Accounting for Racial Wealth Disparities in the United States

While there have always been substantial differences in the wealth accumulated by the white, black, and Hispanic families living in the United States, these differences had remained relatively constant over most of the last three decades before rising sharply during the Great Recession. The greater losses in net worth that nonwhite families experienced between 2007 and 2010 has inspired renewed interest in understanding the factors that drive these enduring racial wealth disparities. This paper uses data from the Federal Reserve Board’s Survey of Consumer Finances (SCF) to update and extend the existing literature, and explores the key factors contributing to the wealth gap that persists among white, black, and Hispanic families.

The study focuses on the period from 2001 through 2016, and captures the decade containing the beginning of and the full recovery from the Great Recession. The analysis focuses on three key outcome variables—net worth, total assets, and total debt—and seeks to identify what factors may influence racial differences in wealth accumulation.

Key Findings

Key Findings

- Compared to their nonwhite counterparts, white families are older, more highly educated, more likely to be married or partnered, and more likely to receive an inheritance. White families have longer full-time work histories, higher incomes, and attitudes toward saving and planning that are consistent with successful wealth accumulation.

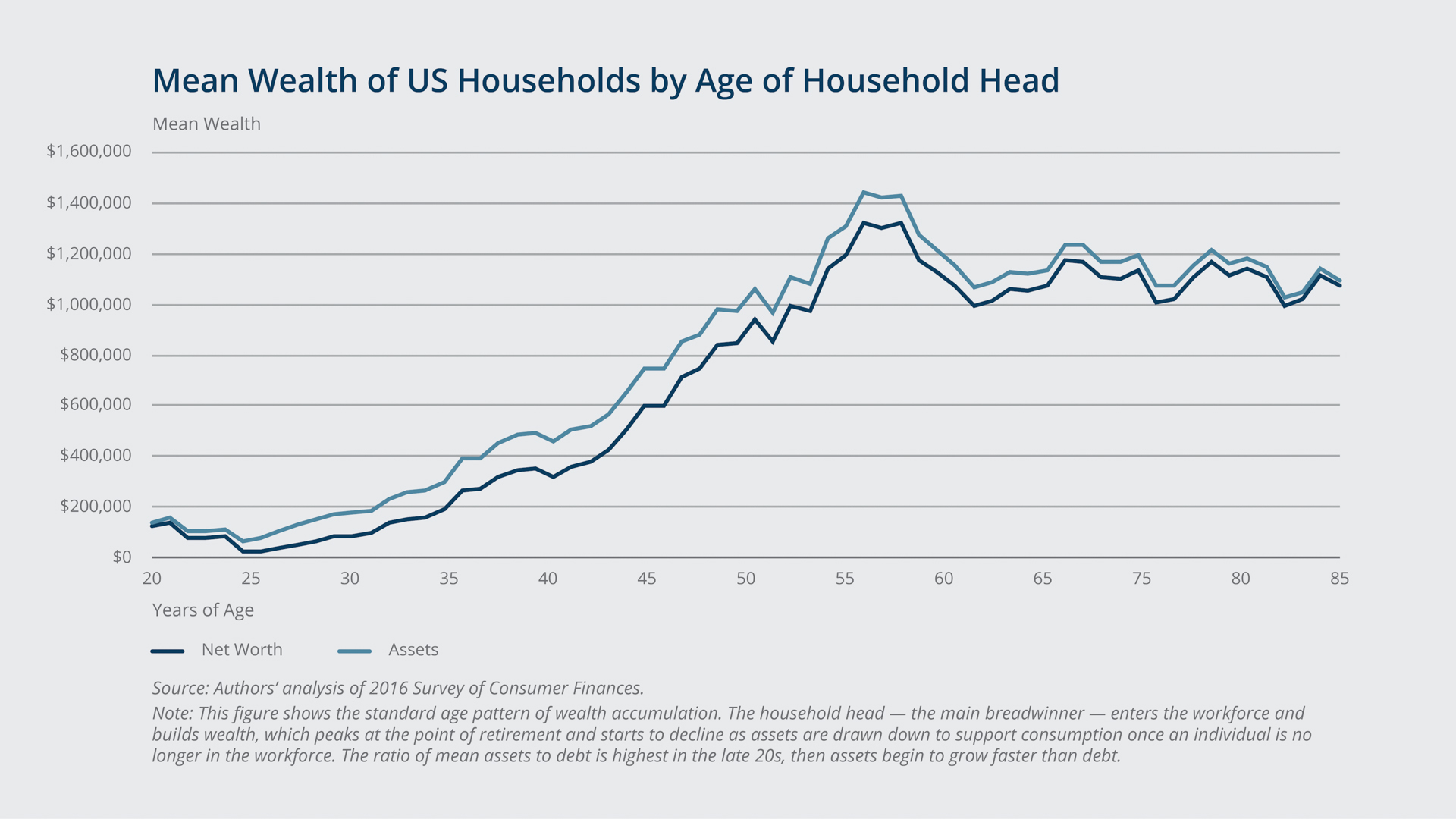

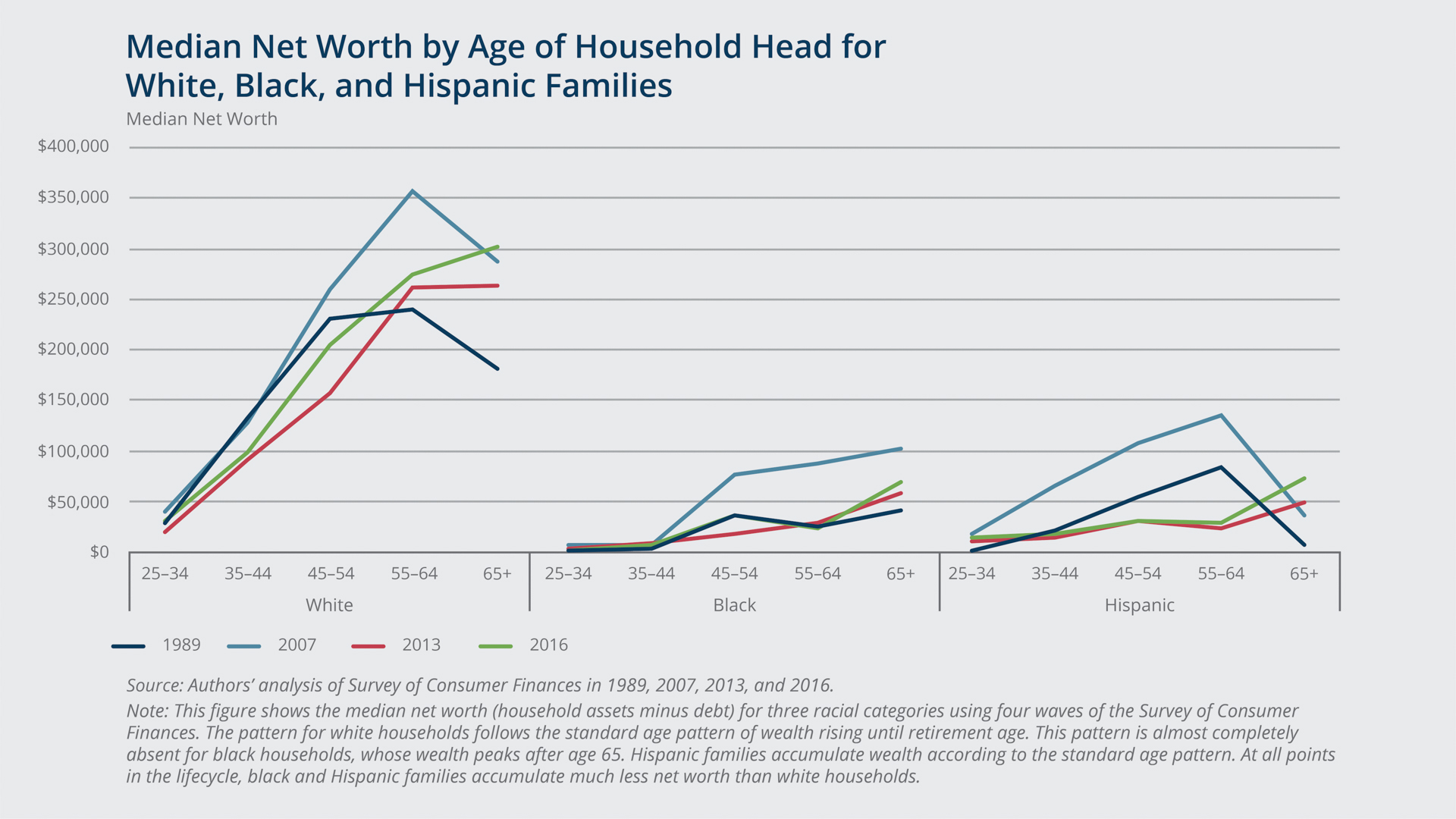

- While the median net worth of white and Hispanic families is the highest at the point of retirement, and thus adheres to the life cycle theory of wealth accumulation, the median wealth of black families only peaks after retirement (age 65 and over). Yet throughout the life cycle, black and Hispanic families have substantially lower net worth than white families. In 2016, the mean assets held by white families were $1 million, while Hispanic families held mean assets of $247,000 and black families had mean assets worth $196,000. All of the wealth gap between white and black families is due to differences in the amount of assets, while the gap between black and Hispanic families is more balanced between differences in assets and debt.

- Differences in human capital—reflected in direct measures of educational attainment, as well as variables for income, occupation, years of full-time employment, and attitudes toward saving and investing—appear to be the most important factors accounting for the racial wealth gap. Human capital differences explain approximately 40 percent of the observed differences in the white/nonwhite wealth gap, while demographic variables and measures gauging family financial support account for one quarter and one-fifth, respectively, of the racial wealth gap.

- Demographic factors—marital status, whether a family has two incomes, and family size—all influence wealth accumulation. The age of the family head is the most important demographic factor influencing the white/Hispanic wealth gap, while nuclear family traits (marital status and the number of children) are the most important demographic factors accounting for the white/black wealth gap.

- The most important elements of family financial support—in terms of accounting for wealth disparities between white and non-white families—are households indicating that they would be able to count on receiving $3,000 in assistance from family or friends in case of an emergency, and the expectation that they will receive an inheritance at some point in the future.

Exhibits

Exhibits

Implications

Implications

Using more recent data than previous studies, nearly all of the white/Hispanic wealth gap at the mean and the median of the US wealth distribution can be explained by differences in observable traits, with basic demographic traits and human capital characteristics accounting for most of the gap. Differences in observable characteristics involving human capital, demographic traits, and receiving family financial support, including inheritances, also account for about 89 percent of the white/black wealth gap. Observable factors account for almost all of the differences at the bottom of the wealth distribution, but are less able to explain differences at the top of the wealth distribution: observable factors account for just 61 percent of the white/black gap and 80 percent of the white/Hispanic gap. While the decomposition analysis accounts for the contributions of the factors that are the proximate drivers, if not necessarily the underlying causal factors, gaining a better understanding their relative contributions helps us to better understand racial wealth differences.

Abstract

Abstract

Using data from the Survey of Consumer Finances, this paper updates and extends previous research on the racial wealth gap in the United States. We explore several hypotheses that help explain differential wealth accumulation by racial groups, including the importance of receiving inheritances and other financial support from relatives and the conditions in local real estate markets. By exploring the disparities among white, black, and Hispanic families, we make new contributions to the literature. We find that observable factors account for the entire wealth gap between white and Hispanic families and most of the gap between white and black families. Differences in human capital, demographics, and family financial support each make substantial contributions to the wealth gaps we observe between white and nonwhite families. Yet a substantial portion of the wealth gap between white and black families remains unaccounted for after a detailed decomposition. This unexplained portion is greater at the top of the wealth distribution.