Massachusetts Business Taxes: Unfair? Inadequate? Uncompetitive?

Motivation for the Research

Massachusetts policymakers have vigorously debated the optimal level of state and local business taxes since the founding of the Commonwealth. Lately, they have focused on three concerns about these taxes: Are they "fair"? Are they "adequate"? Are they "competitive"?

For those who have struggled to give policymakers lucid, impartial insights into these issues, recent developments have been discouraging. Sparring interest groups have spawned a thicket of statistics whose derivation is not always clearly explained and whose significance and relevance are sometimes difficult to fathom.

This paper aims to clarify recent debate about the fairness, adequacy, and competitiveness of state and local business taxation in Massachusetts.

Research Approach

The author defines a business tax and explains the concepts of fairness, adequacy, and competitiveness in the context of business taxation. He then presents and assesses the validity of indicators recently used in Massachusetts to evaluate the Commonwealth's business taxes in general, and its corporate excise tax in particular, in the context of these three normative goals. Finally, he presents two new indicators of tax competitiveness and applies them to business taxation in the 50 states, in order to assess the competitiveness of Massachusetts business taxes.

Key Findings

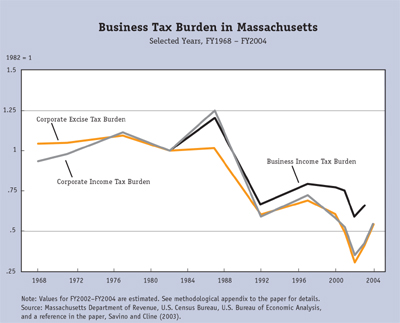

- Evidence shows that the adequacy of the Massachusetts corporate excise tax has diminished in recent years. In the aggregate, the bases of the Commonwealth's corporate income taxes have been eroding, especially during the last decade.

- Evidence concerning the fairness of the Massachusetts corporate excise tax, as well as the fairness of the Commonwealth's business taxes in general, is inconclusive, although modifications to the corporate excise tax introduced in recent years clearly favor some types of firms over others.

- Taken as a whole, Massachusetts business taxes do not diminish the Commonwealth's competitive standing. The author finds abundant evidence that Massachusetts business taxes are competitive, even from data supplied by business interest groups.

- One can best gain insight into a state's business tax competitiveness through the "representative firm" approach. In this approach, the tax analyst attempts to view a state's business taxes and those of its competitors through the eyes of a rational, well-informed, profit-maximizing firm that is in the process of choosing a site for a new facility.

Implications

The author recommends a healthy skepticism concerning the statistical validity and unbiasedness of all these types of indicators, including the two new measures he introduces in this paper- which are, however, an improvement over existing measures.

Policymakers and policy analysts could better evaluate the fairness of the Commonwealth's business taxes if they had more data on how the ratio of taxes to pretax profits differs on average across industries and business size. In possession of such data, they could evaluate disparities in the ratio and changes over time. If such disparities have widened dramatically, and if there is no reason to believe that the incidence of the benefits of state and local public services has changed in a similar fashion, then policymakers would have reason to be concerned about the fairness of state and local business taxes.

About the Authors

About the Authors

Robert Tannenwald