Student-Loan Debt, Delinquency, and Default: A New England Perspective

In 2009, student debt became the largest non-housing-related consumer debt in the United States. By the end of 2015, outstanding student debt balances had reached $1.23 trillion. These milestones coincided with increasing rates of delinquency and default among borrowers, raising concerns about the affordability of student debt and leading many to warn about a “student debt crisis.” For New England, with its highly educated population and large higher education industry, student debt is a salient economic and policy issue. All six New England states have formed subcommittees, fielded commissions, contracted studies, and proposed or passed legislation targeting student debt. Unfortunately, such policy discussions often lack detailed information on trends in state and regional student-loan debt.

This report analyzes trends in student-loan debt, delinquency, and defaults in New England relative to the nation. Analyzing data at both the institutional level, where student loan debt is originated, and the individual level, where borrowers make payments, it discusses factors that may influence students’ ability to sustain payments on their student loan debt.

Key Findings

Key Findings

- Students attending New England institutions face higher costs to obtain a postsecondary education than students in other regions, partly as a result of higher tuition and fees across all types of institutions, but mostly as a result of a high concentration of students in New England attending costlier, private, four-year institutions.

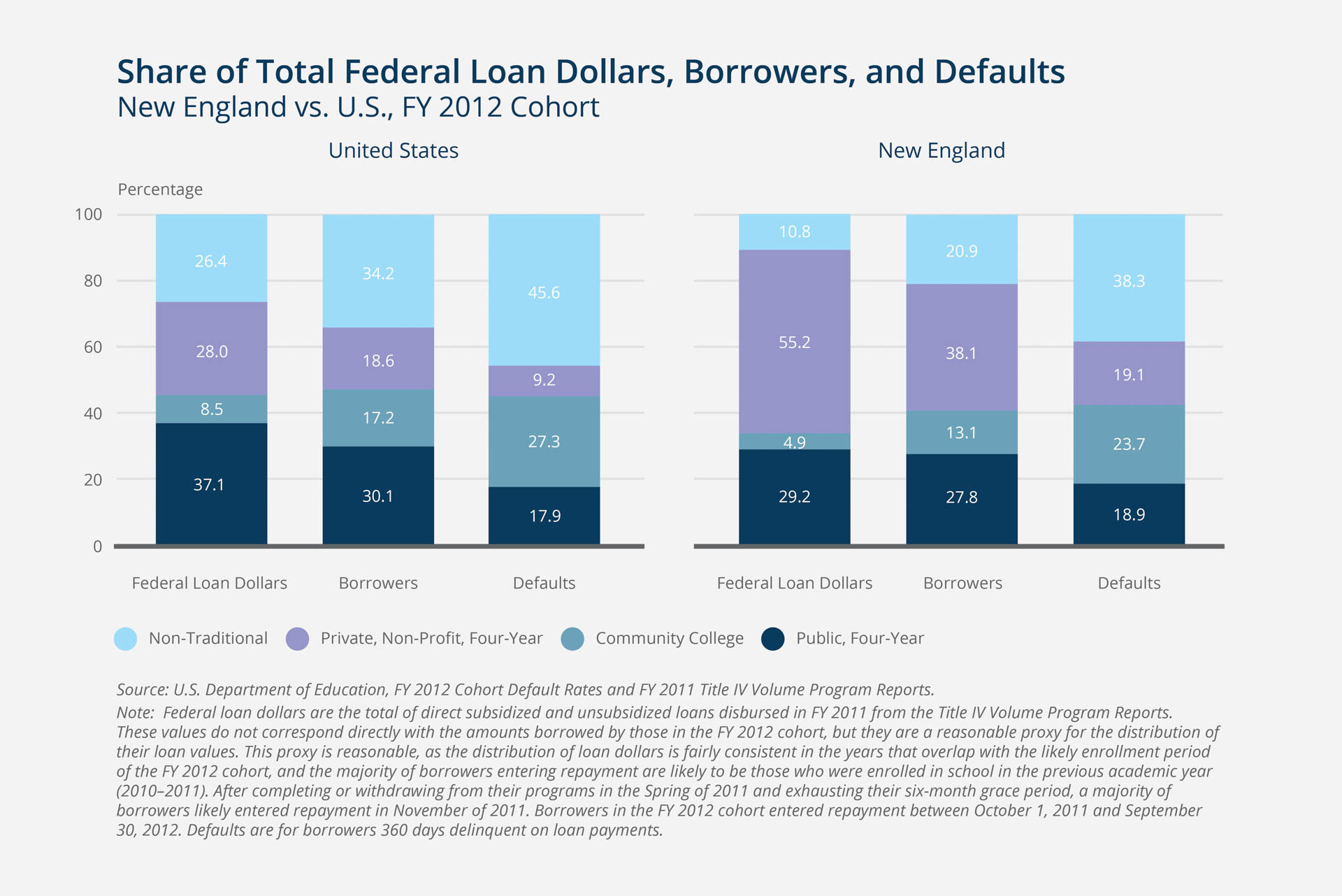

- Student-loan borrowers attending institutions of higher education in New England generally have lower rates of default on these loans than borrowers attending such institutions elsewhere in the nation, possibly reflecting a combination of institutional quality and better regional labor markets for graduates.

- Residents of New England also have persistently lower rates of delinquency on student loans, despite having levels of debt markedly similar to those of borrowers nationwide.

- We find suggestive evidence at both the institutional and the individual level that borrowers from disadvantaged backgrounds are more likely than other borrowers to be delinquent and to default on their student loans, perhaps because they disproportionately enroll in institutions with weak educational outcomes and poor labor market outcomes for their graduates.

Exhibits

Exhibits