Does Fed Policy Reveal a Ternary Mandate?

Although the creation of the Federal Reserve in 1913 was, in part, a response to repeated episodes of financial instability, the Fed is usually described as having a dual mandate, targeting low inflation and full employment. Even so, many would argue that during the recent financial crisis, and perhaps at other times in the more distant past, monetary policy may have reacted to concerns about financial instability. Thus, an important question is whether the Fed should pursue, or in fact is implicitly pursuing, a third mandate related to financial stability. The issue of what the Fed should, and does, target takes on added importance given the current discussions about imposing limits on how monetary policy is implemented. The authors use a new, direct measure of FOMC financial instability concerns constructed from FOMC meeting transcripts to examine whether monetary policy has reacted in a manner consistent with having financial stability as a third mandate.

Key Findings

Key Findings

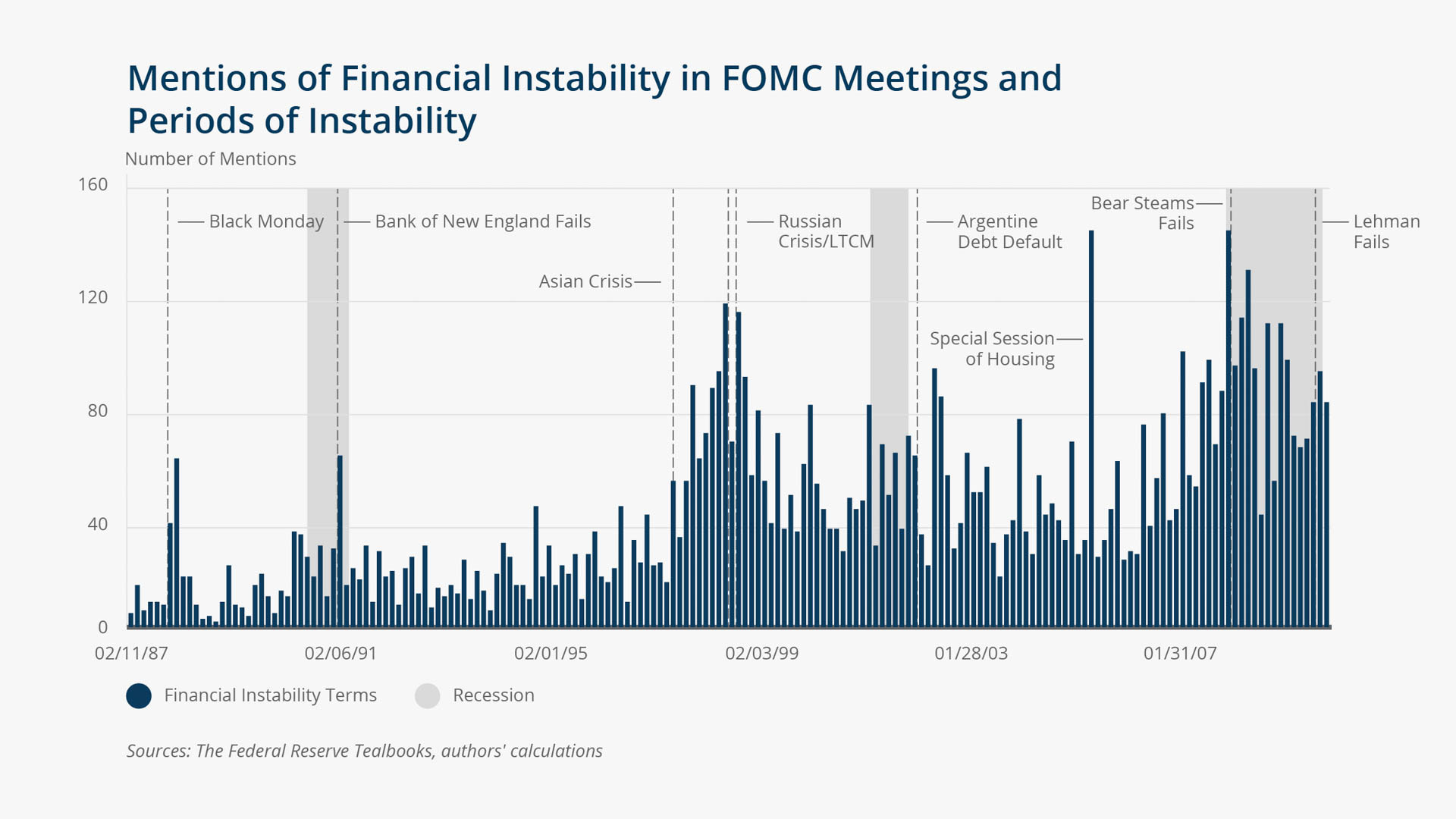

- The authors document that terms related to financial instability are mentioned frequently in the transcripts of FOMC monetary policy meetings and find that, even after controlling for forecasts of inflation and unemployment, the word counts of terms related to financial instability correlate with monetary policy decisions. Thus, the FOMC not only “talks the talk” about financial stability, but it “walks the walk.”

- The mentions of terms related to financial instability tend to occur most frequently during periods of financial turbulence.

- In a simple model that allows the inclusion of financial instability in the utility function for monetary policy, financial instability concerns become relevant for the setting of monetary policy.

- Frequent mentions of financial instability terms at the FOMC, particularly during economic bust subperiods, result in a statistically significant reduction in the funds rate relative to that implied by a simple reaction function based on Federal Reserve staff forecasts of inflation and unemployment rates, indicating that simple reaction functions estimated during periods of financial instability may significantly miss actual FOMC behavior. Moreover, the authors obtain qualitatively similar results when they adjust the Tealbook forecasts to more fully incorporate their financial instability measure, consistent with the significant financial instability effect representing an independent effect on monetary policy.

Exhibits

Exhibits

Implications

Implications

While the results strongly suggest that the FOMC often behaves as if monetary policy has a third mandate, the paper’s evidence is not definitive, as there might be alternative explanations for why the FOMC is responding to financial instability concerns.

There are reasons to believe that financial stability may be an explicit consideration of monetary policy makers. In addition, this paper highlights why a simple policy rule is unlikely to capture actual FOMC behavior. Estimated coefficients on inflation and unemployment forecasts seem to change during periods of financial instability, in addition to the FOMC responding independently to the financial instability concerns. Following a simple policy rule that does not reflect this behavior would fail to capture the way the monetary policy loss function has been addressed by the FOMC.