The Influence of Gender and Income on the Household Division of Financial Responsibility

Most previous research on household dynamics has focused on how married couples divide responsibilities for "housework," a broad category that generally includes routine cleaning chores, child care, and house repairs. These studies often rely on diary-based records of the amount of time a member spends on these various activities. There has been less research on how married couples divide the responsibility for making important household decisions, in part because there is a lack of data, and what data that does exist relies on self-assessments of household dynamics, which may not be accurate measures of true dynamics. This study takes advantage of data from the 2012 Survey of Consumer Payment Choice that asked both adult members from mixed-gender households how they divided responsibility for four tasks related to financial activity. These four tasks—household shopping, monthly bill paying, important saving and investment decisions, and other financial decisions (for example, where to bank—fall along various points between a routinized activity to one involving more complex decisionmaking. The paper investigates how gender and income dynamics influence the division of responsibility between the male and the female partner in carrying out these four tasks. Households are divided into one of three categories: one in which the male is the primary (the largest) wage earner, one in which the incomes of both adults are roughly equal, and one in which the female is the primary wage earner. In the majority of the two-adult households surveyed, the male is the primary wage earner.

Key Findings

Key Findings

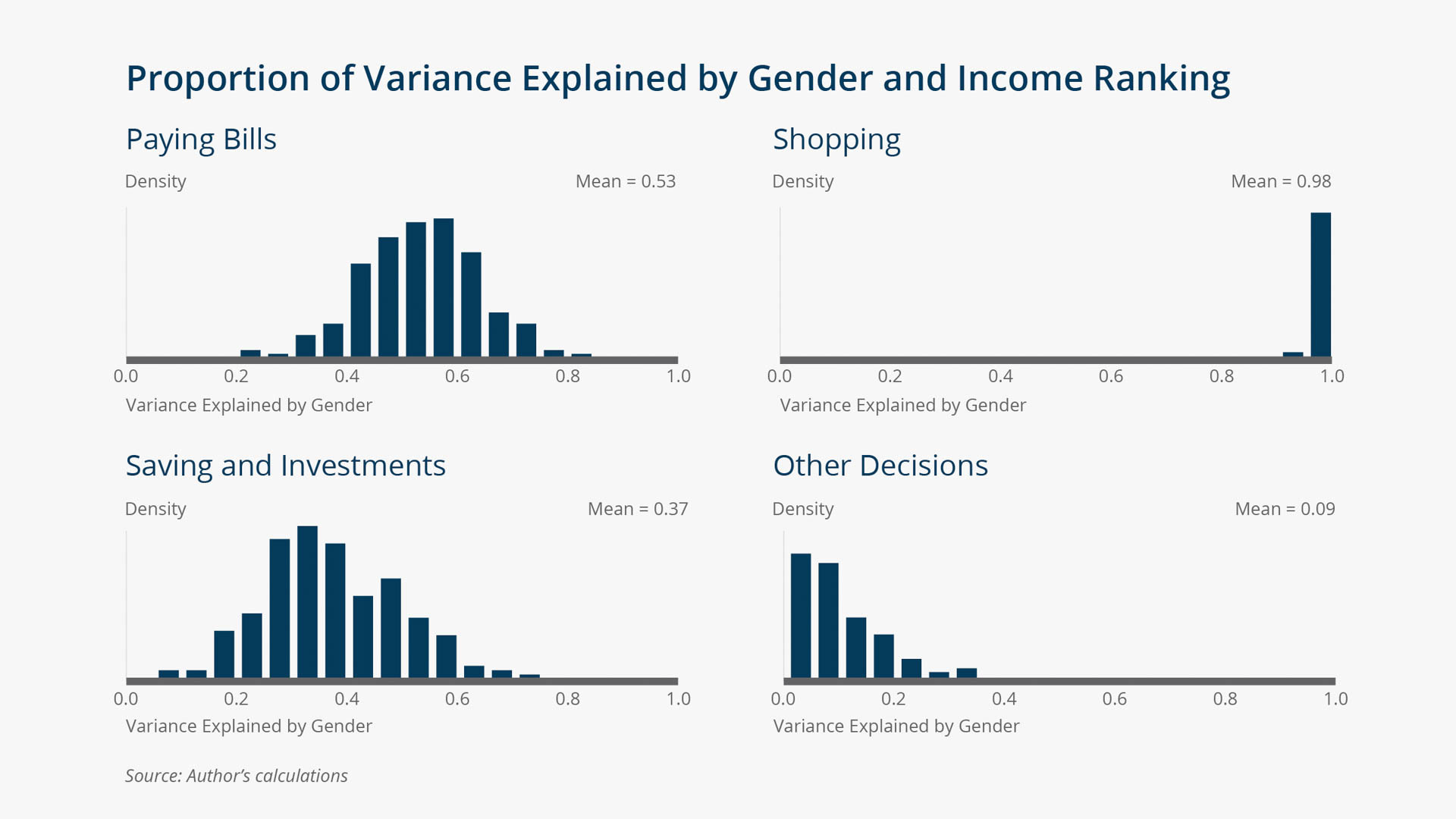

- As an adult's relative income ranking increases, there is a greater likelihood that they will have more responsibility for paying monthly bills, making saving and investment decisions, and making decisions about other financial matters.

- Gender almost fully determines the likely division of responsibility for household shopping, a task traditionally associated with women. In close to 50 percent of households, women have the major responsibility for household shopping (and bill paying), even when women are the primary wage earners.

- Over 50 percent of households reported an equal share of responsibility for financial decisions, regardless of the member's gender and relative income ranking.

Exhibits

Exhibits

Implications

Implications

Relative income ranking is more important than gender in defining the responsibility for household roles related to financial matters, though traditional gender roles still seem to operate for women when it comes to being responsible for household shopping. The methodological approach used in the paper can be used to gain insight into a wide range of abstract concepts that cannot be gauged using objective measures.

Abstract

Abstract

This paper studies how gender and income dynamics influence the division of responsibility in two-adult households for various activities, including those tasks directly related to financial decisionmaking. The data, from the 2012 Survey of Consumer Payment Choice, consist of the respondents' categorical self-assessments of their individual levels of responsibility for various tasks. A data construct, in which some households have both adults participate in the survey, is exploited to develop a penalized latent variable model that accounts for systemic response errors. The data reveal that that women, even when they are the primary earner, are much more likely than men to have the major responsibility for household shopping and bill paying. With regard to financial decisionmaking, however, there is a greater propensity to share responsibility equally, and income ranking is more important than gender in defining household roles, with higher earners more likely to have a larger share of responsibility.