2014 Series • No. 14–2

Research Department Working Papers

Labor Market Transitions and the Availability of Unemployment Insurance

Economists often expect that unemployment insurance (UI) benefits will result in elevated unemployment rates because recipients face an incentive to remain unemployed in order to continue receiving benefits-as taking a job or dropping out of the labor force would cause their UI benefit payments to cease. Interest in this issue intensified when the available weeks of federally funded UI benefits were extended in response to the prolonged recovery from the Great Recession. This recent episode provides new data with which to investigate empirically the effect of UI benefit availability on the ranks of the unemployed and on the U.S. unemployment rate. By using individual data from the Current Population Survey for the 2005-2013 period-during which the federal government extended and then reduced the length of benefit weeks to varying degrees in different states-the author studies how the program parameters in the UI system influenced the monthly transition rates of job losers to either employment or dropping out of the labor force. Job losers are defined as unemployed individuals who are on temporary layoff, who permanently lost jobs, or who completed temporary jobs.

Key Findings

Key Findings

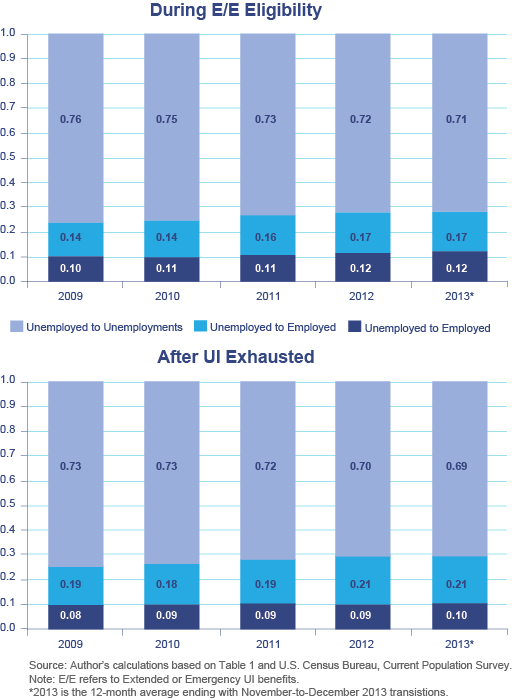

- Unemployed job losers have low rates of exiting the labor force until they approach the maximum weeks of combined state and extended federal UI benefits available in their state at that time.

- The coefficient estimates indicate that among job losers, about 4.5 percentage points more of them transition out of the labor force in the month after they exhaust their emergency and extended benefits than in the penultimate month or the month of exhaustion.

- The transitions from being unemployed to having a job appear to be unaffected by the availability of emergency and extended UI benefits.

Exhibits

Exhibits

Implications

Implications

These results are consistent with the view that during the Great Recession and its aftermath, many job losers continued to look for work, did not find employment, and kept their labor market status as "unemployed" until their eligibility for UI benefits ended, then gradually dropped out of the labor force. These findings suggest that longer periods of UI availability—up to 99 weeks in some states during 2010 and 2011—contributed to elevated jobless rates during this period, but not because this longer availability discouraged recipients from taking jobs. Rather, the longer federal benefits periods gave the long-term unemployed income support while the economy still had too few job openings. By the same token, the sharp contraction of benefit weeks that occurred in 2012 and continued into 2013, then followed by the total cutoff of federal benefits in January 2014, likely contributed to declines in unemployment and participation rates beyond what one would expect based on the improving economy alone.

Abstract

Abstract

Economists often expect unemployment insurance (UI) benefits to elevate unemployment rates because recipients may choose to remain unemployed in order to continue receiving benefits, instead of accepting a job or dropping out of the labor force. This paper uses individual data from the Current Population Survey for the period between 2005 and 2013—a period during which the federal government extended and then reduced the length of benefit availability to varying degrees in different states—to investigate the influence of program parameters in the UI system on monthly transition rates of unemployed individuals. The main finding is that unemployed job losers tend to remain unemployed until they exhaust UI benefits, at which point they become more likely to drop out of the labor force; transitions to a job appear to be unaffected by UI benefit extensions. These findings imply that the longer periods of benefit eligibility under the federal programs EUC08 and EB—up to 99 weeks in many states in 2011 and 2012—contributed to the elevated jobless rates observed during that period, but not via lower employment. By the same token, the sharp contraction of benefit weeks that occurred in 2012 and continued more gradually in 2013 likely contributed to declines in unemployment and participation rates beyond what one would expect based on the improving economy alone. Similarly, the December 28, 2013 sudden cutoff of federal UI payments to an estimated 1.3 million jobless Americans who had been looking for work for more than six months is adding to the pace of transitions from unemployment to dropping out of the labor force, thus reducing the unemployment rate and the labor force participation rate further in the first half of 2014, although very modestly.