2015 Series • No. 2015–6

Current Policy Perspectives

Why Has the Cyclicality of Productivity Changed? What Does It Mean?

Historically, U.S. labor productivity (output per hour) and total factor productivity (TFP) rose in booms and fell in recessions. Different models of business cycles explain this procyclicality differently. Traditional Keynesian models relied on "factor hoarding," that is, variations in how intensively labor and capital were utilized over the business cycle. Real business cycle (RBC) models instead posit that procyclical technology shocks drive the business cycle.

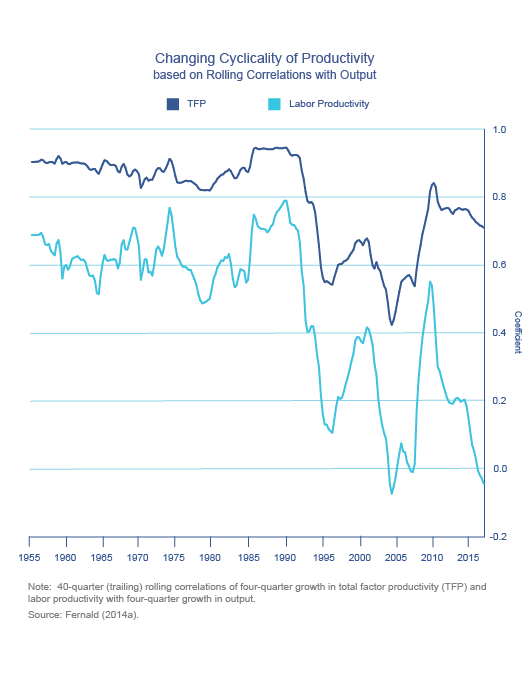

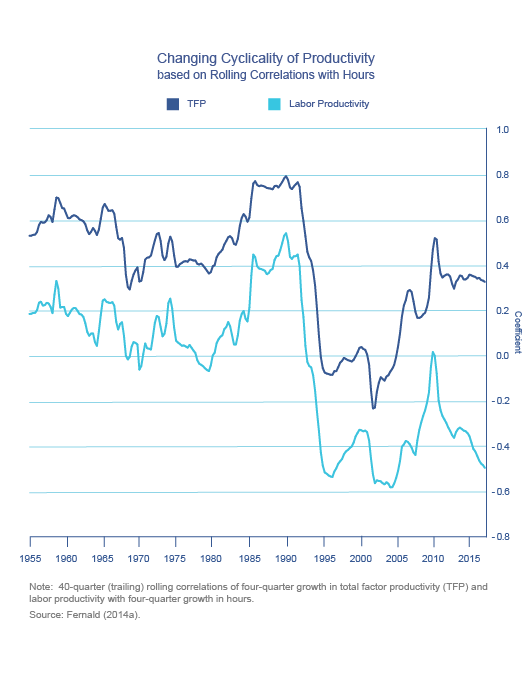

Since the mid-1980s, however, the procyclicality of productivity has waned. TFP has been roughly acyclical with respect to inputs, whereas labor productivity has become significantly countercyclical. The slow pace of productivity growth after 2010, when the post-Great- Recession recovery gained a firm footing, is broadly consistent with these patterns. In this paper, the authors seek to understand empirically the forces behind the changing cyclicality of productivity.

Key Findings

Key Findings

- The key empirical proximate "fact" driving the changes in the cyclicality of productivity is reduced variation in factor utilization. Indeed, empirically, variations in factor utilization are the only source of procyclicality with respect to inputs. After adjusting for utilization, the response of the economy to changes in technology has been more or less consistently countercyclical. The one exception appears to have been during the Volcker period, when technology improvements tended to be (weakly) associated with increases in inputs.

- Increased flexibility of labor-market institutions has likely played a role. But the industry evidence does not suggest much reduced use of hours per worker relative to employment?which one would expect to find under this story. This suggests a role for changes in the persistence of different kinds of shocks as well as the evolving sectoral composition of the economy.

- At a deeper level, technology shocks have plausibly come to account for a greater share of the variations in output and input than non-technology shocks. This leads to lower correlations of TFP with output and input because technology improvements reduce (labor) input in the short run. At the same time, both the extensive and the intensive labor margins now contract less in response to a positive technology impulse. This suggests that monetary policy may now do a better job than previously of accommodating technology shocks.

Exhibits

Exhibits

Implications

Implications

There are a number of open questions. In terms of modeling, quantitative models can sharpen our understanding of how the different forces interact to account for the observed changes in dynamics. Such models can also examine whether and, if so, how the reduced role of factor utilization influences the propagation of shocks in the economy.

It is also imperative to pursue better data on output, especially in terms of quality and varieties, to more accurately assess the extent to which the diminished procyclicality of productivity is attributed to the increased role of output mismeasurement. In particular, more-granular data that also cover a broader range of activities are needed to construct more-accurate estimates of intangible investment.

Abstract

Abstract

It is useful to reflect on how the financial environment changed in the interim between the bank credit crunch episode in the early 1990s and the recent financial crisis. What did we learn from the earlier crisis and how did the credit crunch literature help guide policy in the more recent crisis? Among the important changes were the consolidation of the banking sector and the dramatic growth in nonbank financial intermediaries, which are much more susceptible than banks to liquidity risks due to a lack of deposit insurance. This paper highlights the fact that while broker-dealers, money market mutual funds, and issuers of asset-backed securities were not particularly important in the early 1990s when the bank credit crunch occurred, they had grown dramatically over the subsequent two decades to become both a major source of financing and a key element in exacerbating the problems experienced during the recent financial crisis.