Transparency in State Debt Disclosure

Government transparency has become an increasingly popular and important issue in the United States and in many other countries in recent decades. It helps improve citizens' understanding of public policies, promote public trust in government, reduce corruption, and hold officials accountable for their performance. Transparency hinges critically on the accessibility and disclosure of information, which is widely regarded as a public good contributing to the functioning of markets.

Fiscal transparency is one important aspect of government transparency. One particularly concerning issue, which has been largely hidden from the public view until recently, is the ever-growing debt of public authorities. The public and the media tend to focus on the debt issuance of the primary government units and may give less scrutiny to the numerous public authorities. Ordinary citizens also often find it difficult to track changes in the public authorities' debt from one year to the next.

Despite strong public interest, to the authors' best knowledge, there has been little research on transparency in state and local debt disclosure. This is likely partly due to a lack of data and lack of a measure of debt transparency. To fill this need, the authors develop a new measure of relative debt transparency by comparing two datasets of state debt, one of which has recently become available.

Key Findings

Key Findings

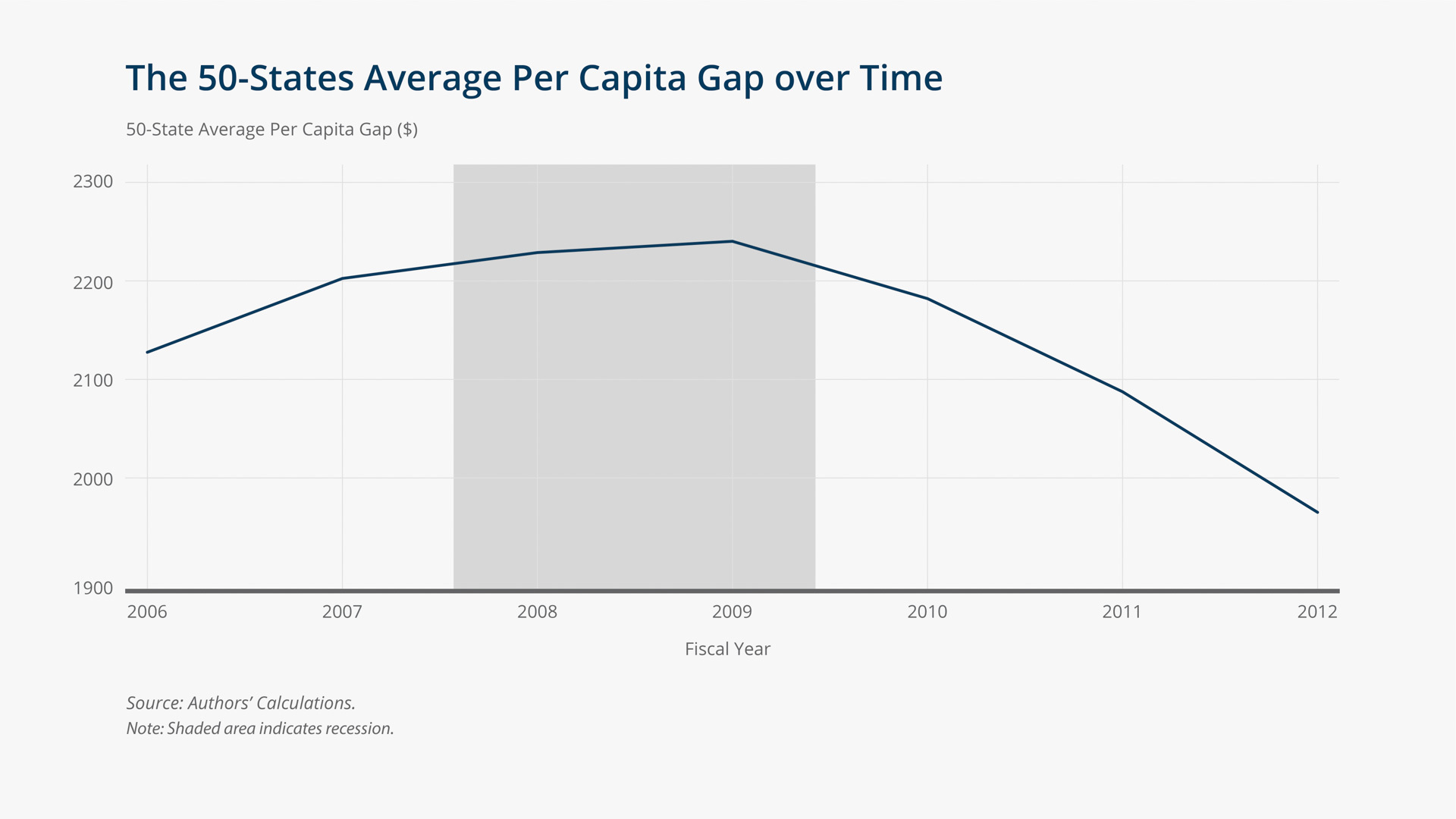

- Because there is a much longer delay in the release of the U.S. Census Bureau's Annual Survey of State Government Finances than in the release of states' Comprehensive Annual Financial Reports' (CAFR) statistical section, in many cases ordinary citizens can only rely on state CAFRs to gauge state financial performance in the most recent fiscal year. Using these two data sources, this paper introduces a measure of relative transparency in state debt disclosure. It is defined as the gap in reported state debt between the annual Census survey and the state CAFR statistical section after the implementation of Governmental Accounting Standards Board Statement No. 44, Economic Condition Reporting: The Statistical Section (GASB 44) in FY 2006. The authors show that the gap measure results mostly from governments' using accounting choices to exclude some dependent agencies' debt from the CAFR statistical section.

- The regression results show that the gap in reported state debt tends to increase with an unexpected deficit. The effect of an unexpected deficit lasts more than one year while declining over time. A state is also likely to experience a larger gap in reported state debt when its government is under one political party's control than when it has a divided government.

Exhibits

Exhibits

Implications

Implications

These results suggest that fiscal stress and political competition create opposite effects on state debt transparency.

Ordinary citizens can use the new gap measure to assess the information they glean from their state's CAFR statistical section as a rough indicator of the condition of their state government finances, discounting or inflating their overall impression based on the new gap measure.

Abstract

Abstract

We develop a new measure of relative debt transparency by comparing the amount of state debt reported in the annual Census survey and the amount reported in the statistical section of the state Comprehensive Annual Financial Report (CAFR). GASB 44 requires states to start reporting their total debt in the CAFR statistical section in FY 2006. However, states are allowed to use accounting choices to exclude some dependent agencies' debt, which contributes to a gap between the two data sources. The regression results suggest that the gap tends to increase when states face greater fiscal stress or less political competition. Such patterns are not found in the pre-GASB 44 period.