2015 • No. 15–4

Research Data Reports

The 2013 Survey of Consumer Payment Choice: Summary Results

This report presents key findings from the 2013 Survey of Consumer Payment Choice (SCPC).

Key Findings

Key Findings

- In 2013, the number of consumer payments per month did not change significantly from 2012: the number of check payments continued to decline, offsetting the number of noncheck payments, which continued to increase.

- The number of transactions conducted with each of the noncheck payment transaction types also remained insignificantly different from the number in 2012.

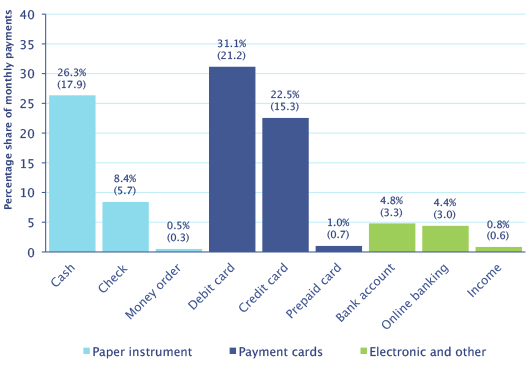

- Debit cards and cash continued to account for the two largest shares of consumer payments in 2013 (31.1 and 26.3 percent, respectively), and the share of credit cards reached 22.5 percent.

- Adoption of mobile banking and the number of mobile payments increased significantly over 2012, with almost half of consumers having access to mobile banking in 2013, and over a third reporting that they had used mobile payments during the year.

- Consumers continue to prefer PIN as a method of authorizing debit card payments, and so far there is no apparent evidence that Regulation II (debit card interchange fees) has had a measurable impact on consumer preferences. As in the previous surveys, consumers assess the quality of payment security in diverse ways not only across payment instruments but also across payment locations. (The questions about consumers' assessments of the speed and security of payments were much more detailed in the 2013 SCPC than in the earlier years' surveys.)

Exhibits

Exhibits

Implications

Implications

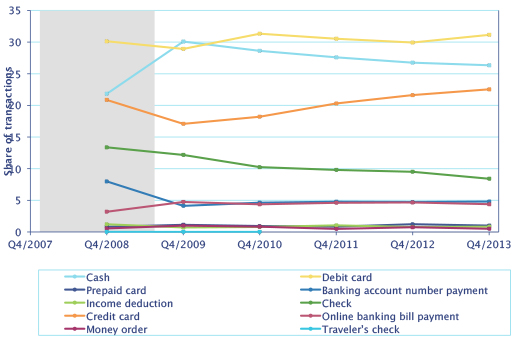

The 2013 SCPC provides an updated snapshot of U.S. consumer payment choices that reflects widespread diversity and the influence of new payment innovations but also a persistent reliance on cash. When combined with similar data from the preceding years, the SCPC begins to suggest trends in consumer payments. One apparent trend is a steady decline in check payments at an average rate of nearly 10 percent per year from 2008 to 2013. This trend agrees with a longer-term trend in check use by the whole economy at least since 2000, as identified by the Federal Reserve Payment Study. One apparent cyclical fluctuation—an increase in the use of cash and decrease in the use of credit cards at the end of the last recession—appears to have subsided by 2013.

The overall picture of consumer payments that emerges from the 2008–2013 SCPC may provide useful information and background for assessing potential policy changes, such as the Federal Reserve's strategic plan for the U.S. payment system (Federal Reserve System 2015). To that end, the 2013 SCPC solicited detailed responses about consumers' assessments of various aspects of speed and security. However, firm conclusions about policy implications cannot be drawn from the official tables alone. More research is needed using individual consumer responses to enable one to draw such policy implications and certainly to develop more effective policies.

Abstract

Abstract

In 2013, the average number of consumer payments per month did not change significantly from the average number in 2012. The number of check payments continued to decline, and although the number of noncheck payments increased to offset the decline in checks, the number of transactions conducted with each noncheck payment instrument type did not change significantly in 2013 for any single instrument type. Thus, the shares of payments made with each of the major instrument types did not change significantly. Debit cards and cash continued to account for the two largest shares of consumer payments in 2013 (31.1 and 26.3 percent, respectively), and the credit card share reached 22.5 percent. Adoption of mobile banking and the number of mobile payments increased significantly over 2012, with almost half of consumers having access to mobile banking in 2013, and over a third reporting that they had used mobile payments during the year.

Resources

Resources

Derived Variables with Raw Data

Results

- The 2013 Survey of Consumer Payment Choice: Summary Results

- The 2013 Survey of Consumer Payment Choice: Technical Appendix

- Data User Manual (pdf)

- Online Survey Instrument (pdf)

- Online Survey Instrument, Supplement Speed & Security, 2013 (pdf)

- Tables of Standard Errors (pdf)

- Variable Name Look-up (xlsx)