Integrated Household Surveys: An Assessment of U.S. Methods and an Innovation

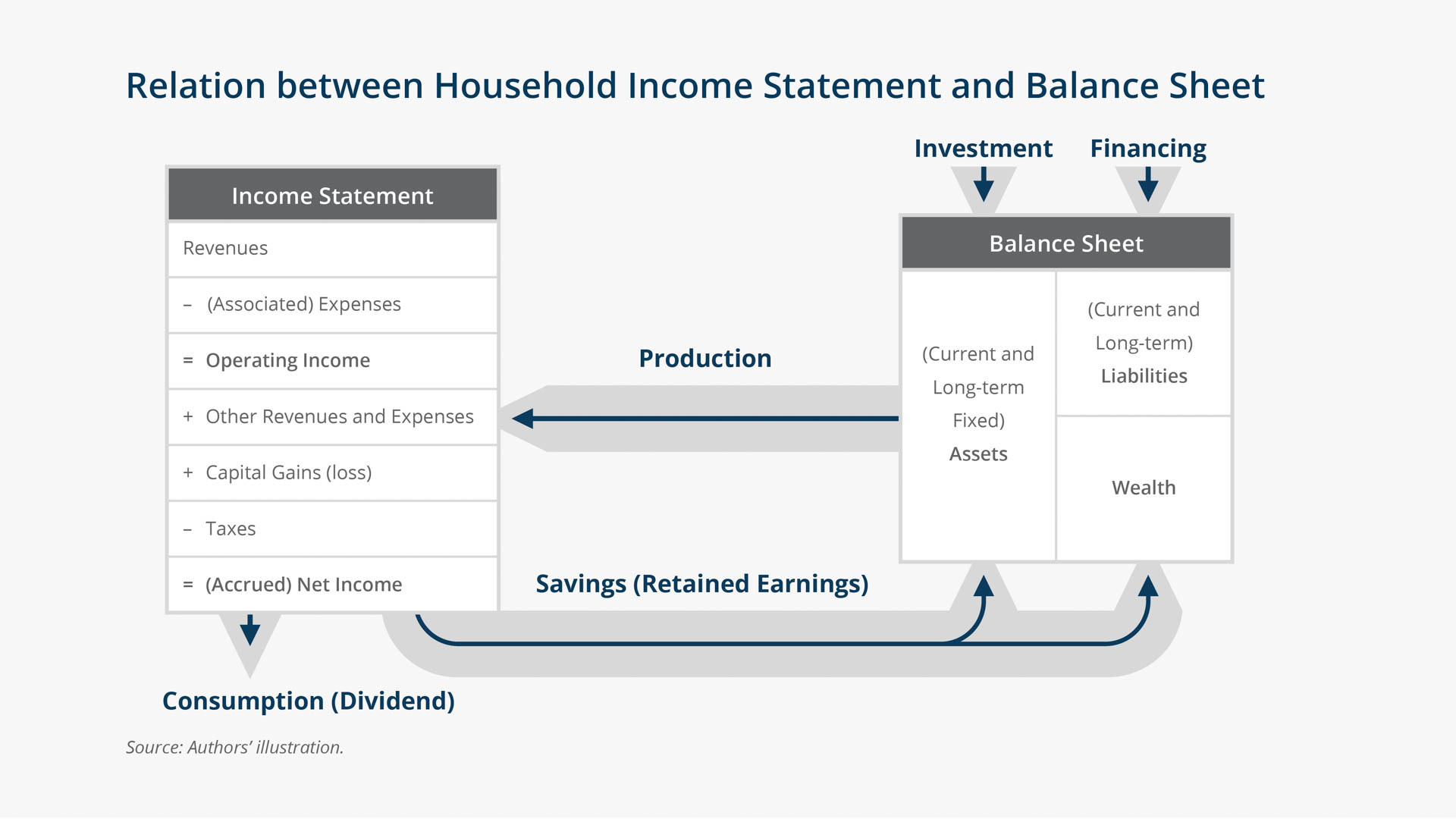

With the desirability of having better data on U.S. household decisionmaking thrown into relief by the global Financial Crisis of 2008–09, the authors of this paper draw upon the experience of nearly two decades of work in Thailand (developed and documented in Samphantharak and Townsend 2010, henceforth S&T) that reveals the advantages of integrating household surveys and household financial statements. Using methodology developed by ST, the authors assess the extent to which U.S. household surveys are integrated with elements of household financial statements and demonstrate how a diary of consumer payment choices can be used to construct a new statement of liquidity flows that advances the current state of the art in measuring stock-flow dynamics.

An overarching goal of this paper is to present a comprehensive vision for practical implementation of household surveys that are integrated with financial statements and payments data, leaving no gaps in measurement, and strengthening the theoretical and applied linkages among measures. The new statement of U.S. household liquidity flows takes a step closer toward realizing the overarching vision of the paper.

Key Findings

Key Findings

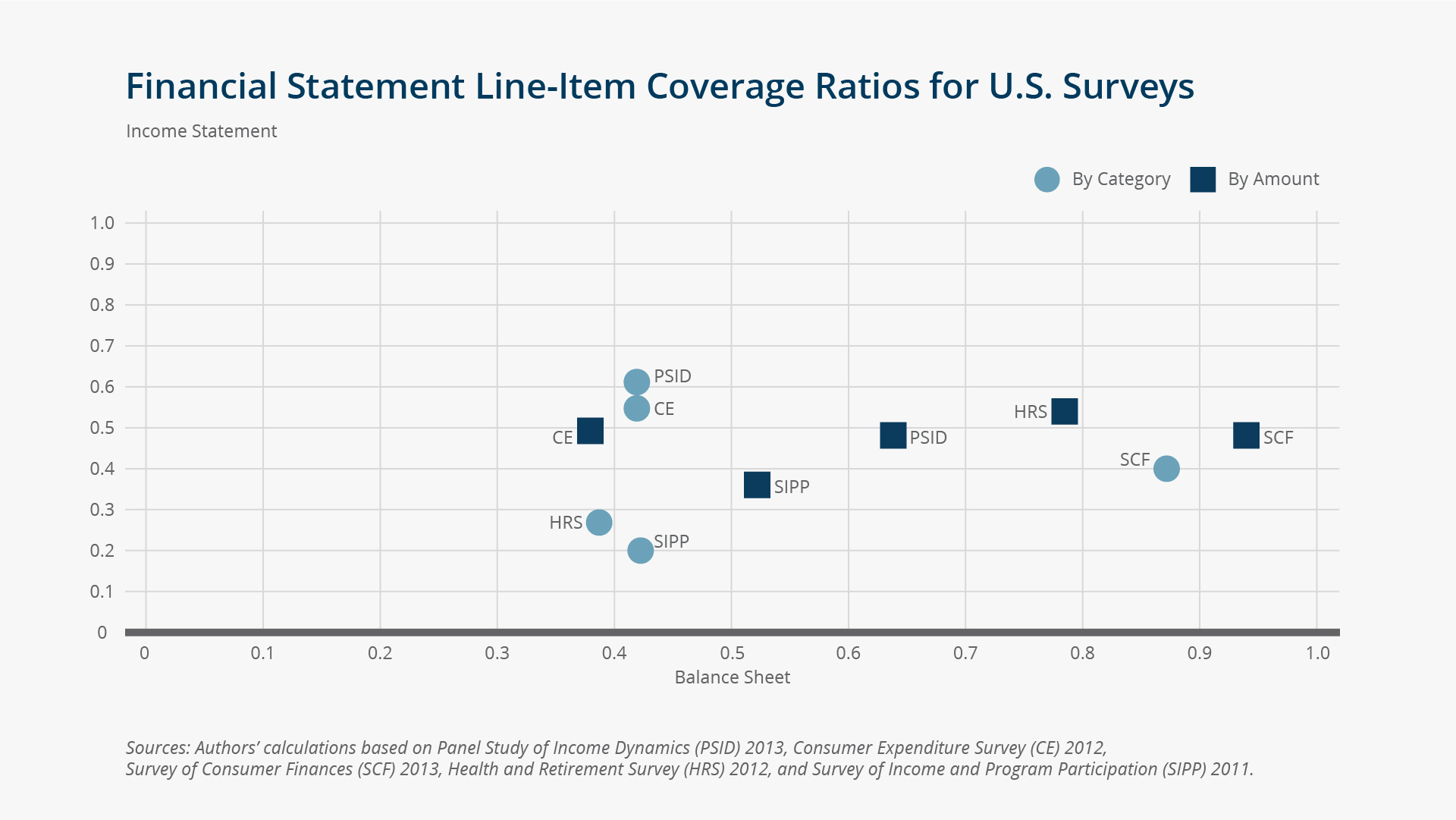

- The authors' construction of U.S. household financial statements with data from U.S. surveys is, to the best of their knowledge, the first attempt to assess the consistency of the main surveys of U.S. household economic behavior with financial data from the Flow of Funds in a comprehensive and comparative (across surveys) fashion. The results show that none of the surveys is fully integrated with the financial statements because these surveys do not have comprehensive coverage of items or measure all items accurately and thus do not track the dynamic evolution of balance-sheet stocks and income-statement flows accurately over time. The authors' comparison reveals the extent to which each survey, which has its own particular objectives and uses, is consistent with the S&T framework.

- The authors construct the first account-to-account cash-flows statement using payment instruments (shown in Table 9), with data from the Diary of Consumer Payment Choice (DCPC). Their DCPC estimates of the dynamic stock-flow identity for cash (currency only) are the first effort to measure directly all of the variables in the identity, both the asset stocks (current and lagged) and the cash flows (deposits and withdrawals), using the same data source and doing so on a daily basis (rather than using recall-based estimates over much longer periods). Although the DCPC omits some minor currency flows, resulting in some remaining errors, the methodology used in this paper is an innovation in measurement and a significant improvement over using the data available in surveys that are not dynamically integrated at the level of individual flows.

Exhibits

Exhibits

Implications

Implications

The central innovation of this paper is the construction of a new, more detailed analysis of cash flows at the level of liquid asset accounts, where currency, checking accounts, and other liquid assets are distinguished and treated separately. Linking all the liquidity accounts to one another and to the expenditures (or investments) they fund makes it possible to better assess the changing landscape of payments taking place in the United States and industrialized countries as well as in emerging-market and low-income countries. This then links back to the need for data to better inform public policy and to provide consumers with the information they need to improve household decisionmaking and economic behavior. This paper provides a framework and guidance for policymakers to implement this longer-run vision. By tracking consumer expenditures that are authorized by payment instruments tied to specific types of liquid asset accounts, the DCPC matches expenditures to the sources of money and credit that fund them. This matching cannot be done feasibly by surveys that track consumer expenditures at the level of individual products (The Consumer Expenditure Survey) or at the level of aggregated expenditure categories ("food away from home").

Abstract

Abstract

We present a vision for improving household financial surveys by integrating responses from questionnaires more completely with financial statements and combining them with payments data from diaries. Integrated household financial accounts—balance sheet, income statement, and statement of cash flows—are used to assess the degree of integration in leading U.S. household surveys, focusing on inconsistencies in measures of the change in cash. Diaries of consumer payment choice can improve dynamic integration. Using payments data, we construct a statement of liquidity flows: a detailed analysis of currency, checking accounts, prepaid cards, credit cards, and other payment instruments, consistent with conventional cash-flows measures and the other financial accounts.