Credit Card Debt and Consumer Payment Choice: What Can We Learn from Credit Bureau Data?

Data from a credit bureau represent unbiased reporting by lenders, but the information doesn’t provide the type of insight about consumers that surveys can offer, such as demographic attributes, income and wealth, and perceptions and attitudes. The author therefore creates a merged dataset that combines information from the Survey of Consumer Payment Choice (SCPC) with Equifax credit bureau data. It includes consumers’ self-reported data on demographics, income, and preferences as well as unbiased Equifax information on their risk scores and credit card behavior. With this merged dataset, the author estimates the adoption and use of credit cards by people with various levels of risk score and by people with and without debt to evaluate the effect of debt on payment behavior.

Key Findings

Key Findings

- Credit card revolvers (consumers who carry unpaid credit card balances) tend to have lower income and be less educated than convenience users (consumers who pay their credit card balances on time). They are also more likely than convenience users to have and use debit cards instead of credit cards.

- Revolvers’ credit card utilization (how much of their credit limit cardholders use) is much higher than that of convenience users.

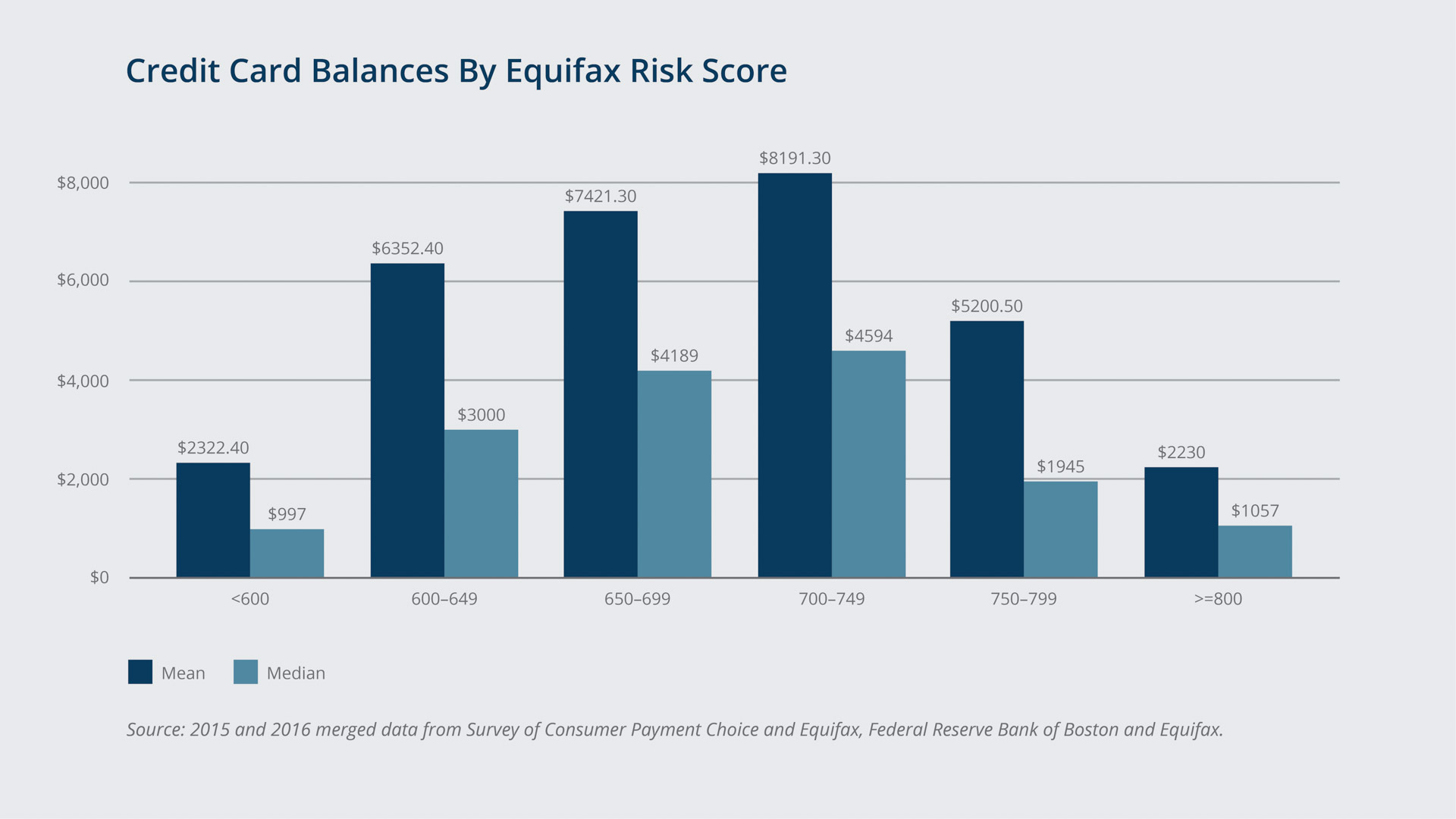

- On average, consumers with higher risk scores (signifying lower risk of default) have higher credit card balances, but above a certain score, the relationship is reverse.

Exhibits

Exhibits

Implications

Implications

The fact that revolvers’ credit card utilization is much higher than that of convenience users suggests that revolvers are liquidity constrained and do not have access to less expensive alternatives for borrowing money. Thus, supply-side constraints may cause credit card revolving. On average, revolvers do have lower income than other consumers, and the high cost of paying off credit card debt could contribute to even larger discrepancies in disposable income.

Regarding the merging of the Equifax and Survey of Consumer Payment Choice data to estimate consumer credit card behavior, the author finds that the regression results based on the merged data are qualitatively similar to those based exclusively on survey data. The results demonstrate that even though survey data may not be as accurate as administrative data, using that information to estimate consumer behavior yields reasonable results and can be employed if administrative data are not available, provided the data can be accurately matched by individual respondents.