2016 • No. 16–05

Research Data Reports

Financial Inclusion and Consumer Payment Choice

Many U.S. policymakers believe that access to safe and affordable financial services is important for dealing with unexpected expenses, avoiding unnecessary fees, establishing the ability to borrow, and saving for the future, and that lack of such access is a sign of financial and civic marginalization that public policy should address.

One aspect of financial inclusion is access to the mainstream payments system, which enables one to conveniently receive funds, make purchases, and pay bills. This research data report identifies consumers according to their banking status in order to see how they receive funds and make payments.

The authors examine the demographic characteristics and use of payment instruments of three groups of U.S. consumers: those without a checking or savings account (unbanked), bank account adopters who have used alternative financial services (AFS) in the past 12 months (underbanked), and bank account adopters who did not use AFS in the past 12 months (fully banked). Understanding payment choices made by consumers—especially those with weak attachment to the banking system—is potentially useful for researchers and policymakers studying financial inclusion, for innovators designing new financial products, and for financial educators seeking to understand consumer decision making.

Key Findings

Key Findings

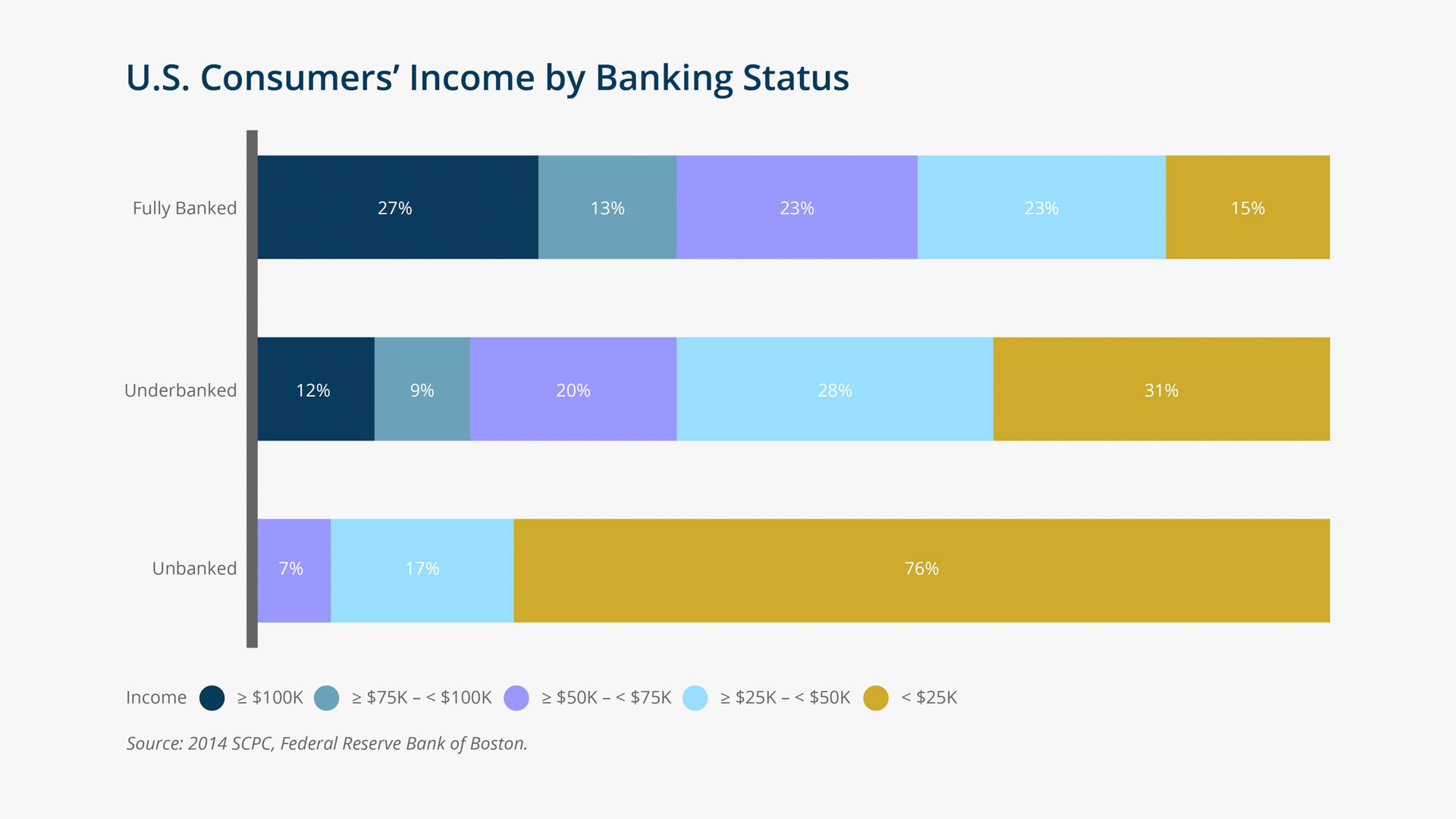

- Consumers in the three groups have different demographic characteristics, income, and payment behaviors. Lower income is correlated with being un- or underbanked, with consumers with the lowest income most likely to be unbanked. Race and education also are associated with banking status.

- The payment behavior of the underbanked is similar to that of the fully banked. Each group makes about half of all payments (by number) using payment instruments linked to a bank account.

- Unbanked consumers make fewer payments per month than the fully banked, and the unbanked rely heavily on cash: 80 percent of their payments are in cash. Reliance on cash means that unbanked consumers pay almost all bills in person or by mail or phone; consumers with a bank account (fully and underbanked) pay two-thirds of bills online or automatically.

- Fewer than half of the unbanked know their credit scores, while about 85 percent of the underbanked and the fully banked know theirs.

- Both unbanked and underbanked consumers are significantly more likely than fully banked consumers to own a general purpose reloadable (GPR) prepaid card.

- The authors find no evidence that consumers are prevented from opening a bank account; many cite personal preferences and cost as reasons for choosing to be unbanked. These preferences are likely related to income constraints.

Exhibits

Exhibits

Implications

Implications

The strong association with income indicates that consumers' stated preferences and reasons for being underbanked may be constrained by their income levels.

Unbanked status is explicitly defined; being underbanked is a fuzzier concept. Further research and survey modifications would be needed to understand underbanked consumers' motivations and constraints more clearly as well as to define their status more precisely.

Abstract

Abstract

This report examines similarities and differences among three groups of consumers: those without a checking or savings account (unbanked), bank account adopters who have used alternative financial services (AFS) in the past 12 months (underbanked), and bank account adopters who did not use AFS in the past 12 months (fully banked).

Consumers in the three groups have different demographic characteristics, income, and payment behaviors:

- The payment behavior of the underbanked is similar to that of the fully banked.

- Unbanked consumers make fewer payments per month than the fully banked and the underbanked.

- Fewer than half of the unbanked know their credit scores, while about 85 percent of the underbanked and the fully banked know theirs.

- Both unbanked and underbanked consumers are significantly more likely thanfully banked consumers to own a general purpose reloadable (GPR) prepaid card.

We find no evidence that consumers are prevented from opening a bank account; many cite personal preferences and cost as reasons for choosing to be unbanked. These preferences are likely related to income constraints.