U.S. Monetary Policy and Emerging Market Credit Cycles

Foreign banks’ lending to firms in emerging market economies (EMEs) is large and denominated primarily in U.S. dollars. This creates a direct connection between U.S. monetary policy and EME credit cycles.

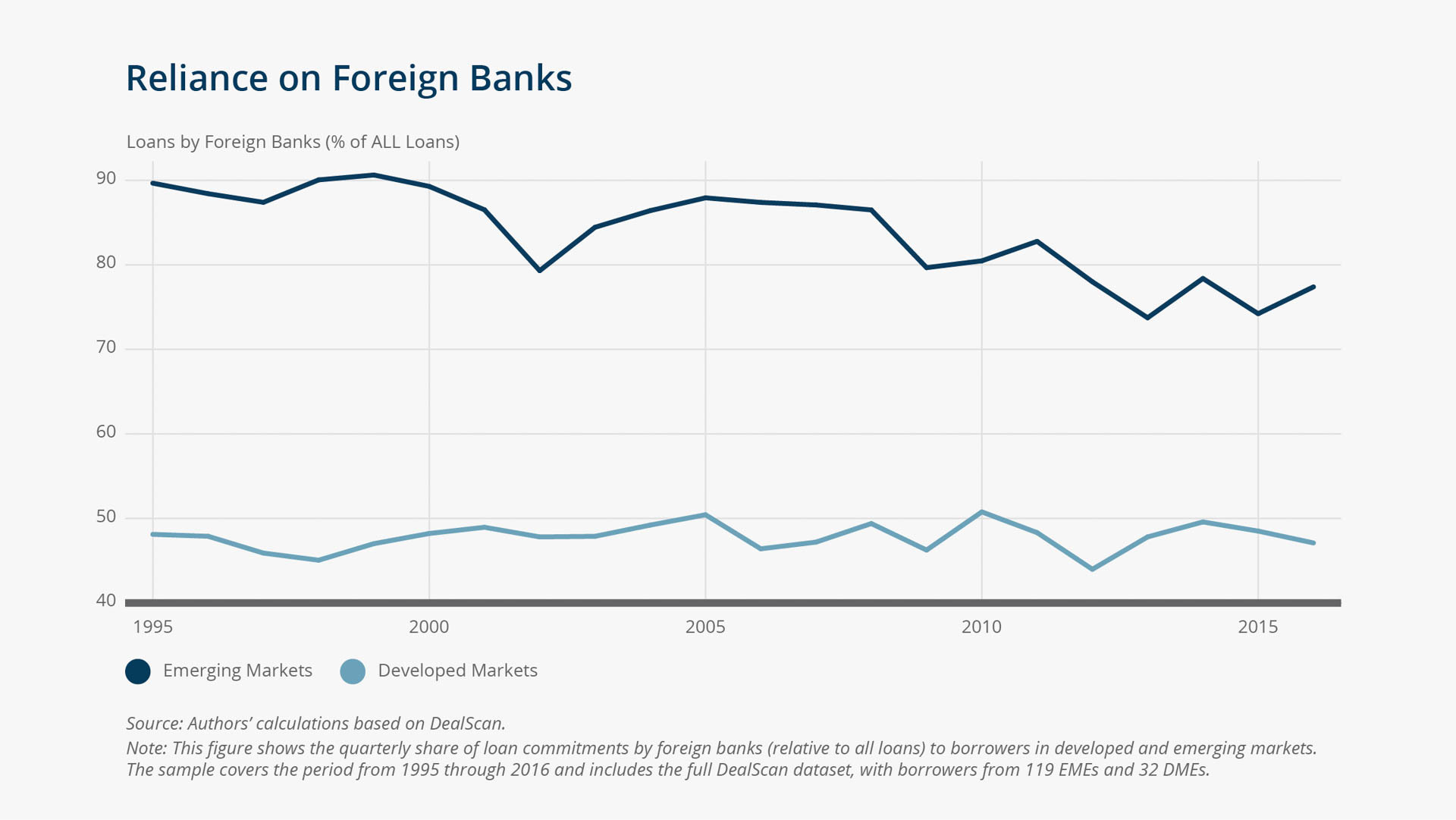

For emerging market economies (EMEs), foreign bank loans denominated primarily in U.S. dollars are by far the most important category of cross-border capital flows. As of 2015, International Monetary Fund (IMF) data indicate that loans represent about half of all external liabilities of emerging market countries. By comparison, foreign bond and equity portfolio investments combined represent only about 20 percent. Much of the foreign lending comes from banks headquartered in developed economies: Bank for International Settlements (BIS) data show that roughly a third of all external liabilities of the emerging markets countries are held by U.S., European, and Japanese banks. Moreover, the volume of these claims has nearly doubled since the onset of the global financial crisis, reaching about $7 trillion in 2016.

Given the economic significance of U.S. dollar lending by global banks to EME firms, this paper examines the extent to which U.S. monetary policy plays an important role as a "push factor" for the credit cycles in these economies.

Key Findings

Key Findings

- Consistent with the general dominance of the dollar in international trade, as found in earlier literature, the authors document that over 80 percent of the cross-border loans to EMEs are denominated in U.S. dollars. This dollar dominance of cross-border credit prevails over time, across different geographical regions and industries.

- The authors estimate that over a typical U.S. monetary easing cycle, EME borrowers face a 32-percentage-point greater increase in the volume of loans issued by foreign banks than borrowers from developed markets face, with a similarly large effect when the U.S. monetary policy stance reverses. This result is robust across different geographical regions and industries, and holds for non-U.S. lenders and lenders with little direct exposure to the U.S. economy. Local EME lenders do not offset the foreign bank capital flows; hence, U.S. monetary policy affects credit conditions for EME firms. The spillover is stronger in higher-yielding and more financially open markets, and for firms with a higher reliance on foreign bank credit.

Exhibits

Exhibits

Implications

Implications

Central banks' mandates typically focus on domestic economic conditions and do not account for potential international spillovers. Aside from isolated examples of collaboration among monetary authorities of major currency areas, EMEs remain outside of these coordination efforts. This issue has resurfaced in the public debate, following the 2008 financial crisis, in the context of large capital inflows into EMEs associated with unprecedented monetary policy accommodation in major currency areas, through both conventional and unconventional measures. Rajan (2014) postulates that emerging market countries wish for stable global capital inflows instead of flows pushed in by foreign monetary policy and points to the unlikelihood that local policy measures will be effective to counteract the global forces. But substantial skepticism remains among economists and monetary authorities about whether a global macro-prudential approach to monetary policy is necessary. This paper provides evidence to inform that debate.

Abstract

Abstract

Foreign banks' lending to firms in emerging market economies (EMEs) is large and denominated primarily in U.S. dollars. This creates a direct connection between U.S. monetary policy and EME credit cycles. We estimate that over a typical U.S. monetary easing cycle, EME borrowers face a 32-percentage-point greater increase in the volume of loans issued by foreign banks than borrowers from developed markets face, with a similarly large effect upon reversal of the U.S. monetary policy stance. This result is robust across different geographical regions and industries, and holds for non-U.S. lenders, including those with little direct exposure to the U.S. economy. Local EME lenders do not offset the foreign bank capital flows; thus, U.S. monetary policy affects credit conditions for EME firms. We show that the spillover is stronger in higher-yielding and more financially open markets, and for firms with a higher reliance on foreign bank credit.