2017 Series • No. 17–6

Current Policy Perspectives

The Equilibrium Real Policy Rate through the Lens of Standard Growth Models

This paper focuses on the roles that total factor productivity (TFP) and potential growth play in determining the equilibrium real policy rate, a concept generally defined as the real interest rate that prevails when the economy is at full employment and inflation is at the central bank’s target rate. It’s an important factor in monetary policy decision-making that has gained prominence lately as the Federal Reserve continues to normalize the stance of monetary policy by raising the policy rate.

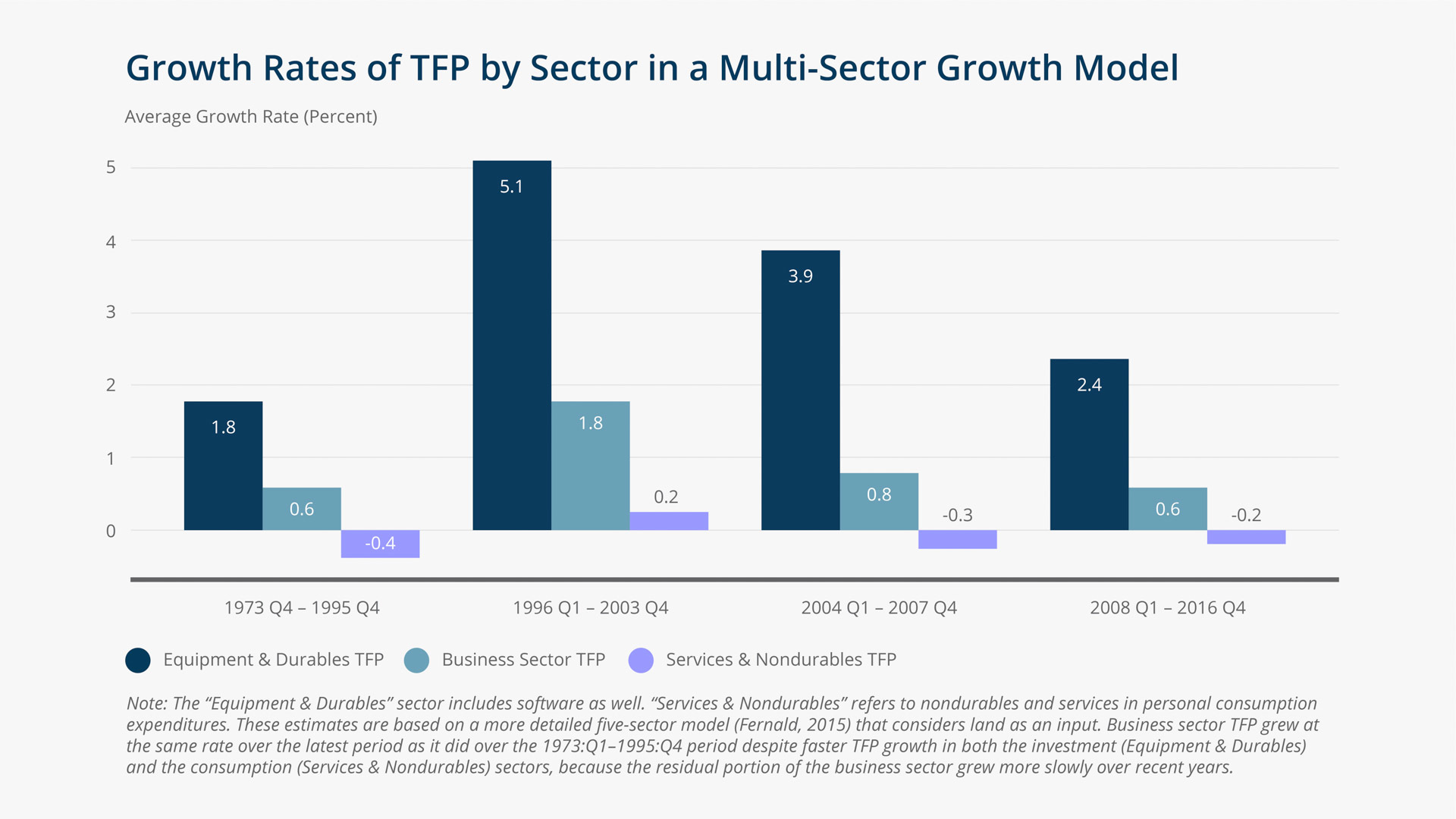

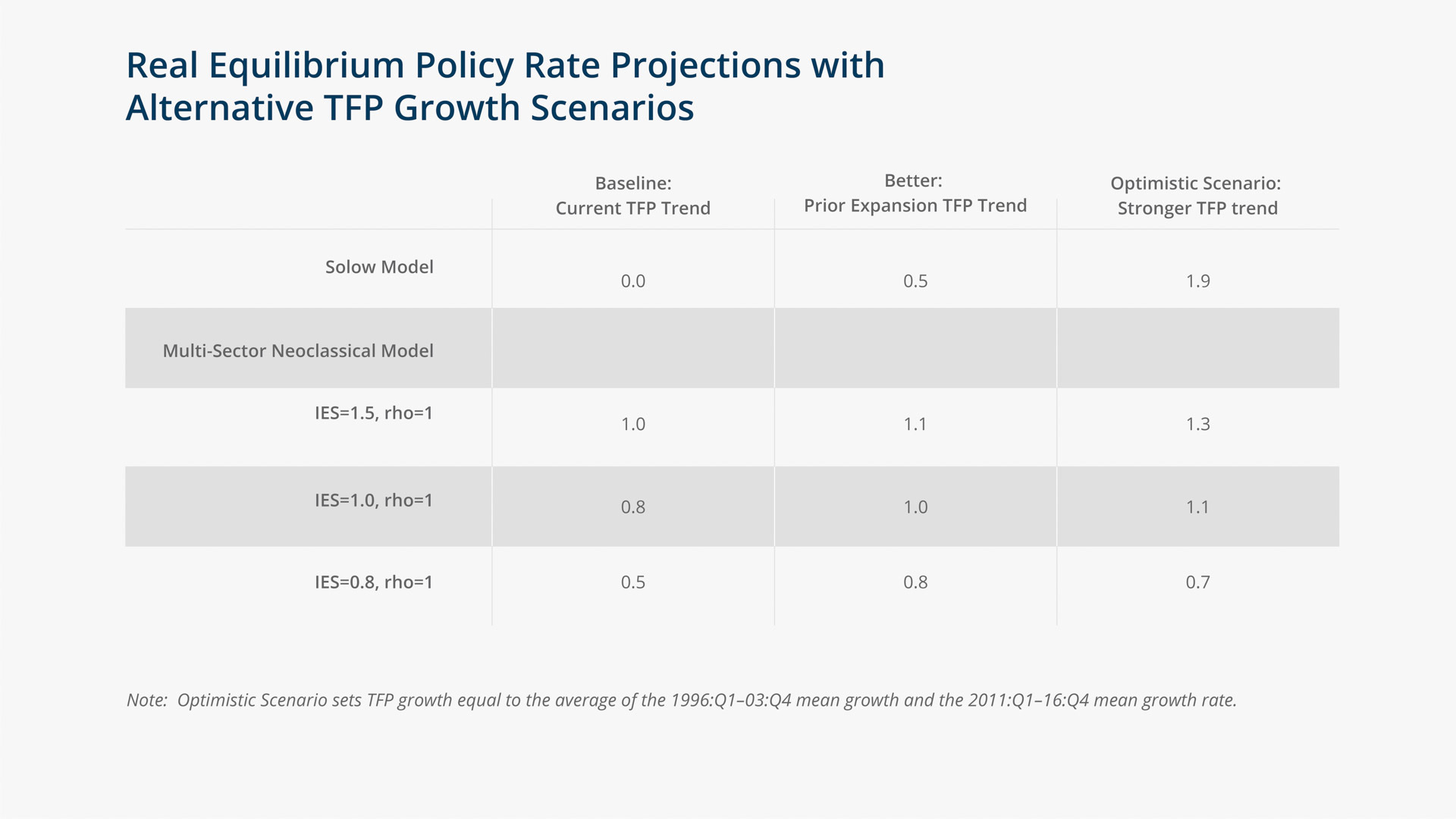

The analysis uses single-sector models for a baseline, but it places more emphasis on the multi-sector neoclassical growth model, which better fits the data from the past three decades. Within the framework of these standard growth models, the authors assess the evolution, current level, and prospective values of the equilibrium real policy rate.

Key Findings

Key Findings

- The equilibrium real policy rate has fallen between 0.3 and more than 1.6 percentage points from the 1973–2007 historical average, depending on the model and parameter values.

- The key factors driving down the equilibrium real policy rate are the decline in growth rates of the labor force and TFP.

- Given the recent sluggish trend in TFP growth, this study’s models suggest a range of 0 percent to 1 percent for the equilibrium real rate in the current policy setting. If possible improvements in the growth rate of TFP are considered, the estimate for the equilibrium real policy rate climbs to almost 2 percent.

Exhibits

Exhibits

Implications

Implications

While standard growth models provide useful information about how various factors affect the equilibrium real policy rate, they don’t reduce the uncertainty surrounding the rate’s value. The authors’ estimates for the rate are based on their projections for TFP growth, but past experience suggests that it is very difficult to predict the future performance of TFP. Moreover, factors other than the long-run growth of technology and the labor force can influence the equilibrium real policy rate over an extended period.

This high level of uncertainty suggests that policy rules relying on equilibrium-rate estimates should be approached with greater caution now than in other periods. While such rules can give clear directional signals when output is far above or below its potential, in the current economic situation their guidance should be used more cautiously. The possible consequence of an error, in either direction, in the estimated equilibrium rate could be a recession.

Such uncertainty surrounding the equilibrium real policy rate and the potential consequences of an estimation error underscore the importance of the Federal Reserve’s practice of constantly monitoring a wide range of indicators of inflation and real activity to gauge the state of the economy.

Abstract

Abstract

The long-run equilibrium real policy rate is a key concept in monetary economics and an important input into monetary policy decision-making. It has gained particular prominence lately as the Federal Reserve continues to normalize monetary policy. In this study, we assess the evolution, current level, and prospective values of this equilibrium rate within the framework of standard growth models. Our analysis considers as a baseline the single-sector Solow model, but it places more emphasis on the multi-sector neoclassical growth model, which better fits the data over the past three decades. We find that the long-run equilibrium policy rate has fallen between 0.3 and more than 1.6 percentage points from the 1973–2007 historical average, depending on the model and parameter values, mainly because of slower growth in total factor productivity (TFP) and the labor force. To the extent that the recent sluggish TFP growth persists, our estimates suggest a range of 0 percent to 1 percent for the equilibrium real rate in the current policy setting. But these estimates are subject to a substantial degree of uncertainty, as has been found in other studies. Policymakers thus need to interpret cautiously the guidance from policy rules that depend on the long-run equilibrium rate. This uncertainty also highlights the importance of the Federal Reserve’s standard practice of constantly monitoring a wide range of indicators of inflation and real activity to gauge as accurately as possible the economy’s reaction to policy.