Achieving Greater Fiscal Stability: Guidance for the New England States

This report considers the New England states' past preparedness for revenue downturns caused by business cycle fluctuations and assesses policy actions that could promote greater fiscal stability in the future.

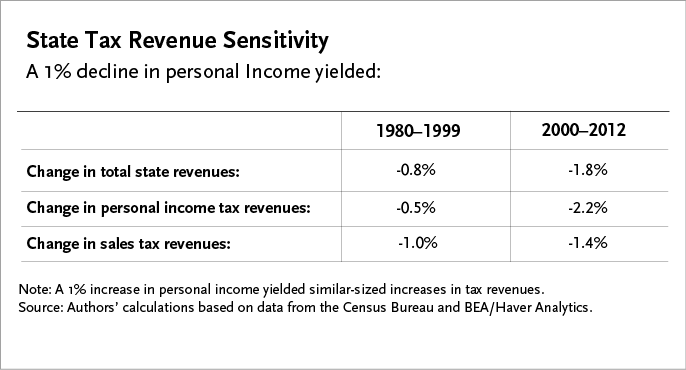

During the recessions in 2001 and in 2007-2009, state governments experienced an unusually high degree of fiscal stress partially due to the increased sensitivity of their revenues to the business cycle: after periods of strong growth, many states saw their tax receipts fall steeply. Rainy day funds are one mechanism by which states can set aside funds to weather these cycles.

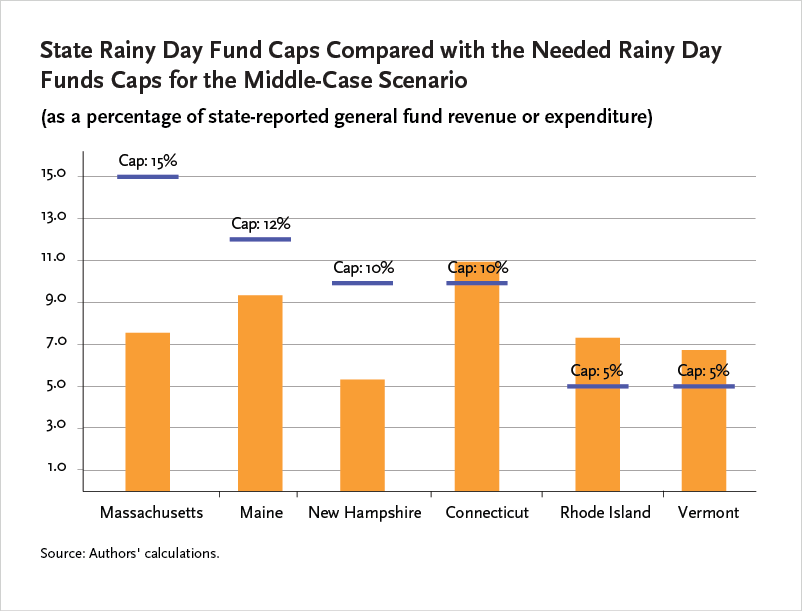

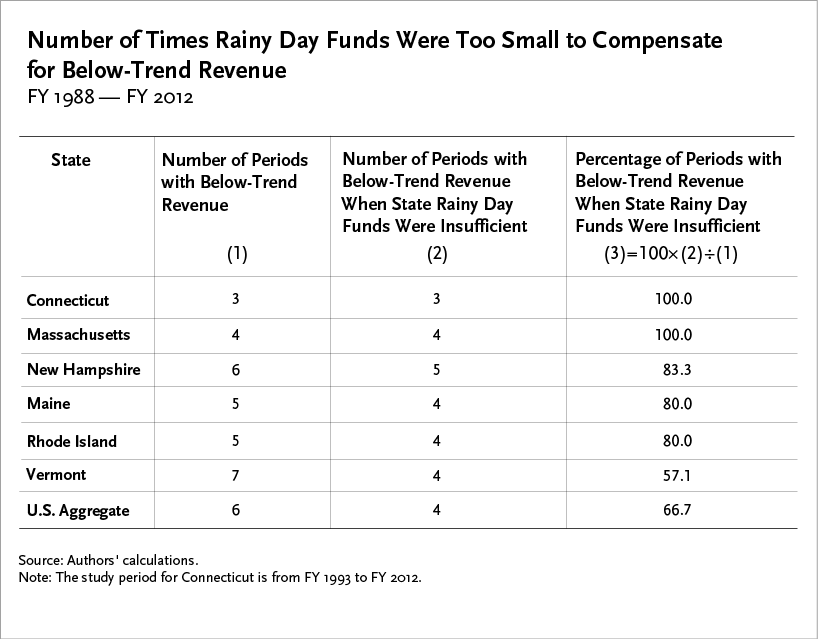

However, in setting the size of their rainy day funds, most states follow guidelines that do not reflect both the magnitude of business cycles and the variation in how individual states' revenues respond to business cycles. As a result, state rainy day fund balances have generally been insufficient to compensate for the revenue shortfalls associated with economic downturns. The research finds that the rainy day fund caps adopted by most of the states in New England-most notably by Connecticut, Rhode Island, and Vermont-are lower than they would have needed to be to avoid having to raise taxes and fees or reduce expenditures during a typical downturn. The authors consider how states might strengthen state rainy day funds to support greater fiscal stability and discuss the role of tax reform in promoting the same goal.

Key Findings

Key Findings

- Many states saw their tax receipts fall steeply during the two most recent recessions, which followed periods of very strong revenue growth. The magnitude of these swings has increased over time: analysis reveals that state tax revenues are increasingly sensitive to state economic conditions.

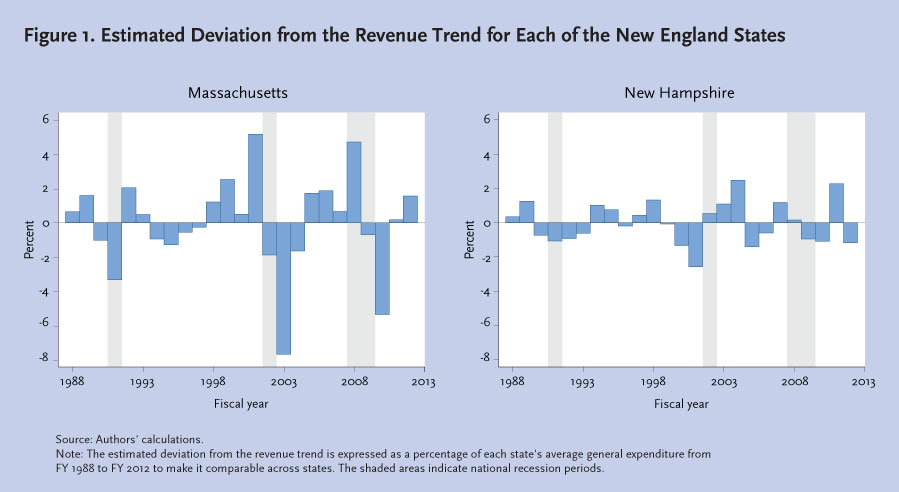

- Over the past 25 years and especially during the two most recent recessions, the New England states have experienced very sizeable revenue shortfalls relative to the long-term trends. Trends in Massachusetts and New Hampshire are shown below; the full report profiles trends in each New England state.

- State rainy day fund balances have generally been insufficient to compensate for the revenue shortfalls associated with economic downturns in the past 25 years.

- The rainy day fund caps adopted by Connecticut, Rhode Island, and Vermont are lower than would have been needed to be to avoid having to raise taxes and fees or reduce expenditures in a typical downturn ("middle-case scenario"). These states should give serious consideration to raising their caps.