How Immigrants Subsidize Care for Seniors

Between 1996 and 2011, immigrants contributed $182.4 billion more to Medicare's Hospital Insurance Trust Fund than the Fund expended on their health-care benefits.

A recent study published by the Partnership for a New American Economy, "Staying Covered: How Immigrants Have Prolonged the Solvency of One of Medicare's Key Trust Funds and Subsidized Care for US Seniors," looks at Medicare's Hospital Insurance Trust Fund and the role that tax revenues from immigrant paychecks have played in keeping Medicare going.[1]

The research was spurred by the observation that although Americans are aware of some of the roles immigrants play in the US health-care system, there was a less visible benefit that might inform the public debate. People know that immigrants work as doctors, home health aides, radiology technicians, and pharmacists; that they staff nursing homes and retirement communities, and contribute to advances in pharmaceuticals, biotechnology, and public-health programs. But there has been less awareness of the importance of immigrants' tax payments in shoring up Medicare.

Keeping Medicare Solvent

Medicare is a publicly funded health-insurance program that provides health care to 50 million American seniors and disabled individuals. In recent years, many policymakers have voiced concerns about the long-term sustainability of the Medicare program.

With baby boomers retiring at the rate of 10,000 people per day, there will soon be fewer working-age Americans to cover the retired cohort's care.[2] Consider that in the 1980s, there were roughly 240 seniors for every 1,000 working-age individuals in the country. But by 2030, the 240 figure is expected to rise to an estimated 411 seniors for every 1,000 working-age adults.[3] The Medicare trustees have written that the imbalance will present a major financial strain on the system. They project that Medicare's Hospital Insurance Trust Fund, a pool of funds covering services such as hospitalizations and home health care, will become insolvent by 2030 if current trends continue.[4]

Considering immigrants' demographic makeup, it makes sense that they would play a valuable role in boosting the finances of the Medicare program. Immigrants tend to be younger than the US population as a whole and are therefore more likely to be of working age.[5] Many come to the United States for the purpose of working, and their high labor-force participation rate makes them valuable contributors to the economy as taxpayers.[6]

The Partnership for a New American Economy study probes data from the Current Population Survey and the Medical Expenditure Panel Survey (MEPS) to examine the impact immigrants have on the Hospital Insurance Trust Fund. The fund is the only part of Medicare that functions like a true trust fund, with the financing coming principally from payroll taxes.

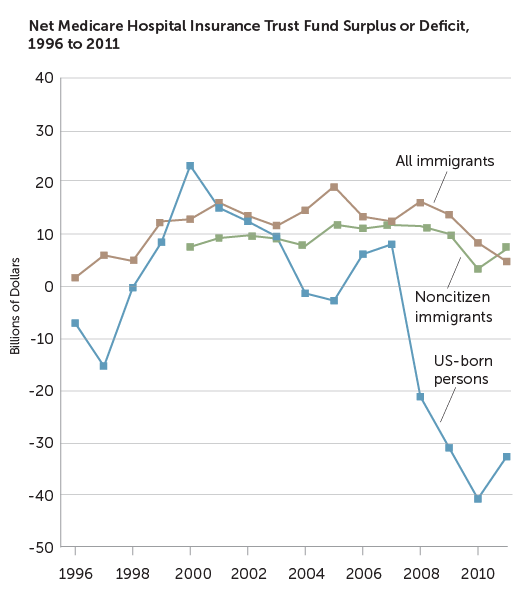

The study finds that, between 1996 and 2011, immigrants contributed $182.4 billion more to Medicare's Hospital Insurance Trust Fund than the Fund expended on their health-care benefits. (See "Net Medicare Hospital Insurance Trust Fund Surplus or Deficit, 1996 to 2011.") In fact, in the average year during that period, immigrants contributed $11.4 billion more to the Fund than was paid out of the Fund for their medical care. During the same period, the US-born population generated a net deficit in the Fund of $68.7 billion.

Immigrants also played a critical role during the Great Recession. From 2008 to 2011, when massive job losses nationwide crimped payroll tax revenues, Medicare's Hospital Insurance Trust Fund operated at an annual deficit, in each year failing to bring in enough contributions to cover costs. During the same time period, however, annual contributions to the Fund from immigrants always exceeded the Fund's annual expenditures on immigrant care. For example, during the worst of the recession in 2008, immigrants paid in $16.3 billion more to the Fund (via payroll taxes) than was paid out of the Fund on their behalf.

Note: Data for noncitizen immigrants for 1996 to 1999 are not shown because citizenship status is unavailable in the MEPS data set.

Source: Authors' analysis of data from 1997 to 2012 Current Population Surveys and 1996 to 2011 Medical Expenditure Panel Surveys.

If Past Is Prologue

According to the study, if immigrants had not participated in the Medicare program from 1996 to 2011, Medicare's core trust fund would be expected to become insolvent by the end of 2027, roughly three years earlier than currently predicted by the Medicare trustees themselves.

The findings counter common misperceptions about the role of immigrants in US entitlement programs. Critics of immigration have argued that immigrants are a net drain on America's health resources-a particular concern as baby boomers retire and become dependent upon the publicly funded Medicare program. The new report, however, shows that instead of being a drain on the Medicare program, immigrants are arguably a key reason why Medicare's Hospital Insurance Trust Fund will remain solvent through the next decade. The positive impact of immigrants on the program may be even more dramatic than described here, as the researchers' calculations cover only the period from 1996 to 2011, whereas immigrants likely also generated surpluses within the Medicare trust fund prior to 1996 and since 2011. Although their analysis is limited to the impact on the Hospital Insurance Trust Fund, it is important to mention that immigrants seek medical care through other publicly subsidized programs, such as Medicare's other trust fund, the Supplemental Medical Insurance Trust Fund as well as uncompensated care and Medicaid. However, immigrants also contribute substantially to federal, state, and local taxes that help support these programs.

The report suggests that any discussion of immigration reform should take into account the significant role that immigrants play in strengthening at least one US entitlement program. The research makes clear that policies that reduce the number of young, working- age immigrants arriving in the United States will weaken the financial health of Medicare's Hospital Insurance Trust Fund. Conversely, policies that increase the number of immigrants arriving in the coming years will likely add to the balance of the Fund. Many of the comprehensive immigration-reform options currently being discussed on Capitol Hill would increase the number of immigrants moving to America in the coming years. That would increase the number of working-age people overall, and by extension, the tax revenues that the Hospital Insurance Trust Fund can ultimately tap.[7]

Leah Zallman is a junior scientist, Adriana Bearse is a research associate, Lisa Arsenault is a senior epidemiologist, and Blessing Dube is a data analyst II at the Institute for Community Health in Cambridge, Massachusetts. Contact them at lzallman@challiance.org.

Endnotes

- Leah Zallman, "Staying Covered: How Immigrants Have Prolonged the Solvency of One of Medicare's Key Trust Funds and Subsidized Care for US Seniors" (report, Partnership for a New American Economy, August 2014), http://www.renewoureconomy.org/research/staying-covered-immigrants-prolonged-solvency-one-medicares-key-trust-funds-subsidized-care-u-s-seniors/.

- See http://www.pewresearch.org/daily-number/baby-boomers-retire/.

- Dowell Myers, "Immigrants' Contributions in an Aging America," Communities , Banking 19, no. 3 (summer 2008), https://www.bostonfed.org/commdev/c,b/2008/summer/myers_immigrants_and_boomers.pdf.

- See http://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/downloads/tr2014.pdf.

- Audrey Singer, "Immigrant Workers, Human Capital Investment and the Shape of Immigration Reform" (report, Brookings Institution, Washington, DC, February 27, 2013).

- "Foreign-Born Workers: Labor Force Characteristics 2014" (report, US Department of Labor Bureau of Labor Statistics, Washington, DC, 2013), http://www.bls.gov/news.release/pdf/forbrn.pdf.

- Determining the exact effect of passing comprehensive immigration reform on Medicare's finances is beyond the scope of this report. Although an increased number of immigrants would boost Medicare's finances, it is also possible a large number of beneficiaries could become eligible to collect Medicare, potentially counteracting at least some of that effect.

Articles may be reprinted if Communities & Banking and the author are credited and the following disclaimer is used: "The views expressed are not necessarily those of the Federal Reserve Bank of Boston or the Federal Reserve System. Information about organizations and upcoming events is strictly informational and not an endorsement."

About the Authors

About the Authors

Leah Zallman, Institute for Community Health

Adriana Bearse, Institute for Community Health

Lisa Arsenault, Institute for Community Health

Blessing Dube, Institute for Community Health