Technological Innovation in Mortgage Underwriting and the Growth in Credit: 1985–2015

There is a debate about whether relaxed mortgage lending standards contributed to the boom—and ensuing bust—in the US housing market during the 2000s. Several studies have explored this question with data from the Home Mortgage Disclosure Act (HMDA). An early paper by Mian and Sufi (2009) claimed that mortgage credit rose disproportionately for low-income borrowers during the boom, and blamed this increase largely on a loosening of income requirements for mortgage lending. Yet Adelino, Schoar, and Severino (2016) found that during the boom, there was a relative increase only in the number of mortgages originated in low-income areas. There was no relative increase in the average size of new mortgages, as loans made to high-income and low-income borrowers rose by similar percentages. As pointed out in a response paper by Mian and Sufi (2017), precisely measuring the relationship between mortgage debt and income for new borrowers is complicated by the potential for borrower-income data in HMDA to be overstated when house prices are rising rapidly (as they were during the boom).

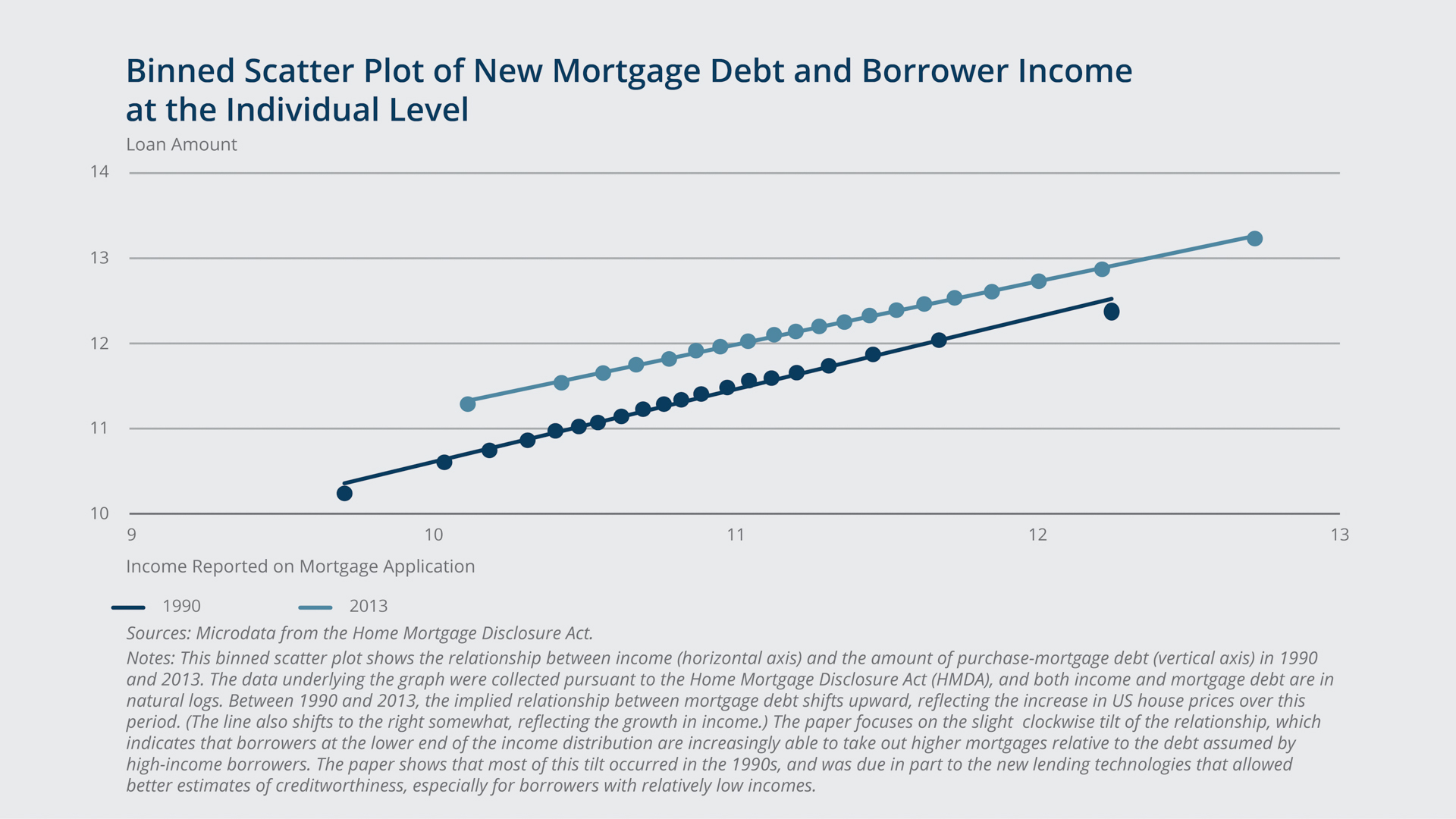

This paper develops some new data sources to provide more-conclusive evidence regarding the relationship between mortgage debt and income since the mid-1980s. It discusses some changes to mortgage underwriting procedures that allowed higher debt-to-income ratios at origination, a development that permitted lower-income borrowers to take out relatively more debt. However, these underwriting changes were driven by technological changes in the 1990s, some years before the boom. During the 2000s boom itself, average mortgage sizes rose proportionally for borrowers across the income distribution, as Adelino and co-authors found.

Key Findings

Key Findings

- While underwriting procedures in past decades placed a great deal of emphasis on the borrower’s debt-to-income ratio, advances in information technology transformed mortgage underwriting practices during the 1990s. Mortgage lenders were able to assemble large datasets of loan-level records to estimate empirical models of default risk, predictions which were significantly enhanced by using consumer credit scores. These empirical models showed that the debt-to-income ratio at origination has little correlation with any eventual default. Rather, mortgage defaults tend to occur when a borrower experiences an income shock, due to job loss or some other financial hardship. As a result, lenders allowed higher debt-to-income ratios at origination, particularly for borrowers with good credit scores.

- The 1990s also saw a long-term decline in nominal interest rates and a series of federal policies aimed at providing mortgage credit to low-income households. Combined with the technology-driven changes in lending standards, the net outcome was that borrowers with steeply rising income profiles took advantage of looser requirements for current income. Hence, the expansion of mortgage credit during the 1990s meant that younger households, especially those that could expect their incomes to rise significantly in the future, became homeowners sooner than otherwise would have been the case.

- Statistically, the paper investigates the debt-income relationship in the same fashion as previous papers. The authors run simple regressions of the size of a new purchase mortgage on the borrower’s income. Separate regressions are run for each year, so that changes in the income coefficients can reflect changes in the underlying relationship between debt and income. These income coefficients are positive in every year, indicating that higher-income borrowers take out larger loans. However, the income coefficients decline throughout the 1990s, indicating that low-income borrowers were able to increase their relative mortgage sizes during that period. During the 2000s, however, the income coefficients remain stable, indicating that the average size of new mortgages rose proportionately across the income distribution.

- To address concerns that borrower income in HMDA can be overstated, the paper uses alternative sources of income data at the Census tract level. It also exploits a separate dataset, the American Housing Survey, which does not suffer from a potential income-overstatement problem.

- Overall, these results establish that changes in mortgage underwriting standards predated the housing boom by some years. Hence, an exogenous relaxation of lending requirements did not contribute to the rapid rise in house prices that occurred in the 2000s. Rather, the large growth in average mortgage sizes for both high-income and low-income borrowers was a consequence—not a cause—of the aggregate increase in house prices.

Exhibits

Exhibits

Implications

Implications

The paper has some implications for how we think about the rapid increase in financial technology. In the 1990s, the mortgage lending industry implemented automated underwriting procedures to complete many of the tasks previously performed by human underwriters. By and large, these new technologies improved the mortgage-lending process. The computerized systems processed data more rapidly, while the use of credit-scoring algorithms improved the assessment of mortgage default risk, which was shown not to be highly correlated with the borrower’s debt-to-income ratio at origination. Defaults rose during the bust not because the process of mortgage lending had become corrupted by these new technologies, but because both borrowers and lenders thought house prices would continue to rise.