Who Is Most Worried about Student-Loan Debt?

Across demographic and economic groups, more than half of individuals with student loans feel concern about their ability to repay.

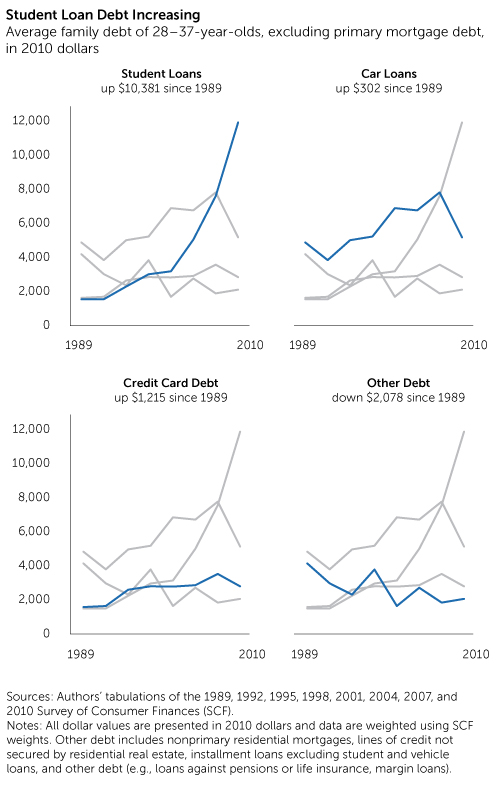

As Americans pursue and invest in more education, they accrue more student-loan debt. Student-loan debt has become an increasingly important component on the balance sheets of many Americans. In 1989, student loans were a relatively small component of the debt held by 29-to-37-year-olds. By 2010, they were second only to mortgage debt. (See "Student-Loan Debt Increasing.") Growing student-loan debt has contributed to generations X and Y having less wealth than their parents' generation had at the same age 25 years ago.[1]

For a deeper understanding, it is instructive to consider exactly who has student-loan debt and who is worried about their ability to repay.[2] According to the FINRA Investor Education Foundation's 2012 National Financial Capability Study (NFCS), 20 percent of all U.S. adults over age 20-and 35 percent of people in their 20s and 30s-have student loan debt.[3] Strikingly, more than half (57 percent) of people with student loans are concerned that they may be unable to repay the debt. The concern cuts across demographic and economic groups but is more prevalent among women, people with financially dependent children, people not employed full time, and people with lower household incomes.

Who Has Student-Loan Debt?

Student-loan debt is not exclusive to those who have been to college. Nine percent of people with no more than a high school degree have student-loan debt. They could have incurred the debt for a nondegree training certificate or by funding a child's education. As much as 25 percent of people with some college education but no college degree have student-loan debt. Some of those people could still be in school, others may have completed a nondegree certificate, and still others may have failed to complete the degree for which they took out the loan. The incidence of student-loan debt is slightly higher for those with a college or graduate degree: 30 percent and 28 percent, respectively.

Student-loan debt is held by adults across the income spectrum but decreases sharply with age. Across four income groups (less than $25,000, $25,000 to $50,000, $50,000 to $100,000, and more than $100,000), a similar 18 percent to 21 percent of people hold student-loan debt. The likelihood of having student-loan debt falls from 40 percent of people in their 20s to 30 percent of people in their 30s, 19 percent of people in their 40s, and 4 percent of people age 60 and older.

African Americans and Hispanics are about twice as likely to have student-loan debt as whites. While 16 percent of whites have such debt, 34 percent of African Americans and 28 percent of Hispanics do. This difference is consistent with the fact white families have six times the wealth of African American and Hispanic families and are five times more likely to receive large gifts or inheritances.[4] Greater family wealth translates into greater opportunity, as adults can use the wealth to finance educations for themselves, their children, or their grandchildren.

Who Is Worried about Repayment?

Fifty-seven percent of people with student loans are concerned about being unable to repay them. To understand who is most worried, we used a regression framework to measure the relationship between student-loan repayment concern and person-level and household- level characteristics. The regression model separately examines each characteristic-educational attainment, household income, age, race/ethnicity, the number of financially dependent children, gender, living arrangement, employment status, and region-while controlling for the remaining characteristics.

People with college degrees are less worried about repayment. People with some college but no degree and people with graduate degrees are 13 percent to 14 percent more likely than people with college degrees to be concerned about repaying student-loan debt. People with some college include those who did not complete their degree and those who received a nondegree certificate that is not as valuable as expected, possibly driving the higher rates of repayment concern. People with graduate degrees could have loans for both college and graduate school, increasing their repayment stress.

Individuals in lower-income households are substantially more likely to have concern about their ability to repay their student loans. For example, compared with people in households with incomes above $100,000, people in households with incomes below $25,000 are 86 percent more likely to worry about repaying their student loans. The concern is nearly as great for people with incomes between $25,000 and $50,000, who are 72 percent more likely to worry about repayment.

Having financially dependent children is strongly related to concerns about student-loan repayment, likely because of competing needs and expenses. Compared with adults who have no financially dependent children, adults with two financially dependent children are 18 percent more likely to be concerned about repaying their student loans. People not employed full time are more worried, even when controlling for household income.

People who live in the Northeast have greater concerns about ability to repay student-loan debt than people in the rest of the country. According to a report from the Federal Reserve Bank of New York, several Northeastern states have above-average student debt per borrower.[5] Although some of these same states have belowaverage student-loan delinquency rates, the higher debt levels could increase stress and concern around ability to repay.

Race and ethnicity, as a well as household structure, are not significantly related to concerns about student-loan repayment. Although the descriptive statistics show that African Americans are more likely than non-Hispanic whites to worry about student-loan repayment, there is no statistically significant difference between the two groups after controlling for person-level and household-level characteristics, including income and employment status.

Student-loan debt has seen sharp increases in recent years, topping $1.2 trillion dollars in 2014. On average, the benefits of postsecondary education outweigh the costs for people able to complete their degree.[6] Nonetheless, the short-term burden of repaying loan balances and interest can delay homeownership, building a rainyday fund, and saving for retirement.

As prospective students contemplate their path, they should consider the likelihood of finishing their degree, earnings in their field of study, and the type of student loan they want (federal or private). Once students have debt, income-contingent repayment initiatives in federal loans can help them meet their obligations with less financial strain. Loans do help students finance their education, but the goal is to complete the degrees without getting buried in debt. Early steps in the right direction can help people move up the wealth-building ladder and attain economic security.

Caroline Ratcliffe and Signe-Mary McKernan are senior fellows at the Urban Institute, based in Washington, DC. Contact them at cratcliffe@urban.org.

Acknowledgments

The authors are grateful to the FINRA Investor Education Foundation and the Ford Foundation for funding this research. All results, interpretations, and conclusions expressed are those of the authors alone and do not necessarily represent the views of the funders or any affiliates, or of the Urban Institute, its trustees, or its funders.

Endnotes

- Eugene Steuerle, Signe-Mary McKernan, Caroline Ratcliffe, and Sisi Zhang, "Lost Generations? Wealth Building among the Young" (white paper, Urban Institute, Washington, DC, 2013), http://www.urban.org/publications/412766.html.

- This article is based on Caroline Ratcliffe and Signe-Mary McKernan, "Forever in Your Debt: Who Has Student Loan Debt, and Who's Worried?" (white paper, Urban Institute, Washington, DC, 2013), http://www.urban.org/publications/412849.html.

- Tabulations from the 2010 Survey of Consumer Finances show similar results: 19 percent of U.S. families headed by a person age 20 or older and 36 percent of families headed by a person in their 20s or 30s have student-loan debt.

- Signe-Mary McKernan, Caroline Ratcliffe, Eugene Steuerle, and Sisi Zhang, "Less Than Equal: Racial Disparities in Wealth Accumulation" (Washington, DC: Urban Institute, 2013); and Signe-Mary McKernan, Caroline Ratcliffe, Margaret Simms, and Sisi Zhang, "Do Racial Disparities in Private Transfers Help Explain the Racial Wealth Gap?" Demography 51, no. 3 (2014).

- "Quarterly Report on Household Debt and Credit" (report, Federal Reserve Bank of New York Research and Statistics Group, Microeconomic Studies, New York, 2013). 6

- See, for example, Christopher Avery and Sarah Turner, "Student Loans: Do College Students Borrow Too Much-Or Not Enough?" Journal of Economic Perspectives 26, no. 1 (2012): 165-92; and Michael Greenstone, Adam Looney, Jeremy Patashnik, and Muxin Yu, "Thirteen Economic Facts about Social Mobility and the Role of Education" (Hamilton Project Policy Memo, Brookings Institution, Washington DC, 2013).

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Caroline Ratcliffe, Urban Institute

Signe-Mary McKernan, Urban Institute