the ICR has always lain somewhat below the interest-rate-ICR curve fitted using historical data, indicating that the amount of corporate debt exceeds what the sector would have borrowed in the old ways had it faced the same interest rates. This corroborates the above finding of unprecedented debt-to-GDP ratios. The fact that only the ICR remains healthy by historical standards means that nonfinancial firms are unusually vulnerable to any disruptions to income or a spike in borrowing cost. The much diminished volatility of the macroeconomy, which began in

the mid-1980s and was interrupted only by the Great Recession, may have predisposed firms to assign a rather low probability to income disruptions. However, unforeseen shocks can occur, as evidenced by the unparalleled interruption of regular operation induced by the coronavirus outbreak and the public policy response attempting to halt its spread and save lives.

2.4 Household Sector Leverage Prior to the Financial Crisis

For comparison, we examine indicators of leverage in the household sector during the mid-2000s in the run-up to the Great Recession, since it is recognized, especially ex post, that this was a period of an unsustainable increase in leverage for US households. As shown in panel (a) of Figure 7, just as it did for the nonfinancial business sector in recent years, the household debt-to-assets ratio rose steadily from the 1960s, with an especially steep rise between 2000 and 2007. Likewise, the household debt-to-income ratio shows an essentially uninterrupted climb from the early 1990s to 2007. Both ratios have since fallen back to the levels observed in the late 1990s.

While nonfinancial businesses currently have a healthy ICR, the debt service ratio for households (defined as the ratio of total required debt payments to total disposable income, a measure that is akin to the inverse of the ICR for businesses) also rose noticeably, as shown in panel (b) of Figure 7.11 This pattern suggests that the overall degree of household leverage before the financial crisis was more precarious than the comparable situation of nonfinancial corporations is today, as debt repayments were consuming a rising share of households’ income. Furthermore, the strain was becoming acute for a subset of households. Since the end of the Great Recession, the debt service ratio for US households has fallen to the lowest levels since the early 1980s, owing to both declining debt balances and falling interest rates.

In sum, the three different indicators of corporate leverage appear to tell different stories regarding the severity of the nonfinancial business sector’s indebtedness. The debt-to-GDP ratio exhibits a clear upward trend over the past couple of decades and sends the most alarming signal, while the debt-to-assets ratio seems to have held steady over the same period. In contrast, firms’ ability to service their debt out of income looks rather solid by historical standards. Can the different stories these metrics tell be reconciled? If so, how? We attempt to sketch a preliminary answer to these questions in the next section with a simple stylized model.

3. A Simple Model of Optimal Corporate Leverage

The explanation that can reconcile the disparate patterns obtained from different leverage measures is that the interest rate on corporate debt has fallen exogenously (to an individual firm), at least to some degree, relative to income. Therefore, firms can afford to borrow more, but less than proportionally, so that the flow of interest payments falls relative to income. This section presents a simple model to illustrate this mechanism.

Consider a firm that produces output ![]() using only capital k, with the output elasticity 1 > α > 0. Capital is financed with a given amount of equity e, which is assumed to be fixed, and a variable amount of debt d; that is, k = e + d. Borrowing is associated with an interest rate r, with 1 > r > 0, which the firm takes as given. Output is subject to a random shock

using only capital k, with the output elasticity 1 > α > 0. Capital is financed with a given amount of equity e, which is assumed to be fixed, and a variable amount of debt d; that is, k = e + d. Borrowing is associated with an interest rate r, with 1 > r > 0, which the firm takes as given. Output is subject to a random shock ![]() , with

, with ![]() . The shock is a catch-all term for shocks to income that could be driven by technology or demand factors. Finally, output is taxed at a rate τ, with interest expenses exempt from taxation.

. The shock is a catch-all term for shocks to income that could be driven by technology or demand factors. Finally, output is taxed at a rate τ, with interest expenses exempt from taxation.

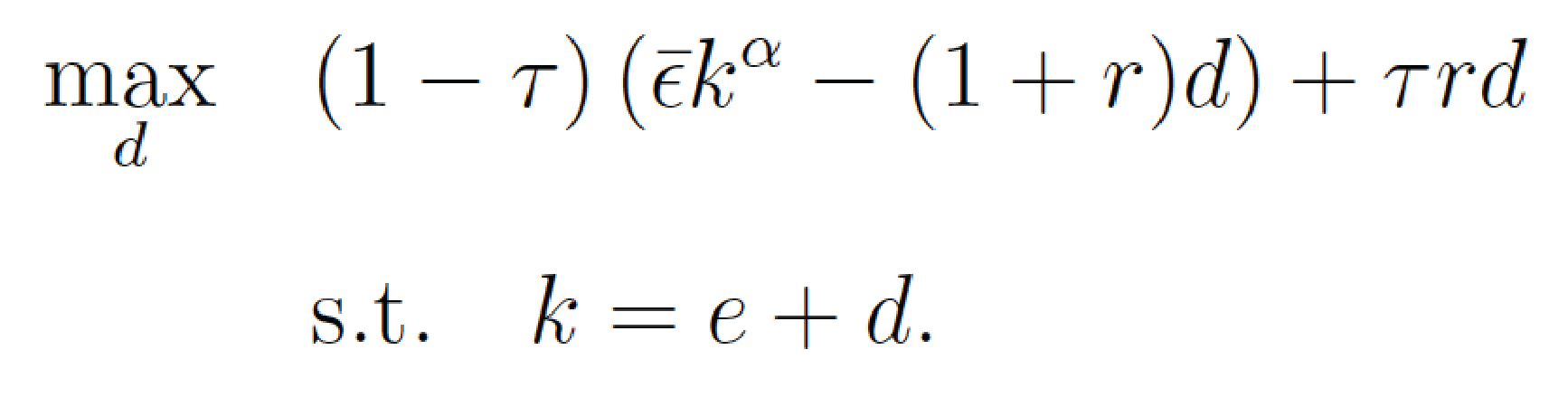

The firm maximizes its expected profits by choosing the amount of debt it issues, and thus its productive capital, given the amount of fixed equity:12

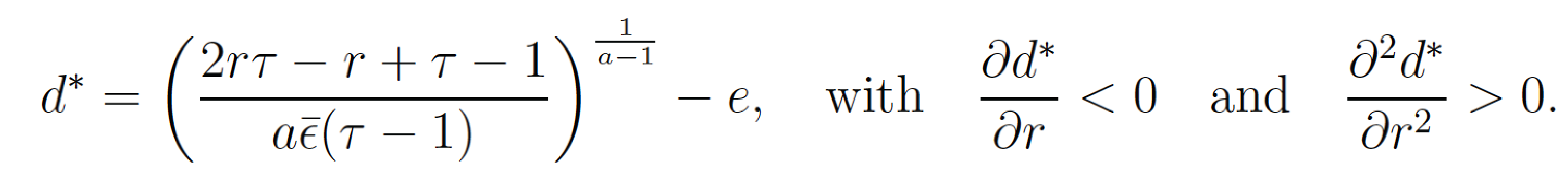

The first-order condition (which states that the firm’s marginal revenue must be equal to the marginal cost of debt) implies that the optimal debt level is:

Thus, in a basic model of optimal debt, lower interest rates lead to higher debt levels. Moreover, larger expected income shocks increase debt levels. Expressing the optimal output corresponding to the optimal choice of debt (equal to d*) as y*, we can present the optimal value of the three leverage measures used in our empirical analysis and derive comparative statics.

Most relevant for our purpose is the result that the debt-to-assets ratio and the debt-to-income ratio, ![]() , rise when the interest rate increases, while the interest coverage ratio,

, rise when the interest rate increases, while the interest coverage ratio, ![]() , also increases in the interest rate.13 Figure 8 illustrates the three different leverage measures as a function of the interest rate.14

, also increases in the interest rate.13 Figure 8 illustrates the three different leverage measures as a function of the interest rate.14

The intuition behind these relationships is that as interest rates decrease exogenously, the firm takes on more debt, but less than proportionally, so that, in equilibrium, the firm has lower interest expenses despite its now higher ratio of debt to income. The firm’s ICR thus rises (in fact, its income is higher than before). At the same time, due to the firm’s concave production function, its output increases less than its debt, so the firm’s debt thus rises relative to its income. This is exactly the pattern observed in the data. Importantly, the model also highlights a strong nonlinearity: At low interest rates, the ICR is more sensitive to a given change in interest rates, and to economic shocks more broadly. That is, at low levels of interest rates, small changes in interest rates trigger larger changes in the ICR compared with the same interest rate change when rates are at higher levels. This can be seen in panel (c) of Figure 8, as the slope of the curve becomes steeper when the interest rate is low.

4. Monetary Policy Considerations

Our aggregate data exploration in Section 2 demonstrates that one’s assessment regarding the current state of nonfinancial corporate leverage depends on which indicator of leverage one considers. Overall, we find that only the debt-to-GDP ratio has exhibited a notable upward trend in recent decades. The debt-to-assets ratio has been more stable by comparison, and in recent years the ICR has been at quite a healthy level by historical standards. Our modeling analysis indicates the need to jointly consider these three different indicators of business indebtedness to arrive at a more complete understanding of the likely driving forces, and to determine whether the current level is a cause for concern.

According to Greenwald (2019), the vast majority of corporate loan contracts featured ICR-based covenants until recent years.15 Although many of these loans also contain another covenant capping the debt-to-earnings ratio, the ICR-based covenant is found to amplify the transmission of monetary policy the most, because the ICR is directly shifted by interest rates. Moreover, of the two types of covenants, the ICR-based one is especially binding in later stages of the business cycle, when interest rates are likely to be high due to the tightening of monetary policy.16 Therefore, the pre-recession ICR is likely to be particularly important for a firm’s investment behavior during a downturn. In fact, given the structure of the covenants, it is quite possible that the relationship between investment and the ICR is nonlinear: When the ICR falls below the threshold set forth in the loan covenant, firms cut investment significantly regardless of the exact value of the ICR, whereas the ICR exerts a more monotonic impact on investment when its value is above the threshold. Anecdotally, the ICR also is often used by bond investors as a key ratio when making investment decisions. To the extent that this assessment is valid, our finding that the current ICR value is fairly strong by historical standards suggests that the current amount of corporate leverage is unlikely to become a significant drag on investment should the US economy falter mildly. On the other hand, the overall average value of the ICR may mask certain industries or firms that have ICRs that are lower than the average sector ICR by a nontrivial degree. We plan to examine this cross-section heterogeneity in subsequent analysis. Moreover, a more substantial negative shock to firms’ cash flow, for example due to the plummeting sales resulting from the restrictive public policy (“social distancing” and the like) in response to the coronavirus outbreak in 2020, can quickly slash firms’ ICR.

Looking forward, we suspect that the impact of a low ICR on investment could be weaker in the next downturn, because ICR-based covenants are being omitted from a growing share of loan contracts, especially in the leveraged-loan space. Even though ICR-based covenants are still prevalent for corporate loan contracts covered in the DealScan database, the leveraged-loan contracts appearing in S&P’s Leveraged Commentary & Data database show that the share of ICR-based covenants fell from 36 percent in 2007 to a low of about 11 percent in 2018. This decline is consistent with the general increase in covenant-lite deals.

We feel it is prudent to remark on potential “unknown unknowns.” We have yet to address one likely key concern that policymakers have regarding corporate leverage: the extent to which the currently high level of debt to income increases the risk of rating downgrades, debt defaults, and even bankruptcy, all of which then become a source of adverse shocks to the economy. Even expected downgrades of investment-grade BBB bonds (which have seen a surge of issuance over this cycle) into the below-investment grade (high-yield) category pose a risk of triggering fire sales. If such fire sales become sufficiently widespread, conditions might spiral into a credit crunch, in which case credit spreads would spike and some firms would become unable to roll over their maturing debt. A deeper recession and slower recovery might ensue. The higher the balance of debt that cannot be rolled over, the greater the likely damage to the economy. The combined effect of plummeting income and much higher interest rates could rapidly reduce the ICR. Indeed, the historical evidence presented in

Figure 9 suggests that decreases in the ICR are largely associated with increases in credit spreads, which are unsurprisingly exacerbated by sluggish and even negative corporate earnings growth. The potential for this dynamic is present even in periods when the Fed lowers the federal funds rate.

Such a crisis scenario is clearly a tail event, which we used to think was sufficiently rare in reality and thus difficult to quantify reliably with historical data. And yet the odds of this scenario taking place in the future may be higher than previously estimated, as evidenced by the abrupt halt of much economic activity and the resulting steep drop in firms’ income in the aftermath of the coronavirus outbreak in the first few months of 2020. Moreover, the consequence of such adverse shocks is likely more serious than in the past due to the more limited capacity of conventional monetary policy in this era of low interest rates. The policy rate may well become constrained by the effective lower bound long before the rate can be cut enough to offset the credit spread spikes.17 This is one important consideration that makes us cautious about counting too much on the currently healthy level of the ICR to continue holding if economic conditions deteriorate. The stress observed in the credit market in early March 2020, following the spread of coronavirus to the United States and Europe, can be regarded as a manifestation of this downside risk. Hence, we think it is prudent to raise the bar on what can be considered a sustainable ratio. Moreover, this scenario heightens the need to look beyond the average ICR for nonfinancial corporations and specific industrial sectors and examine the firm-level distribution.

5. Concluding Remarks

Many policymakers have expressed concerns about the rising level of corporate leverage and the risks this poses to US financial stability, as high leverage raises the odds of debt downgrades and defaults, making it more likely that adverse shocks may emanate from the corporate sector. Moreover, high leverage renders firms more vulnerable to shocks as the cost of credit increases or the availability of credit becomes curtailed during downturns, leading to more severe cuts in investment and even production, thus exacerbating the recession and perhaps also slowing the recovery.

This policy perspective examines three different indicators of leverage, focusing on the somewhat disparate signals they send regarding the current indebtedness of nonfinancial businesses. Even though the US nonfinancial corporate debt-to-income ratio is at a historical high, these firms’ ability to service the debt, as measured by the interest coverage ratio (ICR), looks healthy due in large part to the secular decline in the level of interest rates. A simple model shows that this pattern can be consistent with a firm’s optimal choice of leverage in response to an exogenous decline in interest rates.

On the other hand, the model also reveals the greater vulnerability of the corporate sector, despite its still solid ICR, owing to the greater downside risk stemming from the already low level of US interest rates. That is, the decline in the ICR in response to any yield increase is magnified when interest rates are low. Thus, when risk premia spike by more than what monetary policy can offset with lower interest rates, the ICR may decline substantially more than in previous periods of higher interest rates. This risk is exacerbated by the constraint placed on monetary policy by the prevailing low interest rates and hence the substantial risk of hitting the effective lower bound even in a mild recession. This constraint on policy is likely to limit its potential to offset increases in risk premia and to stimulate aggregate demand, leading to a reduction in income. The combined effect of the two limitations can put sizable pressure on the ICR. Moreover, to the extent that this high leverage is concentrated in some firms or industries, these conditions can further aggravate the tail risk. In other words, things may be different this time, and undesirably so.

Endnotes

- At the individual firm level, leverage is often measured as debt over earnings before interest, tax, depreciation, and amortization.

- These two speeches can be accessed, respectively, at https://www.bostonfed.org/news-and-events/speeches/2019/assessing-economic-conditions-and-risks-to-financial-stability.aspx and https://www.https://www.federalreserve.gov/newsevents/speech/powell20190520a.htm.

- In general, corporate borrowing costs also may rise if monetary policy rates increase in response to a booming economy, although in this case corporate earnings likely would remain strong, thus posing less of a risk to financial stability.

- The FOMC quickly cut the fed funds rate to zero on March 15, 2020, after an earlier cut on March 3, 2020, in response to the sharply negative economic impact of the coronavirus outbreak. This means that the Fed will have to rely on unconventional policy tools to provide additional stimulus.

- GDP is also referred to as gross value added, especially at the sector level. The sum of the nonfinancial business sector’s GDP has amounted to about two-thirds of aggregate US GDP since the early 1990s.

- For example, Jordà, Schularick, and Taylor (2013) find that “excess credit” build-up tends to lead to deeper and longer recessions, with excess credit defined as the rate of change in the ratio of bank loans to GDP, measured as a deviation from its mean, calculated from the previous trough to the subsequent peak.

- Capital income in the national accounts is referred to as operating surplus.

- Whether depreciation is netted out or not does not alter the qualitative pattern for either sector.

- Unfortunately, there is no further breakdown of this item.

- Data from the National Income and Product Accounts reveal that the decline in ICR in the 1960s was a continuation of a decline that had started in the early 1950s, likely a results of the post-1945 transition away from the war footing of the economy, when nonfinancial firms curtailed borrowing substantially.

- The time series pattern is qualitatively the same for US households’ financial obligations ratio, which is a broader measure of precommitted outlays that households must finance out of current income. These include rent payments on tenant-occupied property or monthly mortgage payments, auto payments, homeowners’ insurance, and property tax payments.

- This value of equity is best considered the book value since, in a general equilibrium, the market value of a firm’s equity generally rises as the overall level of interest rates falls.

- As noted above, the firm’s debt-to-assets ratio should be regarded as based on the book value of equity. This ratio will rise less or even hold steady once the general equilibrium increase in the market value of equity is included.

- Note that in order to compare the optimal leverage implied by the model with the empirical values, the magnitudes of the debt-to-income ratio and the ICR implied by the model need to be adjusted for the fact that all the income in the model accrues to capital, whereas in reality only 35 to 40 percent of income accrues to capital. That is, the model-implied ICR would be 2.5 to 3 times that of the ICR based on actual data.

- Financial covenants are performance-based clauses included in loan contracts between the borrower and lender, and violating a covenant typically trigger renegotiation of the contract.

- In particular, the ICR is likely to fall as a result of monetary policy tightening, although it is probably less likely to fall precipitously, because monetary policy would only tighten in response to strong growth when economic conditions are such that income is unlikely to fall.

- The FOMC quickly cut the fed funds rate to zero in March 2020 in response to the sharply negative economic impact of the coronavirus outbreak. This means that the Fed will have to rely on unconventional policy tools to provide additional stimulus.

References

Greenwald, Daniel L. 2019. “Debt Covenants and the Macroeconomy: The Interest Coverage Channel.” MIT Sloan Working Paper 5910–19. Cambridge, MA: MIT Sloan School of Management.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2013. “When Credit Bites Back.” Journal of Money, Credit and Banking 45(S2): 3–28.

The views expressed herein are those of the authors and do not indicate concurrence by the Federal Reserve Bank of Boston, the principals of the Board of Governors, or the Federal Reserve System.

About the Authors

About the Authors

Falk Bräuning,

Federal Reserve Bank of Boston

Email: falk.braeuning@bos.frb.org

J. Christina Wang,

Federal Reserve Bank of Boston

J. Christina Wang is a principal economist and policy advisor in the Federal Reserve Bank of Boston Research Department.

Email: Christina.Wang@bos.frb.org

Acknowledgments

Acknowledgments

The authors thank José Fillat, Giovanni Olivei, and especially Joe Peek for valuable discussions and suggestions. Meghana Bhaskar provided outstanding research assistance.

Resources

Resources

Site Topics

Keywords

- financial stability ,

- monetary policy ,

- business leverage ,

- interest coverage ,

- low interest rate

JEL Codes

- G32 ,

- E43 ,

- E58 ,

- C60