Financial Development, Financial Constraints, and the Volatility of Industrial Output

Motivation for the Research

There is substantial evidence in the literature that industrial output is less volatile in developed countries than in less-developed countries, but the evidence is focused on macroeconomic aggregates.

This paper uses micro data (industry-level and firm-level data) to study volatility-in particular, the effect of financial development on volatility.

The advantage of using micro data lies in allowing a more detailed exploration of the mechanisms behind financial development. Using micro data also enables us to study the composition of the changes in volatility in terms of idiosyncratic and systematic components. Idiosyncratic volatility is defined as industry volatility uncorrelated with the GDP of the country where the industry is located, whereas systematic volatility refers to volatility that affects the entire country and is therefore correlated with GDP.

Research Approach

The mechanism studied in this paper is that financial development allows firms to borrow more freely by relaxing financial constraints. These financial constraints arise from agency problems and asymmetric information, which are ameliorated as financial development increases.

The focus of the paper is on short-run output fluctuations, in contrast with the previous literature in this area, which focuses on long-run growth.

The paper develops a simple model, showing that the effect of financial development on output volatility is ambiguous, depending on the circumstances causing constraint. If firms need funds to smooth unfavorable cash-flow shocks, financial development reduces output volatility. On the other hand, if firms need funds to expand production when confronted with a positive investment opportunity, financial development increases output volatility.

The model is tested empirically, employing cross-country as well as within-country comparisons among industries to identify the effects of financial development on industrial volatility. The use of an industry-level ranking of financial constraints can ease some of the difficulties encountered when measuring constraints at the firm level.

Finally, the paper turns to firm-level data to explore in more detail the mechanism through which volatility is reduced.

Key Findings

- Financial development reduces industrial volatility. This is not surprising, given the macro evidence already available, but now this finding is confirmed by micro evidence-with an extra layer of robustness provided by comparisons of industries that are more financially constrained with those that are less financially constrained. The fact that volatility is reduced suggests that firms face shocks mainly to their cash flows and that as financial development increases, they are able to smooth a larger fraction of these shocks.

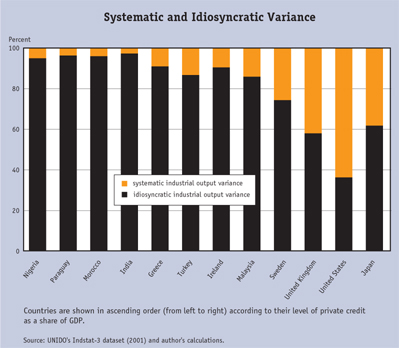

- Systematic and idiosyncratic volatility both fall with financial development, but the fall in idiosyncratic volatility is greater. Hence, the reduction in production volatility comes primarily from a reduction in idiosyncratic volatility.

- As a corollary of the preceding point, the correlation of industry output with GDP increases with financial development, and idiosyncratic volatility represents a smaller share of volatility in countries that are more financially developed than in those that are less financially developed.

- At the firm level, short-term debt exhibits stronger negative correlation with firm activity as financial development increases, suggesting that debt serves to smooth output.

Implications

This paper contributes primarily to the literature on financial constraints and to the ongoing debate about the impact of financial development on real activity. The main message is that a welldeveloped financial system is necessary to ensure a stable productive sector. The results can also be interpreted as showing that banks (the main measure of financial development used in the paper) smooth shocks that affect the productive sector.

A final interesting issue concerns the implications of these findings for the behavior of stock markets. Although a paper by Morck, Yeung, and Yu finds that stocks in less-developed countries tend to have more synchronized movements than stocks in more-developed countries-in other words, that the correlation of a particular stock with the market is higher in a less-developed country- this paper shows that exactly the opposite pattern is true in terms of output correlations with GDP. Reconciling and understanding both results is an important area for future research.

About the Authors

About the Authors

Borja Larrain