Vol. XXXVII • No. 1

Bank Notes

January 2008

Mergers and Acquisitions

Boston Private Financial Holdings, Inc., of Boston, MA, announced on December 11, 2007, that it acquired 70 percent of Davidson Capital Management of Devon, PA. The acquisition marks Boston Private Financial’s entry into the Philadelphia, PA, market. As of November 1, 2007, Davidson Capital Management managed approximately $1 billion of assets. (SNL Bank and Thrift Weekly, Northeastern Edition, 12/17/07; Boston Private press release, 12/11/07)

Central Credit Union Fund Inc., of Auburn, MA, merged into Members United Corporate Federal Credit Union of Warrenville, IL, on December 1, 2007. (Internal sources, 12/06/07)

Community National Bank, a unit of Community Bancorp of Derby, VT, and the National Bank of Middlebury, a unit of Middlebury National Corp., both of Middlebury, VT, have entered into an agreement under which the National Bank of Middlebury will acquire the Vergennes, VT, branch of LyndonBank of Lyndon, VT. The purchase close immediately after completion of the merger of LyndonBank into Community National, which legally occurred on December 31, 2007. (SNL Bank and Thrift Weekly, Northeastern Edition, 12/17/07; internal sources)

Legacy Bancorp Inc. of Pittsfield, MA, announced on December 12, 2007, that Legacy Banks had completed its acquisition of five branch offices of First Niagara Bank, a unit of First Niagara Financial Group, Inc., of Lockport, NY. The branches are located in Windham, Middleburgh, Oak Hill, Greenville, and Whitehall, NY. In doing so, Legacy Banks purchased approximately $1.4 million in real property and assumed deposit liabilities of approximately $76.6 million. (SNL Bank and Thrift Weekly, Northeastern Edition, 12/17/07)

Union Bankshares Co. of Ellsworth, ME, and Machias Savings Bank of Machias, ME, announced on December 21, 2007, an agreement under which Union Bankshares’ unit Union Trust Co. will sell a Rockland, ME, branch to Machias Savings Bank. The sale was planned as part of a previously announced merger agreement between Union Bankshares and Camden National Corp. of Camden, ME. The merger has received regulatory approval and is expected to close in early January 2008. The purchase of Union Trust’s Rockland branch by Machias Savings Bank is expected to be finalized by the end of February 2008, subject to regulatory approval. (SNL Bank and Thrift Weekly - Northeastern Edition 12/31/2007)

Northeast Bank Insurance Group, Inc. a wholly owned subsidiary of Northeast Bank of Lewiston, ME, acquired The Hyler Agency of Thomaston, ME. The deal, announced on December 12, 2007, marks the sixth agency acquisition by Northeast Bank Insurance Group in the past year. On November 30, 2007, Northeast Bancorp, the holding company for Northeast Bank, announced that it had finalized a deal to purchase Spence & Mathews Insurance of Berwick, ME. (SNL Bank and Thrift Weekly, Northeastern Edition, 12/17/07; SNL Bank and Thrift Weekly, Northeastern Edition, 12/03/07; Northeast Bancorp press release, 12/12/07)

Corporate Title Changes

Lowell Mass Municipal Employees Federal Credit Union of Lowell, MA, changed its corporate title to Lowell Municipal Employees Federal Credit Union on November 19, 2007. (Internal sources, 11/30/07)

Lynn Postal District Employees Credit Union of Lynn, MA, changed its corporate title to Massachusetts Postal Employees Credit Union, effective December 1, 2007. (Internal sources, 12/06/07)

Southern Massachusetts Telephone Workers Credit Union of Fairhaven, MA, changed its corporate title to Southern Mass Credit Union, effective January 1, 2008. (Internal sources, 12/06/07)

Relocations

Savings Bank of Walpole of Walpole, NH, relocated from 11 Westminster Street to Ames Plaza Lane on November 1, 2007. (Internal sources, 11/30/07)

Federal Financial Institutions Examination Council (FFIEC) Issues Guidance for Pandemic Planning

The FFIEC, on December 12, 2007, issued guidance for financial institutions to help them identify continuity planning that should be in place to minimize the potential adverse effects of a pandemic. The Federal Reserve System and other FFIEC agencies believe that the potentially significant effects a pandemic could have on an institution justify establishing plans to address how each institution will manage a pandemic event. The guidance outlined the following elements that should be included in an institution’s business continuity plan:

- A preventive program;

- A documented strategy;

- A comprehensive framework of facilities, systems, or procedures;

- A testing program; and

- An oversight program to ensure ongoing review and updates to the pandemic plan.

For more information,

please view the Interagency Statement

on Pandemic Planning at www.ffiec.gov/press/pr121207.htm.![]() (Federal

Reserve Supervision and Regulation Letter SR 07-18, 12/12/07)

(Federal

Reserve Supervision and Regulation Letter SR 07-18, 12/12/07)

Proposed Changes to Regulation Z, “Truth in Lending”

The Federal Reserve Board, on December 18, 2007, proposed and asked for public comment on changes to Regulation Z (Truth in Lending). The changes are intended to protect consumers from unfair or deceptive home mortgage lending and advertising practices. The rule, which would be adopted under the Home Ownership and Equity Protection Act (HOEPA), would restrict certain practices and would also require certain mortgage disclosures to be provided earlier in the transaction.

The proposal includes key protections for “higher-priced

mortgage loans” secured by a consumer’s

principal dwelling. Details on the proposed changes

and how to submit comments may be found in the Board’s

December 18, 2007, press release, which is available

online at www.federalreserve.gov/newsevents/press/bcreg/20071218a.htm. ![]() (Federal

Reserve Board press release, 12/18/07)

(Federal

Reserve Board press release, 12/18/07)

FDIC, Other Regulatory Agencies Announce Proposed Procedures Related to the Fair and Accurate Credit Transactions Act (FACTA)

The FDIC, other federal financial institution regulatory agencies, and the Federal Trade Commission, have jointly published for comment regulations and guidelines on the accuracy and integrity of information provided to consumer reporting agencies (CRAs) and proposed regulations on direct disputes to providers of this information.

The

agencies propose to adopt these guidelines and regulations

to satisfy the requirements of section 312 of FACTA,

which amended section 623 of the Fair

Credit Reporting Act (FCRA). Comments

on the proposal are due February 11, 2008. Details

of the proposed rulemaking are available in the FDIC’s

December 21, 2007, Financial Institution Letter,

which is available online at www.fdic.gov/news/news/financial/2007/fil07115.html. ![]() (FDIC

Financial Institution Letter, 12/21/07)

(FDIC

Financial Institution Letter, 12/21/07)

Five Banks Launch Mortgage Relief Initiative for New England

Five banks are working together to reach out to some of the New England homeowners who have been affected – or may soon be affected – by the recent mortgage crisis.

The banks’ initiative, called the Mortgage Relief Fund, should make it easier for some homeowners who are paying high rates – and those who face a reset of an adjustable-rate loan – to refinance into a more affordable mortgage, avoid delinquency, and avoid foreclosure.

The banks – Citizens Bank, Sovereign Bank, TD Banknorth, Webster Bank, and Bank of America – are stepping forward to play a positive role in the challenging situation facing many New England homeowners. The banks have together committed an initial $125 million for mortgage loans.

The banks are working together on this initiative with the support and encouragement of the Federal Reserve Bank of Boston. Eric Rosengren, President and CEO of the Boston Fed, said “I really commend these banks for stepping forward and working so hard to develop this initiative – which we all hope will assist a key subset of borrowers.”

The initiative aims to assist those borrowers who are paying high rates despite good payment histories, and are residing in homes that are worth more than their outstanding mortgage loan balance(s). The banks aim to provide options to such homeowners, if they are experiencing financial difficulties now or expect to soon.

As noted by the Boston Reserve Bank, other financial institutions may also participate. For more information about the program, please visit www.bos.frb.org/news/press/2007/pr122007.htm. (Internal sources, 12/20/07)

Federal Reserve Study: Over Two-Thirds of Noncash Payments Are Electronic

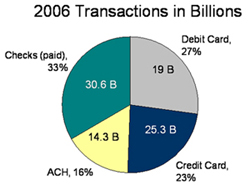

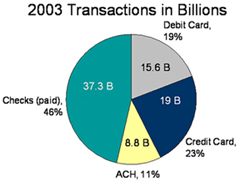

The Federal Reserve’s 2007 study of noncash payments, released on December 10, 2007, revealed that in 2006, the period of the study, more than two-thirds of all U.S. noncash payments were made electronically. In 2006, all types of electronic payments grew, while check payments decreased. In comparison, an earlier Federal Reserve study found that in 2003, a roughly equal number of electronic and check payments were made.

Of 2006’s 93 billion noncash payments, about 30 billion were checks, and about 63 billion were electronic payments, representing a drop of nearly 7 billion checks paid since 2003.

The study also found that debit cards have surpassed credit cards as the most frequently used electronic payment type. The highest rate of growth from 2003 to 2006 was in ACH payments (18.6% CAGR), followed closely by debit card payments (17.5% CAGR).

Meanwhile, checks declined by an average of 6.4 percent per year since 2003 ― indicating that the decrease in check writing, first seen in the mid-1990’s, has picked up in recent years.

One of the most significant changes seen was the increase in electronic check processing. In 2006, about 40 percent of all interbank checks were electronically converted at some point during collection, including 3 billion consumer checks that were converted into ACH transactions.

“The results of the study underscore the importance of check electronification and other innovations that improve the efficiency of the U.S. payments system,” said Richard Oliver, executive vice president of the Atlanta Reserve Bank and the Federal Reserve Banks’ product manager for retail payments.

A summary report of the 2007

Federal Reserve Payments Study![]() is

available online at www.frbservices.org.

is

available online at www.frbservices.org. ![]() Detailed

reports will be available early this year. (Federal

Reserve press release, 12/10/07)

Detailed

reports will be available early this year. (Federal

Reserve press release, 12/10/07)

Items in Bank Notes focused on developments affecting banking structure in New England. They were condensed from daily newspapers and press releases from federal and state financial regulatory agencies. Their reproduction does not imply our endorsement of the accuracy, opinions or policies reflected in the subject matter.

collapse all

collapse all

expand all

expand all