2015 Series • No. 15–14

Research Department Working Papers

From Urban Core to Wealthy Towns: Nonschool Fiscal Disparities across Connecticut Municipalities

Fiscal disparities occur when economic resources and public service needs are unevenly distributed across localities. There are two equity concerns associated with fiscal disparities. First, as Yinger (1986) shows, it is not considered fair to require two otherwise-identical households to pay a different amount of taxes for the same level of public services simply because they live in different towns. Second, fiscal disparities render some towns at a disadvantage in economic competition (Downes and Pogue 1992). These towns must impose a higher tax rate and/or provide a lower level of public services, making them less attractive to private businesses and residents.

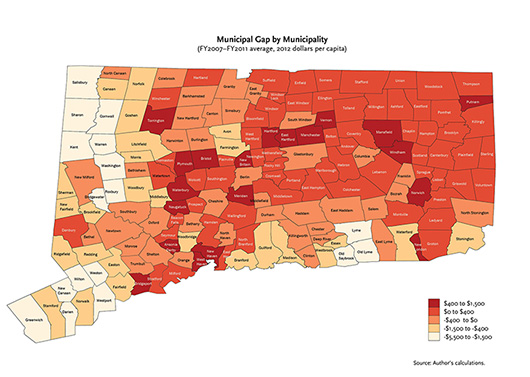

Using a cost-capacity gap framework and a newly assembled dataset of local financial records, this paper is the first study to quantify nonschool fiscal disparities across Connecticut municipalities. Municipal gap is defined as the difference between municipal cost and municipal capacity. A positive gap indicates greater need (measured by the cost to fund the common nonschool services) than capacity, while a negative gap indicates more capacity than need.

Key Findings

Key Findings

- Forty-six percent of Connecticut municipalities experienced positive municipal gaps in FY 2011, and nearly 60 percent of the state population resides in these positive-gap municipalities.

- The municipal gap varies widely across municipality types. Urban core communities have the largest positive municipal gap - on average, more than $1,000 per capita. Wealthy towns have the largest negative municipal gap per capita (-$3,591 on average).

- Municipalities with the largest negative gaps tend to be clustered in the southwestern and northwestern corners of the state and in three towns along the southern shoreline, while those in the central and eastern parts of the state tend to have large positive municipal gaps.

- The distribution of the municipal gap shows very strong time-persistence.

- Between FY 2007 and FY 2011, around 20 percent of aggregate nonschool grants were awarded to negative-gap communities, suggesting that the distribution of these grants is broadly spread and not well targeted to fiscally disadvantaged communities.

- The distribution of nonschool grants is positively but loosely associated with the distribution of municipal gaps, suggesting that nonschool grants exert some limited equalizing effect.

- Connecticut has greater disparity across municipalities in terms of nonschool fiscal gaps than Massachusetts. However, Connecticut nonschool grants are distributed in a less equalizing manner than Massachusetts nonschool grants.

Exhibits

Exhibits

Implications

Implications

This paper's conceptual framework and empirical approach can be generalized to other states. More studies of nonschool fiscal disparities using other states' data should help policymakers across the country to have a deeper and more comprehensive understanding of local fiscal condition and potentially improve their grant systems.

Abstract

Abstract

Using a cost-capacity gap framework, this paper is the first study to quantify nonschool fiscal disparities across Connecticut municipalities. In the absence of a Uniform Chart of Accounts for municipalities, the paper uses a newly assembled dataset of multi-year local financial records, adjusted to be comparable across municipalities and therefore suitable for regression analysis. The paper finds significant nonschool fiscal disparities among Connecticut municipalities. Fiscal disparities are driven primarily by the uneven distribution of the property tax base across the state, while cost differentials also play an important role. State nonschool grants are found to have a relatively small effect in offsetting municipal fiscal disparities. Unlike previous research focused on a single state, this paper also conducts a comparison between Connecticut and Massachusetts. This paper's conceptual framework and empirical approach are generalizable to other states.