Measuring Consumer Expenditures with Payment Diaries

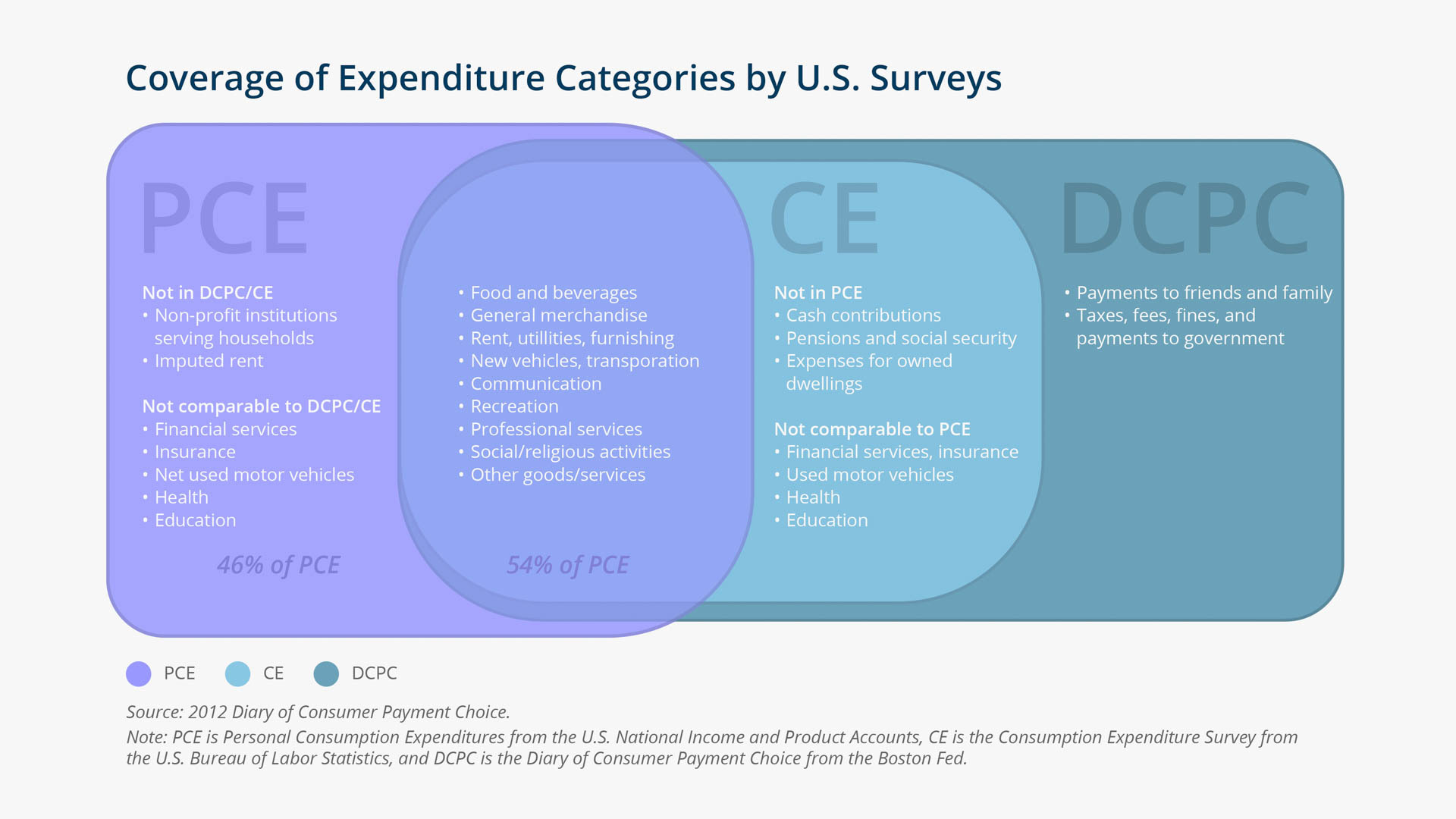

Obtaining the best possible estimates of consumer expenditures is crucial to proper construction of consumption data and applied economic research on consumer behavior. Measuring consumer expenditures well is complex and difficult. The challenges, which are manifest in discrepancies between microeconomic and aggregate estimates of consumption and related data, confound efforts to understand households' responses to the recent financial crisis. One basic problem is that the leading U.S. data source, the Consumer Expenditure Survey, covers only about three-fifths of personal consumption expenditures. However, in a potentially promising development, Bagnall et al. (2016) report that aggregate payment values from individual consumer diaries conducted during the 2009–2012 period in seven industrial countries amounted to between 72 and 111 percent of national income estimates of consumption, suggesting that payments data might contribute to a solution. Though imperfect, these relatively high estimates merit further investigation.

This paper uses the Boston Fed's 2012 Diary of Consumer Payment Choice (DCPC) to describe and quantify the advantages of collecting consumer expenditure data using payment diaries that record daily authorizations by the type of payment instrument (cash, check, money order, debit or credit card, online banking, etc.) at the point-of-sale (POS), for bill payment (BP), and for all other payments.

Key Findings

Key Findings

- There are advantages to measuring consumer expenditures by tracking the authorization of payments by instrument type. The main advantages appear to be the following: 1) the ability to measure expenditures by payment instrument aggregated into lumpy purchases ("shopping baskets"), 2) relatively low respondent burden, and 3) effective random sampling.

- Three notable results emerge from comparing the 2012 DCPC estimates with estimates from other reputable estimates of the current value of consumer expenditures:

- DCPC payments estimates are 75 percent higher than Consumer Expenditure Survey estimates;

- DCPC consumption estimates are 17 percent higher than personal consumption expenditures estimates in comparable expenditure categories (about half of the categories are comparable); and

- DCPC payments roughly equal comparably adjusted national income and product accounts disposable income.

Exhibits

Exhibits

Implications

Implications

The results presented in this paper suggest that embarking on further refinement and development of consumer payment diaries, done with the intent of contributing to the accurate measurement of consumption, may yield additional notable contributions.

Abstract

Abstract

As the 2012 Diary of Consumer Payment Choice (DCPC) illustrates, there are advantages to measuring consumer expenditures by tracking the authorization of payments by instrument type (cash, check, debit or credit card, etc.). The main advantages of payment diaries appear to be the following: 1) the ability to measure expenditures by payment instrument aggregated into lumpy purchases ("shopping baskets"), 2) relatively low respondent burden, and 3) effective random sampling. Three notable results emerge from comparing the 2012 DCPC estimates with estimates from other reputable estimates of the current value of consumer expenditures: 1) DCPC payments estimates are 75 percent higher than Consumer Expenditure Survey estimates; 2)DCPC consumption estimates are 17 percent higher than personal consumption expenditures estimates in comparable expenditure categories (about half of the categories are comparable); and 3) DCPC payments roughly equal comparably adjusted national income and product accounts disposable income.