News-Driven Uncertainty Fluctuations

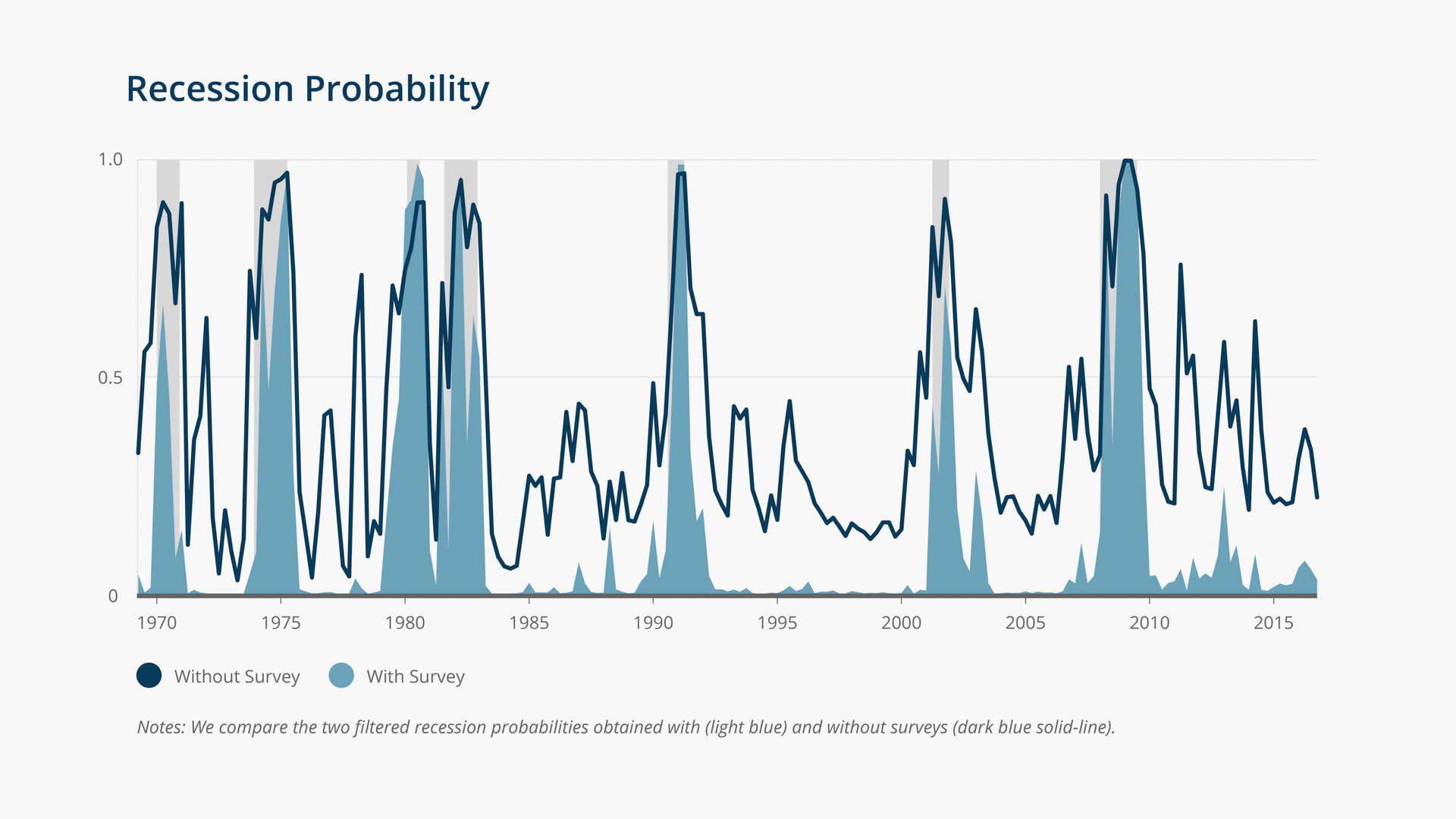

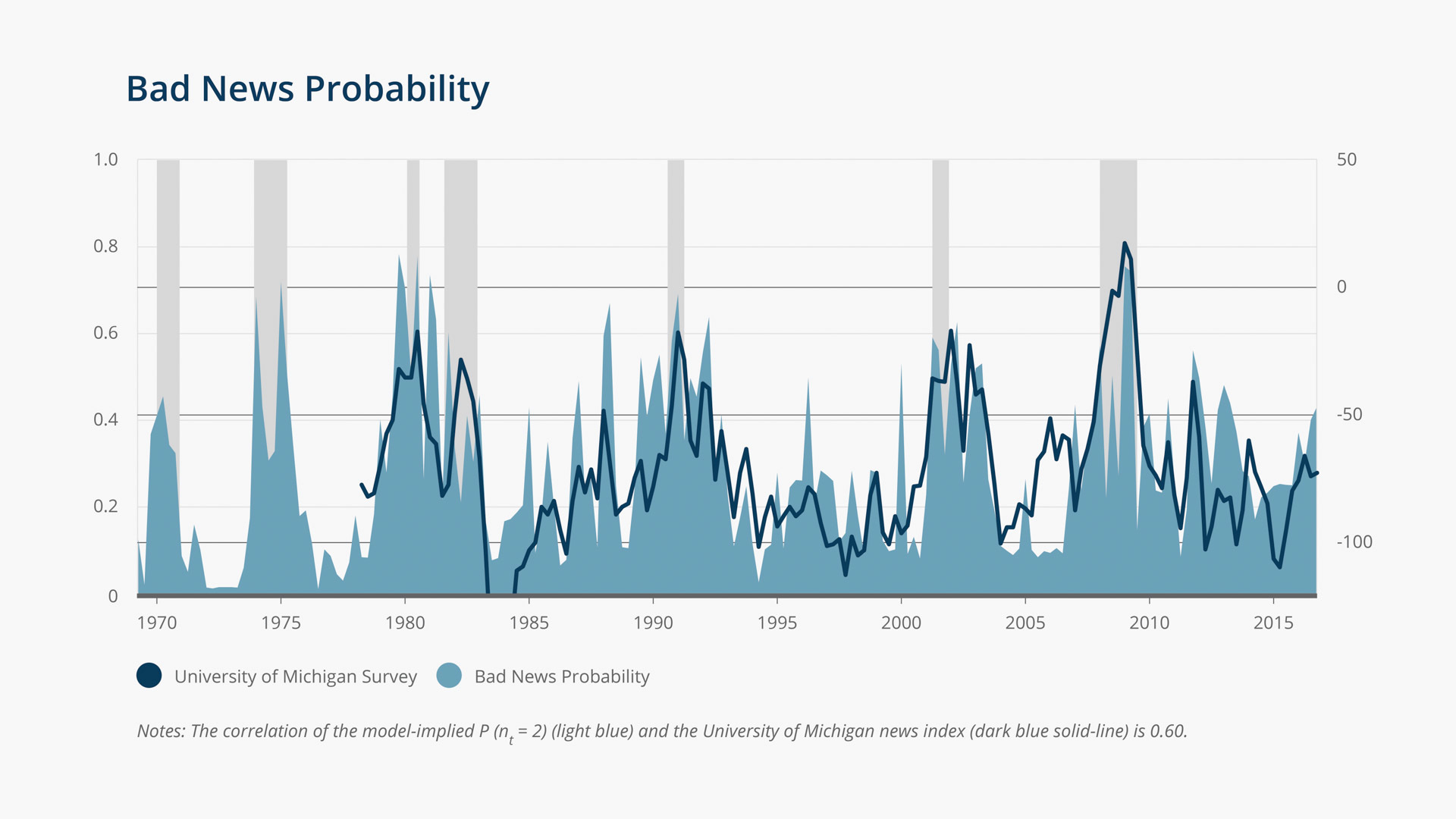

By incorporating news shocks into a two-state Markov-switching growth model, this paper seeks to understand the channels through which news influences agents’ subjective beliefs. More specifically, it looks at how information about the future state increases or reduces levels of uncertainty and how, in turn, fluctuations in news-driven uncertainty affect asset prices. This model is estimated using a novel filtering technique that allows the use of data on both actual output growth and recession probability forecasts from the Survey of Professional Forecasters. The procedure delivers estimates of historical probabilities of the economy being in a recession and agents receiving bad news about the future.

Key Findings

Key Findings

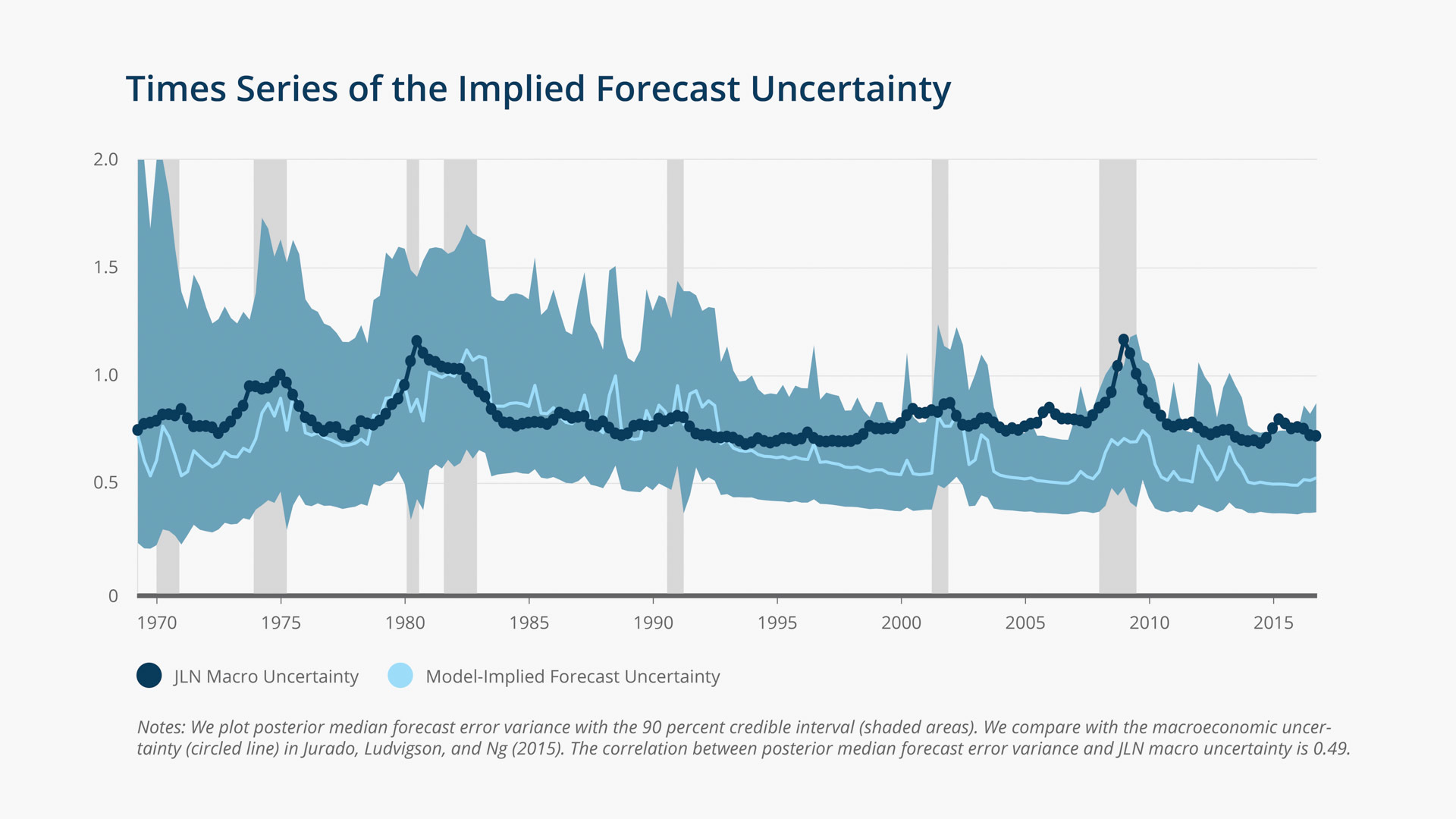

- When news contradicts prior beliefs, uncertainty can increase, because the agent’s posterior beliefs are corrected to a more uniform distribution. Uncertainty can rise in accordance with the agent’s belief in the accuracy of the news.

- Learning the accuracy of news or the persistence of states alters the agent’s response to news, thus giving rise to history-dependent behavior in uncertainty fluctuations.

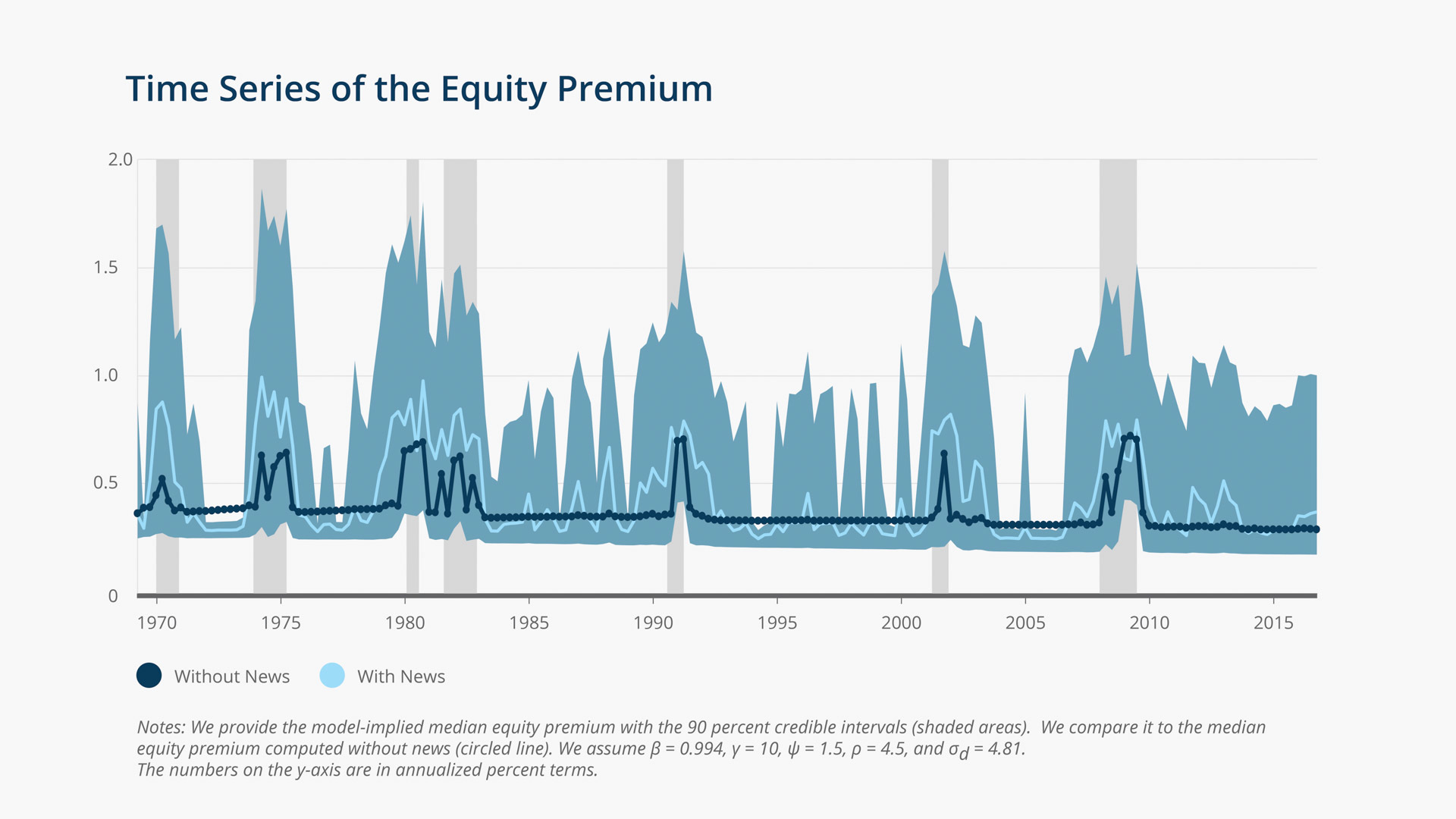

- News shocks can produce modest increases in risk-free rates and equity risk premia while having a substantially larger impact on their volatility. These increases in volatility can be particularly pronounced during economic expansions.

- The arrival of bad news prior to a recession often results in the rise of equity premia several quarters before the recession’s onset.

- When a long period of economic boom creates optimism about the probability of remaining in that good state, the arrival of bad news about the future can trigger a “Minsky moment”—a sudden collapse in asset values.

- The collapse is greater the longer the expansion has lasted, the stronger the prior beliefs about state persistence or news accuracy, and when the agent has a preference for an early resolution of uncertainty.

Exhibits

Exhibits

Implications

Implications

While many studies are aimed at identifying economically important news and their effects through agents’ mean beliefs about future outcomes, relatively few attempt to understand other channels through which news influences agents’ subjective beliefs. The literature has not focused on such questions as whether more information about the future state can increase subjective uncertainty, or if the effect of news can differ depending on the current state of the economy. This paper seeks to answer these and other related questions by incorporating news shocks into a two-state Markov-switching growth model. It then examines the extent to which fluctuations in news-driven uncertainty can generate variation in asset prices.

Abstract

Abstract

We embed a news shock, a noisy indicator of the future state, in a two-state Markov-switching growth model. Our framework, combined with parameter learning, features rich history-dependent uncertainty dynamics. We show that bad news that arrives during a prolonged economic boom can trigger a “Minsky moment”—a sudden collapse in asset values. The effect is greatly amplified when agents have a preference for early resolution of uncertainty. We leverage survey recession probability forecasts to solve a sequential learning problem and estimate the full posterior distribution of model primitives. We identify historical periods in which uncertainty and risk premia were elevated because of news shocks.