2015 Series • No. 15–15

Research Department Working Papers

The Final Countdown: The Effect of Monetary Policy during "Wait-for-It" and Reversal Periods

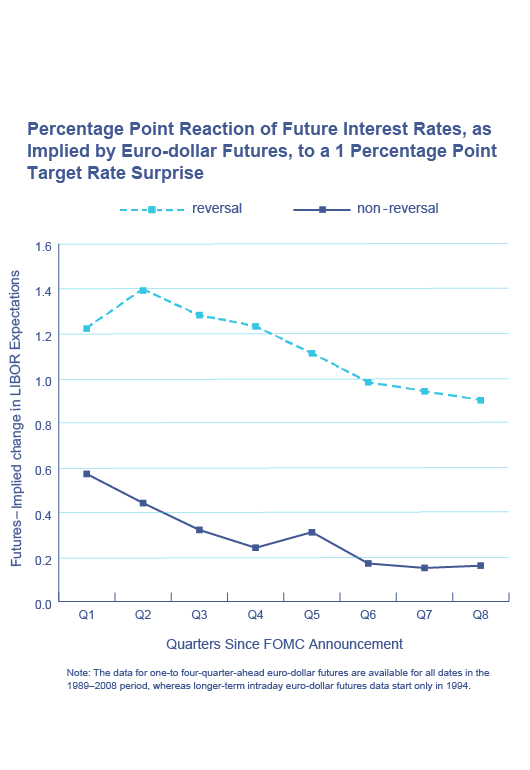

After a long period of loose monetary policy triggered by the Great Recession, some central banks are signaling that they will raise their policy rates soon. Previous research, for example, Bernanke and Kuttner (2005) and Ozdagli (2014), has shown that asset prices react more strongly to monetary policy target surprises on the dates of such a policy reversal announcement. However, we know very little about the channels that generate these effects and whether the cross-sectional differences among firms and sectors play a significant role in transmitting a reversal decision to the economy, a question of primary interest for investors and policymakers.

Key Findings

Key Findings

- This paper provides evidence that a firm's financial health or industry does not seem to play an economically significant role in the differential reaction of stock prices to monetary policy on reversal dates.

- Since the 1990s, each reversal in the direction of monetary policy has been preceded by an extended period of constant interest rates, the wait-for-it (WFI) period. The paper finds that stock prices respond more strongly to surprises in the future path of monetary policy, although not to surprises in the target rate, on FOMC announcement dates during these WFI periods than on non-WFI, non-reversal FOMC announcement days.

- The additional effect of path surprises during the current zero-lower-bound (ZLB) environment closely resembles the effect of the path surprises during the WFI periods in the pre-ZLB environment.

Exhibits

Exhibits

Implications

Implications

The finding that a firm's financial health or industry does not seem to play an economically significant role in the differential reaction of stock prices to monetary policy on reversal dates suggests that a liftoff decision need not raise greater concern regarding credit allocation or weakness in the financial sector than a rate change decision that is not a reversal.

The pattern revealed by the findings of this paper regarding path surprises differs from findings in previous studies that do not find any significant effect on stock prices of path surprises when all FOMC dates are pooled. Combined with the stronger reaction of asset prices to monetary policy on policy reversal dates, this finding lends support to the prediction of previous papers regarding "gradualist" policy: a central bank that adjusts the policy rate slowly can actually lead to a very large reaction to monetary policy, as the market pays closer attention than otherwise to the central bank's medium- or longer-run interest rate target.

The Federal Reserve's policy reversal will likely be followed by other central banks as the world economy recovers, and these results also may provide guidance for them in terms of the timing of their liftoff.