2016 • No. 16–06

Research Data Reports

Do Consumers Rely More Heavily on Credit Cards While Unemployed?

Previous literature has shown that a consumer's payment preferences are correlated with his or her demographic profile and finances. Age, education, employment status, income, credit limits, asset holdings, and a variety of other factors can all contribute to a consumer's payment. Additionally, there is evidence that expectations about the future state of these factors can contribute to a consumer's use of available payment instruments. This report assesses how households change their use of credit cards during periods of unemployment.

This issue has important policy implications. The way individual households manage their finances during unemployment can affect their long-term financial health. Recently, credit card debt has begun to rise after having fallen by more than 25 percent from 2009 to 2014. Relying too heavily on credit cards without paying off credit card debt can increase consumers' debt and cause further deterioration in their financial situation. If credit card debt increases with unemployment, overall debt may increase as well. If, instead, consumers decrease credit card use when unemployed, their debt will likely be lower and they may be able to restore their normal consumption level sooner after returning to work. Thus, credit card behavior has implications for the overall health of the economy and is potentially useful to policymakers in their assessment of the economic outlook.

Key Findings

Key Findings

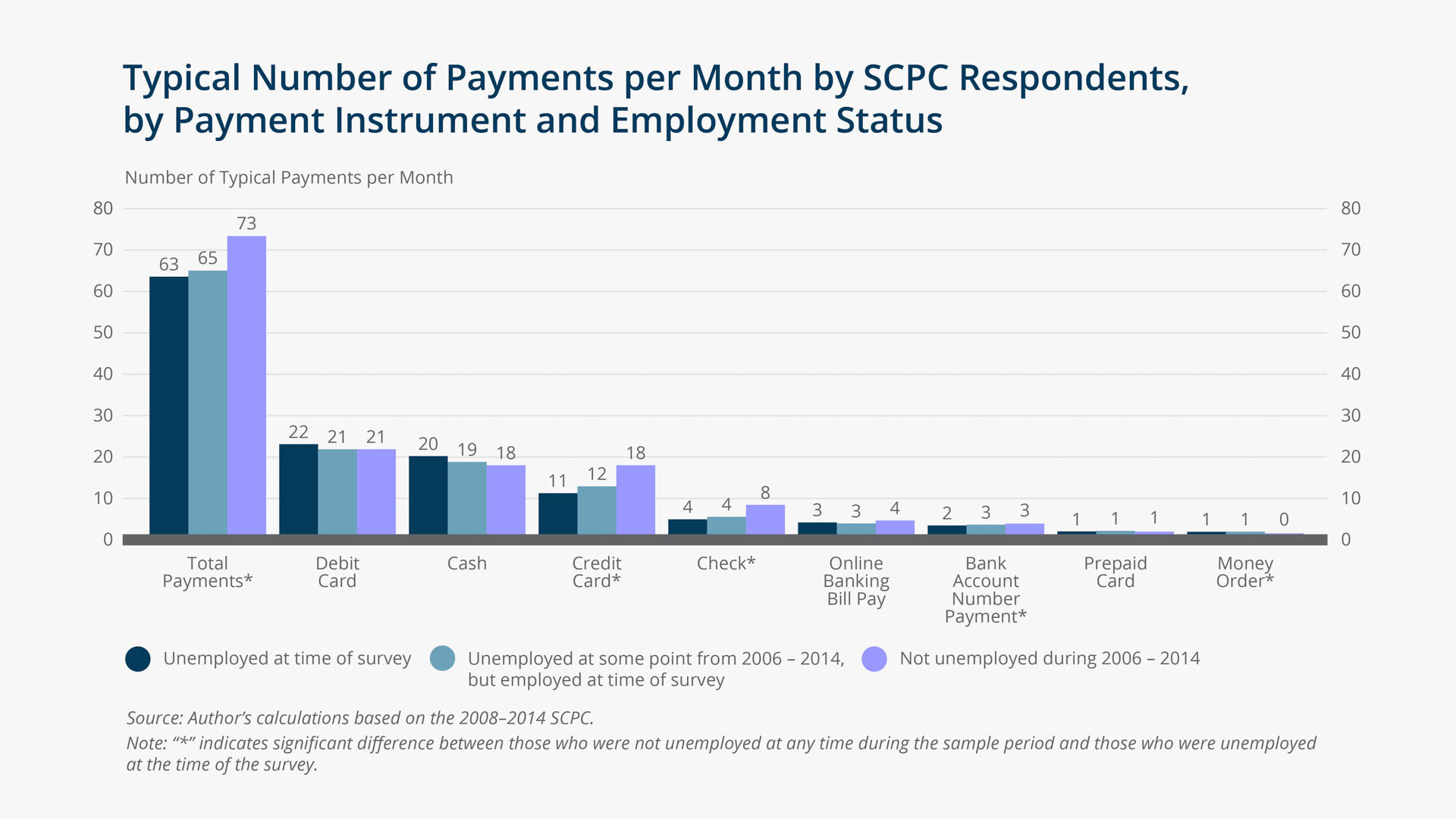

- Respondents who were unemployed at some point during the sample period are demographically distinct from the average respondent: they are significantly younger, have lower incomes, are less likely to be married, and are less likely to be white.

- Respondents who were unemployed at some point during the sample period adopted a different set of payment instruments than the average respondent: they were significantly less likely to have had a bank account and significantly less likely to have had a credit card.

- Respondents who were unemployed at some point during the sample period had a significantly lower share of credit card payments as a percentage of overall payments, meaning they used credit cards less intensively than the average respondent.

- There is some evidence that respondents decrease their credit card use during a period of unemployment. Thus, we do not find evidence that consumers increase their reliance on credit cards during spells of unemployment. On the contrary, the SCPC data indicate that consumers may, in fact, decrease their reliance on credit cards while unemployed.

Exhibits

Exhibits

Implications

Implications

No previous study that the author is aware of has tracked the same individuals' credit card behavior and employment status over time. Using panel data from the survey of consumer payment choice (SCPC), a nationally representative survey that captures payment behavior from the beginning of the recession through the recent recovery, the author finds some evidence, although it is not very strong, that respondents may in fact decrease their use of credit cards during unemployment.

Further research, based on data with more granular information on household balance sheets and the effect of employment expectations, is needed on the changes in individual payment behavior and household balance sheets that result when a consumer is faced with a spell of unemployment or with another event that leads to a substantial change in income.

Abstract

Abstract

Leading up to the Great Recession, households increased their credit card debt by over 16 percent ($121 billion) during the five-year period from 2004 to 2009. The unemployment rate simultaneously began to rise in 2008, increasing from 5.0 percent in January 2008 to a high of 10.0 percent in October of 2009. During the recovery, from 2009 to 2014, credit card debt fell by more than 25 percent, as the unemployment rate returned to near pre-recession levels. These coincident developments have led to speculation that consumers facing unemployment or job uncertainty may have increased their reliance on credit cards.

Using panel data from the Survey of Consumer Payment Choice (SCPC), we analyze consumers' adoption and use of credit cards, along with other payment instruments, among consumers during periods of unemployment. We compare this behavior with that of their employed peers, and we track the same people over time to test whether credit card behavior changes with employment status. Using descriptive statistics and regression analysis, we find the following: 1) Respondents who were unemployed at some point during the sample period are demographically distinct from the average respondent: they are significantly younger, have lower incomes, are less likely to be married, and are less likely to be white; 2) Respondents who were unemployed at some point during the sample period adopted a different set of payment instruments than the average respondent: they were significantly less likely to have had a bank account and significantly less likely to have had a credit card; 3) Respondents who were unemployed at some point during the sample period had a significantly lower share of credit card payments as a percentage of overall payments, meaning they used credit cards less intensively than the average respondent; 4) There is some evidence that respondents decrease their credit card use during a period of unemployment. Thus, we do not find evidence that consumers increase their reliance on credit cards during spells of unemployment. On the contrary, the SCPC data indicate that consumers may, in fact, decrease their reliance on credit cards while unemployed.