Downskilling: Changes in Employer Skill Requirements over the Business Cycle

The weakness of the U.S. labor market during the period following the Great Recession remains poorly understood. Two years after the official end of the Great Recession, the unemployment rate still hovered around 8 percent, although employers reported more vacant positions. This shift in the relationship between unemployment and vacancies, known as the Beveridge curve, has highlighted the need to focus not just on the number of vacancies, but also on their composition and skill requirements.

Explanations for this shift have been explored, including a deterioration in the matching/hiring process in the economy as well as changes in the composition and motivation of the unemployed. More recently, the literature has focused on a decrease in “recruitment intensity” per vacancy during recession, whereby employers behave in ways that can influence the rate of new hires, such as changes in advertising expenditures, screening methods, hiring standards, and compensation. For a given vacancy-to-unemployment ratio, a lower recruiting intensity per vacancy would lower the job fill rate, shifting the Beveridge Curve upward, as observed after the Great Recession. Yet to date evidence of direct measures of recruitment intensity across employers has been limited.

The authors directly measure an important channel along which recruitment intensity may have shifted during the Great Recession—the skill requirements employers use to screen candidates when filling a new vacancy. Previous work examining this dynamic found that employers raised education and experience requirements within occupations, and even within firm and job titles. This growth in skill levels within occupations has colloquially become known as upskilling. In this paper, the authors build on their earlier study of the Great Recession, by analyzing skill trends during the subsequent recovery.

Key Findings

Key Findings

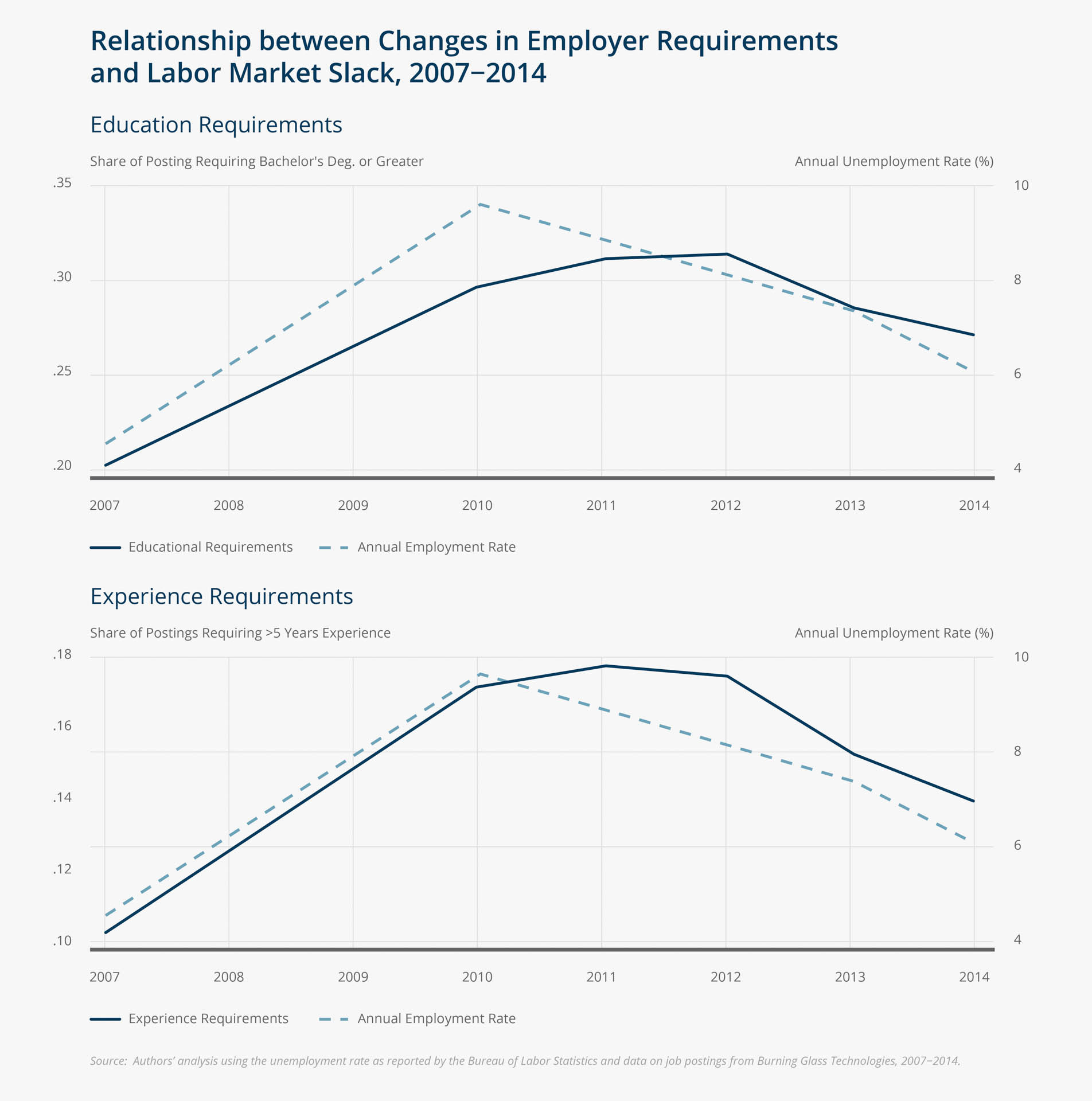

- Using a novel dataset of 82.5 million online job postings, the authors find that employer skill requirements fell as the labor market improved from 2010 to 2014. A 1 percentage point reduction in the local unemployment rate over that period is associated with a roughly 0.27 percentage point reduction in the fraction of jobs requiring at least a bachelor’s degree and a roughly 0.23 percentage point reduction in the fraction requiring five or more years’ experience. This pattern is established using multiple measures of labor productivity, is bolstered by similar trends among previously unmeasured dimensions of skill, and even occurs within firm-job title pairs.

- The authors further confirm the causal effect of labor market tightening on skill requirements using a natural experiment stemming from the fracking boom in the United States. This boom in natural gas production served as an exogenous shock to the local labor supply of tradable, non-fracking industries in nearby counties. These industries are not plausibly affected by local demand shocks or natural gas extraction technology, but still show a decrease in skill requirements in response to tighter labor markets brought about by the fracking boom.

Exhibits

Exhibits

Implications

Implications

These results indicate that labor market-induced downskilling has reversed much of the cyclical increase in education and experience requirements that occurred during the Great Recession. The authors conclude that the demand for skilled workers is dynamic and responsive to labor market conditions, with employers acting strategically to fill positions with higher-skilled workers during a period of slack labor markets. To the degree that changes in employer requirements vary with the business cycle, it is possible that, during slack times, workers with less experience and lower levels of education will have longer spells of unemployment, regardless of their industry and occupation. The findings also caution policymakers against targeting high-frequency changes in labor market posting requirements within occupations in designing training programs, since these requirements may revert during recoveries. However, shifts in demand across occupations may be less cyclical than changes in the employer requirements studied in this paper. Therefore, real-time labor market information on changes in the number and share of job vacancies across occupations may in fact be quite useful in determining which training programs should be funded.