2015 Small Business Credit Survey

Federal Reserve policymakers have been interested in understanding the impact of the recession and resulting recovery on small businesses. With limited data available on small business credit conditions, the Federal Reserve Bank of Boston conducted a survey to reach a broad base of business owners and gather information on credit experiences.

The questionnaire was developed in partnership with participating Reserve Banks throughout the Federal Reserve System. The goal of the multiyear survey is to maintain a core set of questions, while being able to add questions focused on emerging issues. The survey uses a convenience sample and runs for approximately 6 to 8 weeks.

The core questions cover the following topics: performance indicators, financing and debt, reasons for seeking financing and sources of advice, applications, credit application outcomes, financing experience of micro firms, financing experience of growth firms, and online sources of financing.

Key Findings

Key Findings

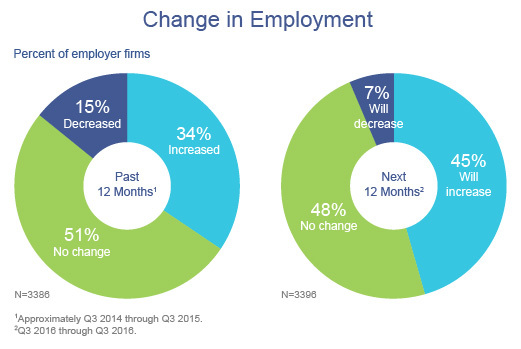

- Businesses report improved performance in 2015.

- Net number of firms reporting profitability, revenue growth, and employment growth all increased year-over-year.

- Roughly one-third of respondents are growing firms, measured as firms that had revenue growth and added employees in the prior 12 months (and do not plan to reduce their workforce in the coming 12 months).

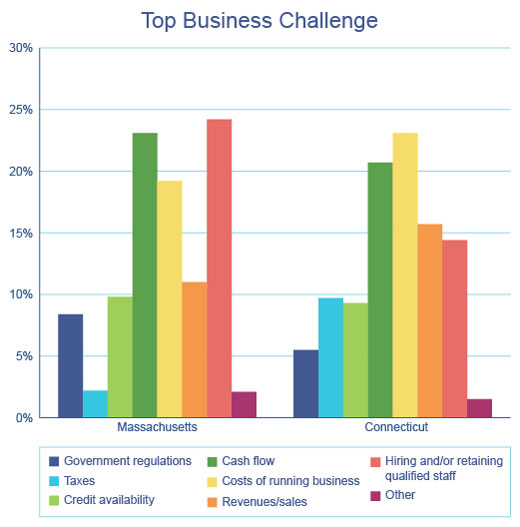

- Firms across the board report challenges with cash flow.

- 22% say managing cash flow is their top business challenge, above business costs and far above government regulations and taxes.

- Talent is an issue for growing firms. 24% say that finding/retaining qualified staff is their top challenge.

- Majority of respondents (62%) hold debt. Most debt is small and secured with personal assets.

- More than half hold $100k or less in debt.

- 63% of firms pledged personal assets or guarantee to secure debt.

- Use of personal asset collateral is very common, even among large and mature firms. 58% of firms with more than $10 million in revenues and 63% of firms that started more than 11 years ago used personal assets or guarantees to secure their financing.

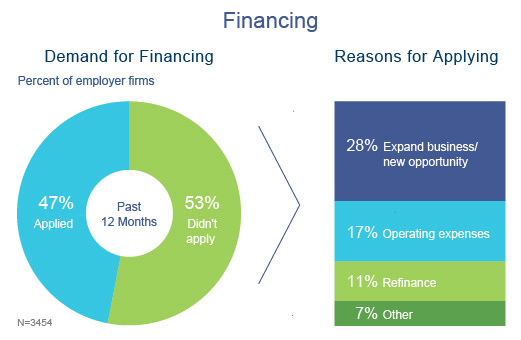

- 47% of firms applied for credit in the prior 12 months (Q3 2014-Q3 2015).

- The top two reasons for borrowing are to expand the business or to meet operating expenses (i.e. cash flow).

- Demand is highest among young (less than 6 years old), growing, and larger-revenue firms.

- Among those not borrowing, only half indicated they have sufficient financing.

- Debt aversion is fairly common—13% of firms said they didn't want to take on debt, including 9% of growing firms.

- 9% of all firms reported being discouraged (did not apply because they believed they would be turned down).

- 50% of applicant firms received all of the credit they sought.

- A higher share of applicants reported revenue and employment growth from last year, two indicators of improved applicant quality.

- In the 2015 survey, half of applicants reported receiving all of the financing they applied for and 18% of applicants received no financing.

- Banks are the dominant advisory and credit channel, but noteworthy use of loan brokers and online lending by smallest and weakest applicants was also reported.

- The majority of small business credit seekers turned to their banker for advice. However, microbusiness applicants also relied heavily on SBDCs, their friends and family, and loan brokers. 22% sought advice from a loan broker compared to just 7% of firms with more than $10 million in annual revenues.

- The majority of applicant firms sought traditional loans of credit from banks, but 30% of microbusinesses (annual revenues of less than $100K) and 22% of small firms ($100K-$1M) applied to an online lender.

- Firms denied for traditional bank financing primarily applied for credit cards and online lenders. Only 38% were able to find financing elsewhere, and most received only some of the financing requested.

- 50% of applicants had a financing shortfall, receiving less than the full amount requested.

- Growing firms reported insufficient collateral as the main reason they received less than the amount requested.

- 1/3 of growing firms reported that they had to delay expansion as a result of not receiving all of the credit requested. 21% said they used personal funds to meet expenses.

- Startups used personal funds to cover their financing shortfall or were unable to meet their expenses.

- Net satisfaction levels were highest for applicants that went to small banks, lowest at online lenders. 30% of firms overall cite transparency issues with online lenders.

- Successful applicants who went to small banks were the most satisfied with their experience. Online lenders and large banks both had much lower satisfaction scores overall.

- The application process was the most cited reason for dissatisfaction with both large and small banks.

- Interest rates and repayment terms led the complaints at online lenders.

- 30% of applicants cited transparency issues with all lenders.

Exhibits

Exhibits