2014 Series • No. 14–11

Research Department Working Papers

Smoothing State Tax Revenues over the Business Cycle: Gauging Fiscal Needs and Opportunities

During the two most recent U.S. recessions in 2001 and in 2007-2009, state governments experienced an unusually high degree of fiscal stress due to increased revenue cyclicality. Expanding upon the aggregate evidence, this paper explores the degree to which individual states have experienced fluctuating tax receipts over the business cycle. The findings provide state policymakers with information to better understand the extent and causes of this tax revenue cyclicality and, in the context of balanced budget requirements, the efficacy of alternative measures that might be employed to smooth the sensitivity of state resources to economic conditions.

Key Findings

Key Findings

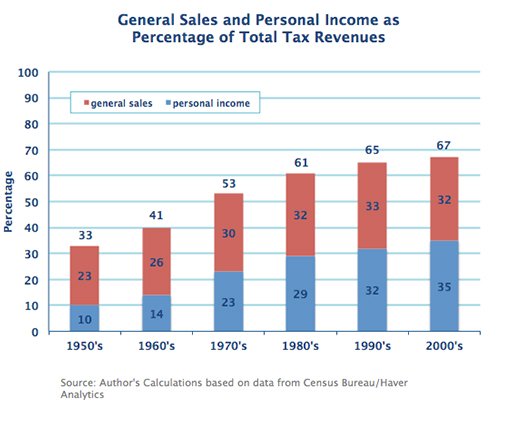

- Fluctuations in personal income tax receipts were the chief cause of the greater cyclicality of state tax revenues in the 2000s.?? In the aggregate, the elasticity of total state tax revenue with respect to personal income was 0.83 in the 1980s and the 1990s, but increased to 1.76 in the 2000s. Most states experienced greater tax revenue cyclicality in the 2000s than in the prior two decades.

- Investment income became much more cyclical in the 2000s and accounted for a higher share of the overall federal adjusted gross income (AGI), which is used as a basis for figuring state income taxes in the 41 states that tax personal income. During the 1980s and the 1990s, capital gains accounted for 4 percent of federal AGI, but increased to 6 percent of federal AGI in the 2000s. The increased volatility of aggregate state income tax receipts was due to capital gains flowing disproportionately to taxpayers who are subject to the highest statutory marginal tax rate.

- State departures from the federal definitions of AGI and taxable income did not have a marked effect on the cyclicality of personal income tax revenues in most cases.??

- In 27 of the 38 states with both income and general sales taxes, sales tax revenues were more cyclically sensitive than income tax receipts during the 1980s and the 1990s, but this pattern reversed in the 2000s.

Exhibits

Exhibits

Implications

Implications

The evidence presented in this paper indicates that the existing differences across state income tax laws contributed very little during the 2000s to making income tax revenues in some states more cyclically stable than in other states. The implication is that in order to substantially reduce the elasticity of personal income tax revenues with respect to personal income, a state would likely have to revise its tax code very substantially, or be willing to raise tax rates when receipts go down and reduce these rates when receipts go up. While the latter action is common, the political reality is that rate hikes are not palatable when taxpayer incomes are falling. All in all, the research presented in this paper suggests that the most viable way for states to avoid large spending swings over the business cycle while adhering to balanced budget requirements is to allocate some portion of unexpectedly strong revenue receipts to a budget stabilization fund.

Abstract

Abstract

The high degree of fiscal stress experienced by state governments in the 2001 and the 2007–2009 recessions has prompted renewed discussions of alternative approaches to stabilizing state finances over the business cycle. Prompted by evidence of increased state tax revenue cyclicality in the aggregate, this study explores state-specific patterns so as to inform policymakers in individual states. It finds that while elasticity levels continued to differ across states, most states experienced greater cyclical sensitivity in the 2000s than in the 1980s and 1990s. In addition, during the 2000s personal income tax receipts varied more over the business cycle than sales tax receipts in most states that imposed both forms of taxation. This trend represented a departure from the patterns of the prior two decades, when sales tax receipts were more cyclically sensitive than individual income tax receipts in the majority of states. Cross-section regressions reveal that the main source of variation in income tax elasticities across states during the 2000s was the cyclical sensitivity of their residents' incomes as reflected on their federal income tax returns. By contrast, state-specific features such as the tax treatment of capital gains or the progressivity of tax rates did not account for significant differences in revenue elasticities across states. In addition, state departures from the federal definitions of adjusted gross income and taxable income, on the whole, did not contribute to increased revenue volatility over the business cycle. The findings are used to evaluate the efficacy of alternative measures that could be used to help stabilize state revenues, including reforms of state tax and stabilization trust structures.